Stock Market Today: Foiled Again! Sizable Snap-Back Fizzles Late

The Nasdaq fell even further into correction territory Thursday after early gains collapsed in the afternoon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

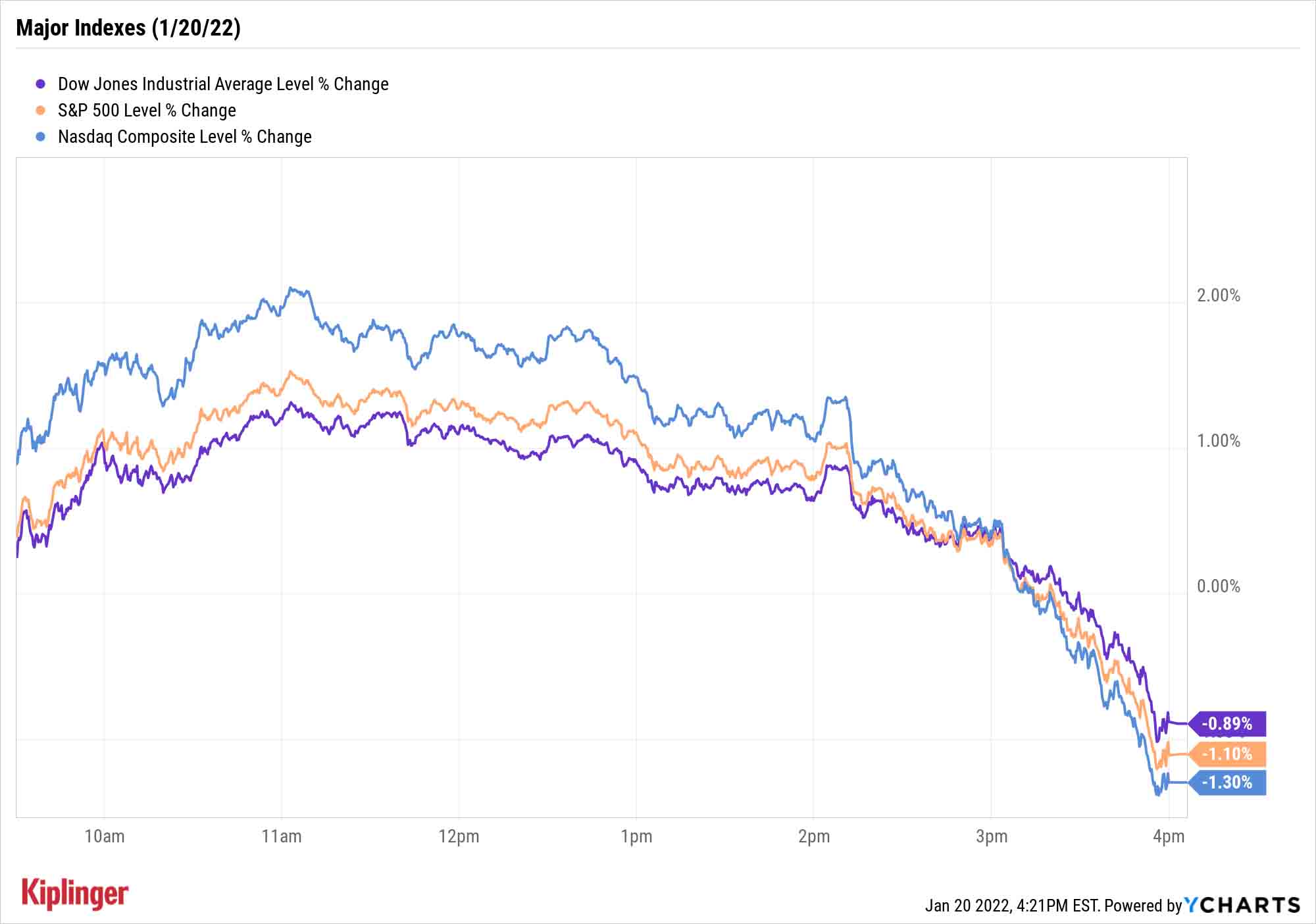

Stocks suffered another failure to launch on Thursday as a brisk morning run in the major indexes crumbled in the afternoon, resulting in another disappointing finish in the red, and a deeper turn into correction territory for the Nasdaq Composite.

Initial claims for unemployment benefits were in focus today. Filings for the week ended Jan. 15 climbed by 55,000, to 286,000 – the highest level since late October.

"Thursday's rise in weekly jobless claims show that the labor market is starting to reflect the negative economic impacts from the Omicron wave," says Robert Schein, chief investment officer of Blanke Schein Wealth Management, adding that "we still believe the labor market is strong enough for the Federal Reserve to proceed with its expected rate-hike plans in 2022."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Existing-home sales for December also disappointed, off 4.6% month-over-month and down 7.1% year-over-year amid scarce inventory.

Stocks nonetheless seem primed for a bounce off recent declines (even if only of the dead-cat variety), perhaps encouraged by Street-beating earnings from the likes of Travelers (TRV, +3.2%) and Union Pacific (UNP, +1.1%).

But what momentum there was faded fast.

The Dow Jones Industrial Average, up 1.3% at its highs, reversed to finish 0.9% lower to 34,715, with the S&P 500 (-1.1% to 4,482) following suit. The Nasdaq, already in correction territory, watched a 2.1% intraday climb turn to ash, closing down 1.3% to 14,154.

While the short-term collapse of the Nasdaq seems somewhat sudden, John Lynch, chief investment officer for Comerica Wealth Management, highlights some underlying rot: "Though the Composite entered correction territory yesterday, performance at the stock level had already weakened significantly," he says. "The Nasdaq-100 members have already experienced an average decline of 22.0% from their 52-week highs.

"As investors reprice the risk of Fed rate hikes, the indexes simply need to catch up to their average stock. We believe solid growth in the economy and profits should preclude anything more than a 10.0% correction in the major equity indexes."

Other news in the stock market today:

- The small-cap Russell 2000 plunged 1.9% to 2,024.

- U.S. crude oil futures eased back 0.3% to $85.55 per barrel.

- Gold futures posted a marginal loss, ending at $1,842.60 an ounce.

- Bitcoin actually put together a solid return of 2.6%, to $42,726.19. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Peloton Interactive (PTON) slumped 23.9% after CNBC reported that the company is suspending production of its connected fitness Bike exercise bike and Tread+ treadmills for the next two months. The move comes amid decreased demand, according to internal documents obtained by CNBC. Since closing at a record high of $162.72 in December 2020, PTON shares have surrendered more than 85%.

- American Airlines Group (AAL) slid 3.2% after the travel name reported earnings. In its fourth quarter, AAL reported higher-than-expected revenue of $9.43 billion, but adjusted earnings of $1.42 fell short of the consensus estimate and the airline said it expects first-quarter revenue to be down 20% to 22% when compared to Q1 2019. CFRA Research analyst Colin Scarola kept a Hold rating on AAL after earnings, saying inflation is starting to drive up costs. "Notably, AAL's labor costs are approaching 2019 levels, even with headcount still down 9% vs. the same point in 2019," Scarola writes in a note. "And the price of jet fuel is currently about 23% higher than the average price during 2019."

Give Europe a Glance

Investors concerned about U.S. stocks' sluggish start to 2022 might want to look overseas.

European equities have long underperformed their American counterparts and the same was true in 2021. But 2022 is shaping up as the year in which returns from across the pond might finally outpace those seen here at home, notes BCA Research.

Although European equities face persistent headwinds, including sensitivity to the Chinese economy, the trajectory of COVID-19 and tensions over Ukraine, "these risks are likely to fade over the year and will give way to an improvement in the outlook for eurozone equities," BCA strategists say. "The Eurozone economy is still operating below potential. This implies that the European economy has more room to catch up, which will support earnings and therefore risk assets."

Europe is also fruitful ground for investors seeking value stocks, with the region sporting "much more attractive" valuations at the moment, adds BCA.

Value is the primary focus of our examination of the best European stocks to buy for 2022, but we also highlight a few growthier options. And one trait these names pretty much all share is they generally deliver greater income than their U.S. cousins. (Indeed, a few are even members of the European Dividend Aristocrats.)

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.