Stock Market Today: Stocks Enjoy Stellar End to Woeful January

A violent rebound in scores of battered stocks Monday helped the major indexes pare their still-substantial January losses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

January 2022 will still go down as a turbulent and loss-ridden month for stocks, but at least it ended on a high note.

A relatively quiet news weekend followed by little in the way of fresh economic data gave investors little to go on Monday, but the session was peppered with a host of individual relief rallies.

Most notable was the S&P 500's seventh-largest holding, Tesla (TSLA), which popped 10.7% thanks to Credit Suisse analysts, who upgraded the stock to Outperform after it lost 20% in January.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"With the market disproportionately punishing growth stocks in the past month, we believe an attractive entry point has emerged for Tesla," said CS analysts, adding that Tesla checks off a number of boxes: attractive growth story, disruption, decarbonization and more.

Netflix (NFLX, +11.1%), Moderna (MRNA, +6.2%), PayPal (PYPL, +5.2%) and Nvidia (NVDA, +7.2%) were among other recently beat-up stocks that closed the month with a rebound.

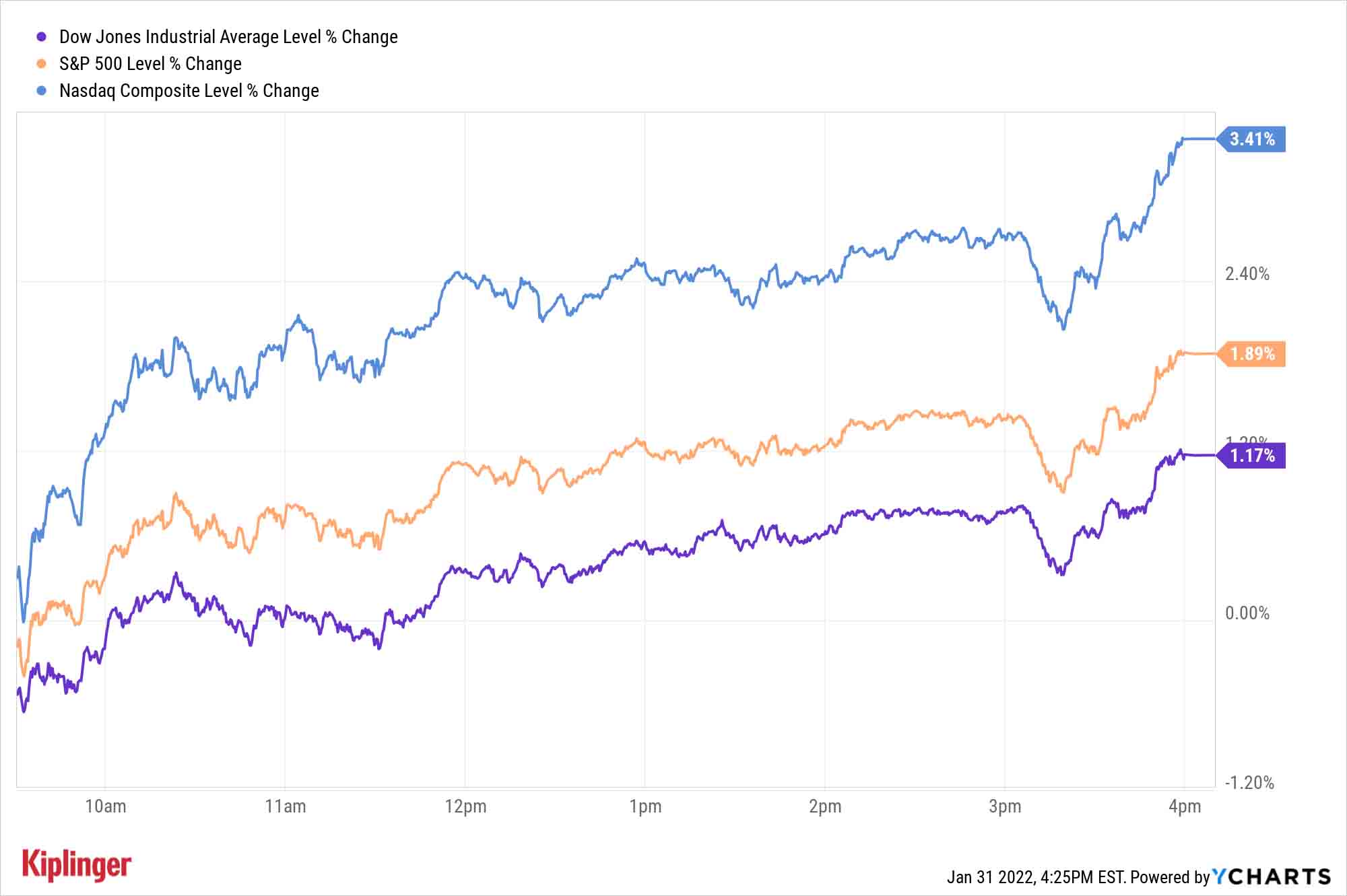

The S&P 500 gained 1.9% Monday to 4,515, leaving it down 5.3% for the month. That marks the index's worst January since 2009, and the worst month for stocks overall since March 2020. The Dow Jones Industrial Average (+1.2% to 35,131) finished January off 3.3%, and the Nasdaq Composite (+3.4% to 14,239) trimmed its full-month losses to 9.0%.

Other news in the stock market today:

- The small-cap Russell 2000 also roared back Monday, jumping 3.1% to 2,028.

- U.S. crude oil futures surged 1.5% to settle at $88.15 per barrel.

- Gold futures gained nearly 0.6% to end at $1,796.40 an ounce.

- Bitcoin recovered some ground over the weekend and into Monday, improving by 1.9% to $38,484.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Spotify (SPOT) jumped 13.5% after the audio streaming service over the weekend said it would start adding content advisories to podcasts that contain information about COVID-19. This comes after several musicians, including Neil Young, pulled their music from Spotify to protest podcaster Joe Rogan from spreading misinformation about COVID-19 on his show "The Joe Rogan Experience." SPOT was also upgraded to Buy from Neutral by Citigroup analysts.

- Barclays analyst Benjamin Theurer issued a double uptrade on Beyond Meat (BYND, +15.2%) stock today, raising his outlook on the plant-based protein maker to Overweight from Underweight (the equivalents of Buy and Sell, respectively), saying there are "more positives than negatives" in the U.S. alternative meat product market. BYND already has several high-profile partnerships, including with drinkmaker PepsiCo (PEP) and Taco Bell parent Yum! Brands (YUM). And earlier this month, McDonald's (MCD) said in February it will boost its test market for BYND's plant-based burger by another 600 locations.

A Weak Environment for IPOs, But ...

Market pundits generally predict more volatility ahead, but that doesn't mean investors should write off 2022.

"Market corrections are a normal part of investing and may present opportunities for value-conscious investors," say Jason Pride and Michael Reynolds, CIO of private wealth and vice president of investment strategy, respectively, at investment firm Glenmede. "Growth should continue in 2022, albeit at a slower yet still acceptable pace consistent with an ongoing expansion."

One area of the market desperately looking for signs of normalization and stability is initial public offerings (IPOs). Last year marked a banner year for IPOs, with more than a thousand companies raising roughly $316 billion, according to financial markets platform Dealogic. However, increased volatility slowed IPOs to a crawl in the latter part of 2021, and the slowdown extended into January.

Nevertheless, once the IPO gears start moving again, investors should be able to gain access to several exciting, well-known names. Here, we outline 11 companies widely expected to launch IPOs in the year ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.