Stock Market Today: Stocks Ride Facebook's Coattails Deep Into the Red

Facebook, Spotify and Honeywell go belly-up after earnings to sink the indexes Thursday; Amazon spikes after-hours on a Q4 beat.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

This week’s relief rally came to an abrupt stop Thursday as a few high-profile earnings reports cratered investor confidence and weighed on the major indexes.

Front and center was Facebook parent Meta Platforms (FB, -26.4%), which suffered its largest one-day price decline following a fourth-quarter faceplant reported last night.

Revenue of $33.7 billion beat Street expectations, but earnings of $3.67 per share missed by a wide margin. The company's first-quarter sales guidance of $27 billion to $29 billion was also shy of analysts' forecasts. Apple's (AAPL) iOS privacy changes are responsible for some of FB's woes, but it has other troubles as well.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“The revenue and expense outlook reflects a shift in content to lower monetization Reels from Newsfeed, a rebuild in targeting capabilities (that will be more AI-based), TikTok competition, and big – and now public – investments in Metaverse,” say BofA Securities analysts, who maintained their Buy rating in anticipation of an easier second half of 2022.

Streaming music provider Spotify (SPOT, -16.8%) likewise tumbled as better-than-expected quarterly earnings and revenue were overshadowed by weak Q1 user-growth guidance. Meanwhile, industrial conglomerate Honeywell (HON, -7.6%) posted strong Q4 results but disappointed traders with its current-quarter sales forecast.

Fears of a dour January jobs report (due Friday) also weighed on stocks.

"Expectations are for another slowdown, with about 175,000 jobs added, down from 199,000 in December," says Brad McMillan, chief investment officer for independent broker-dealer Commonwealth Financial Network. "With everything that is going on, especially the number of people who have the Omicron variant and are presumably not at work, that would be a great result. Unfortunately, the real number is likely to be well below that and will probably be negative – maybe significantly so."

"But while the damage would be real, it would be a medical issue – a short-term consequence of the Omicron wave – rather than a sign of economic weakness. As the medical situation changes, so will the employment impact. … As such, a terrible jobs report in January will not derail either the labor market or the economy. More, we can also expect a very strong bounce back in February."

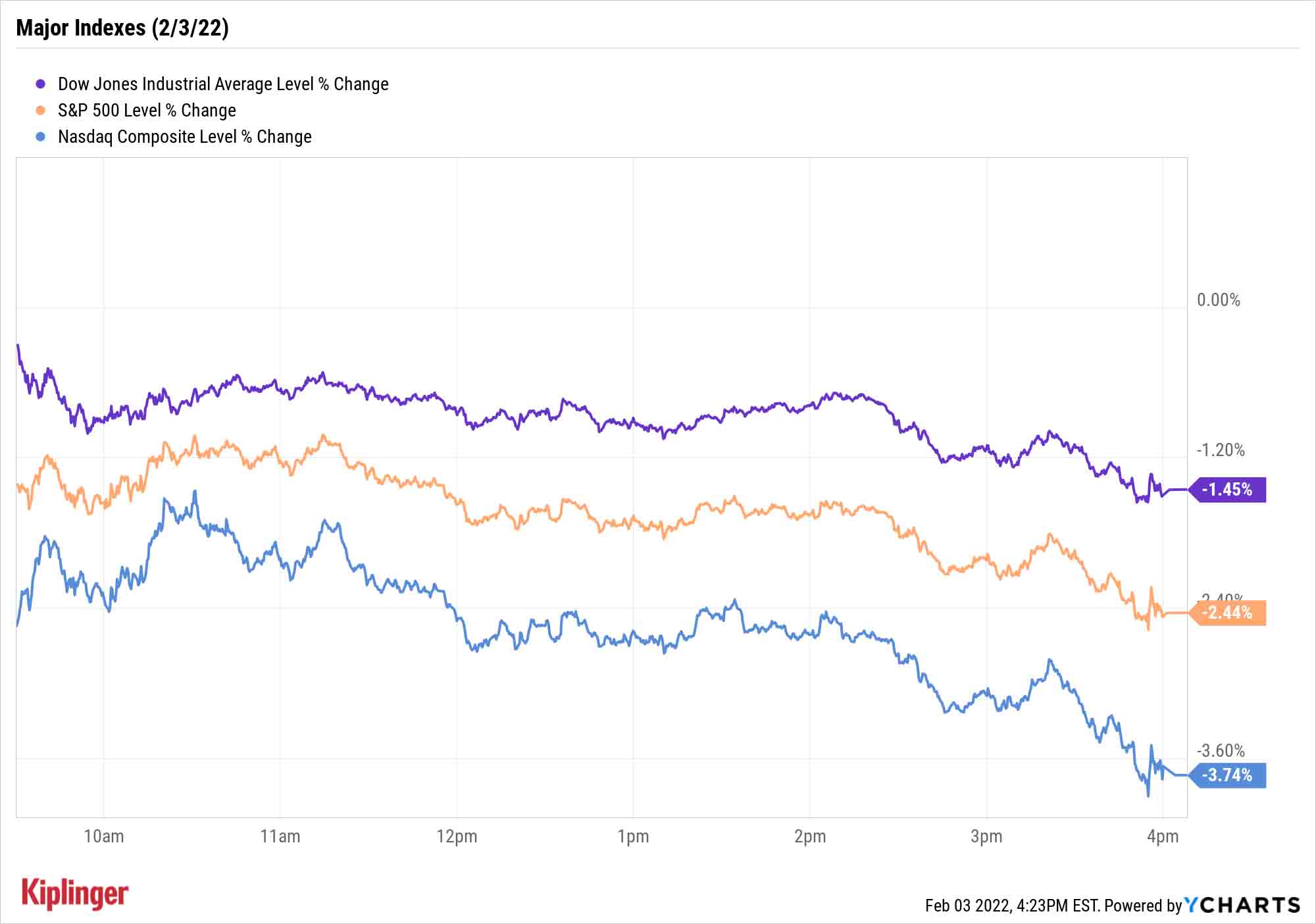

Still, near-term fears clearly dominated Thursday's session. The Nasdaq Composite fell 3.7%, to 13,878, while the S&P 500 dropped 2.4% to 4,477 and the Dow Jones Industrial Average declined 1.5% to 35,111.

There was better news after the bell, however. E-commerce giant Amazon.com (AMZN) surged 13% after announcing its fourth-quarter results. AMZN said revenue jumped 9% year-over-year to $137.4 billion, while adjusted earnings per share arrived at $27.75 per share – nearly double the year-ago figure. Amazon also said it was raising its annual Amazon Prime membership price by almost 17% to $139; that's the first price hike for Prime memberships since 2018.

Social media companies Snap (SNAP, +33% after hours) and Pinterest (PINS, +18%) also surged in the evening after they reported Street-beating earnings and quarterly user growth.

Other news in the stock market today:

- The small-cap Russell 2000 dropped 1.9% to 1,991.

- A massive winter storm barreling across the central portion of the country helped send U.S. crude oil futures up 2.3% to $90.72 per barrel – their first settlement north of the $90 per-barrel mark since October 2014.

- Gold futures gave back 0.3% to finish at $1,804.10, snapping a three-day winning streak.

- Bitcoin struggled again, retreating 3.3% to $36,366.38. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- T-Mobile US (TMUS) was a rare splash of green in today's trading. The telecommunications stock jumped 10.2% after the company posted higher-than-expected fourth-quarter adjusted earnings of 34 cents per share and said free cash flow more than doubled year-over-year to $1.1 billion – which helped offset lower-than-anticipated quarterly revenue of $20.8 billion. "TMUS reported a solid quarter and management's 2022 guidance alleviated concerns with shutting down legacy Sprint," Oppenheimer analyst Timothy Horan says. "Momentum from 2021 will position TMUS for a strong year of growth in 2022. High speed internet service will be a key sector with promising growth potential." The analyst maintained an Outperform rating on the stock, which is the equivalent of a Buy.

How to Profit From Transformational Trends

It's easy to forget that investing is a long-term proposition when the short term is so painful. Investors in growth stocks sure have the fresh bruises to prove it.

Facebook, a consensus front-runner of the metaverse, has lost a quarter of its value this week. PayPal (PYPL), which spearheaded the revolution into digital payments, is off 28% in just four days.

However, as Kiplinger contributor Jeff Reeves explains, "the most profitable investing strategies often don't involve reacting in real-time to short-term disruptions. Sometimes simply getting in on the ground floor of a long-term trend, and then buying and holding for years or even decades, can drive tremendous returns."

No one knows where Facebook, PayPal and other recently battered growth plays will go from here. What we do know is that any investment in disruptive trends should be measured in years – not days or weeks.

One way to steady your hand as you try to take advantage of sweeping technological, lifestyle and other changes is to diversify your holdings. This lessens the risk that any single stock will wreck your portfolio and make you lose sight of your long-term goals.

These seven megatrend-focused stock ETFs offer such diversification – as well as the potential for outperformance – by riding powerful, secular themes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.