Stock Market Today: Stocks Slip as Russia-Ukraine Tensions Build

Oil prices zipped higher Monday as the U.S. ordered Kyiv embassy closed, but energy stocks and other cyclicals finished in the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Equities struggled out of the gate Monday as investors, already trying to keep one eye trained on any signs of the Federal Reserve's next move, had to keep their other eye out for developments in Eastern Europe.

Citing the ongoing buildup of Russian troops along the Ukrainian border, Secretary of State Antony Blinken today ordered the U.S. Embassy in the capital Kyiv closed, sending staffers there west to Lviv. Multiple reports say U.S. intelligence believes an attack could come this week.

"Open hostilities could cause disruptions to supply chains, and Western threats to impose financial sanctions could cause issues for banks that have extended credit to Russian guarantors," say Jason Pride and Michael Reynolds, CIO of private wealth and vice president of investment strategy, respectively, at investment firm Glenmede. The direct impact would be limited, though, with the pair noting that "Russia and Ukraine combined represent less than 3% of global GDP and 0.5% of global equity market capitalization."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The escalation of Russia and Ukraine tensions come at a time when the stock market is already vulnerable given inflation worries and the potential for Federal Reserve tightening," adds George Ball, chairman of investment firm Sanders Morris Harris. "If an armed conflict between Russia and Ukraine is somehow avoided, a short lived relief rally is likely, but there are still too many worries on the horizon for any type of longer lasting upward move higher in stocks."

The growing conflict continued to put a spark into energy prices, with U.S. crude oil futures closing up 2.5% to $95.46 per barrel – their highest close in more than seven years. And it also weighed on predominantly cyclical stocks; financials (-1.1%) and materials (-0.8%) were lower, and energy (-2.3%) was the worst of all 11 sectors – despite oil's spike.

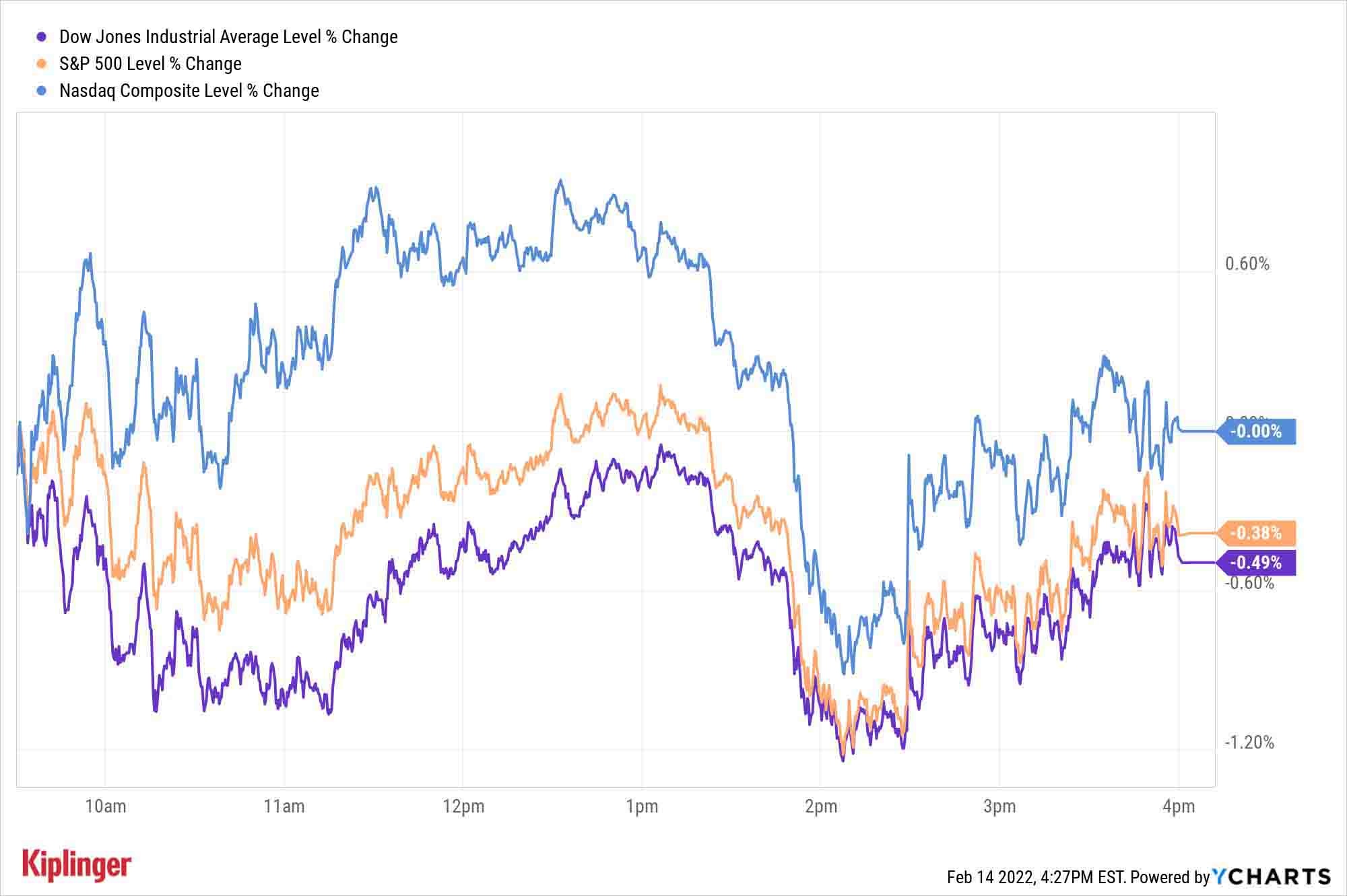

The Dow Jones Industrial Average (-0.5% to 34,566) and S&P 500 (-0.4% to 4,401) finished modestly lower, while the Nasdaq Composite closed with a marginal loss to 13,790.

After the bell, Warren Buffett's Berkshire Hathaway (BRK.B) filed its latest 13F with the Securities and Exchange Commission. Among his many moves, Buffett added video game maker Activision Blizzard (ATVI) and cut loose Teva Pharmaceutical (TEVA). (You can check out the rest of Buffett's most recent buys and sells here.)

Other news in the stock market today:

- The small-cap Russell 2000 was off 0.5% to 2,020.

- Gold futures also got a lift on Russia-Ukraine tensions, jumping 1.5% to $1,869.40 an ounce – their highest settlement since mid-November.

- Bitcoin lost a little ground, sliding 0.3% to $42,198.55. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Cisco Systems (CSCO, -1.3%) was in the news after The Wall Street Journal reported late Friday that the networking technologies company made a more than $20-billion bid to buy cloud solutions specialist Splunk (SPLK, +9.1%). However, the article also stated, according to people familiar with the matter, that the two companies are currently not in active talks. "We believe a potential purchase of Splunk makes a lot of sense for CSCO as it would add an incredibly powerful tool to its portfolio and could create billions of new cross-selling opportunities," says CFRA Research analyst Keith Snyder (Buy). "While the unconfirmed price is expensive, we believe it is worth it given the potential synergies and rapid market growth.

- Callaway Golf (ELY) advanced 3.0% after Stephens analyst Daniel Imbro called the mid-cap stock a top pick. "We believe that Callaway has a number of catalysts ahead of it, with an analyst day upcoming in the second quarter, an improving supply chain and Topgolf traffic improving through the first quarter," he says. Imbro isn't alone in his bullish outlook. "We also expect tailwinds for Topgolf as consumers return to normal social activities as Covid-19 fades," wrote CFRA Research analyst Zachary Warring (Buy) on Friday. "ELY expects to open 10 new Topgolf venues in 2022, with most coming in the back half of the year to bring the total venue count to 80. We see value in shares at these levels."

How to Head Off Inflation

A Russian invasion of Ukraine could accelerate another major market worry: inflation.

"By pushing energy prices even higher, a Russian invasion would likely exacerbate inflation and redouble pressure on the Fed to raise interest rates," says Bill Adams, chief economist for Comerica Bank. "From the Fed's perspective, the inflationary effects of a Russian invasion and higher energy prices would likely outweigh the shock's negative implications for global growth."

While that could in turn rock the major indexes, some sectors would seemingly be better off than others – including healthcare and consumer staples – thanks to their core necessity and ability to pass higher prices along to consumers. Interestingly, you can find this dynamic at play among the Dow Jones's most highly rated dividend stocks – a group of five companies yielding at least 2% that have also largely outperformed the market so far in 2022.

Investors seeking out safety might very well find it in this five-stock mini portfolio, which combines blue-chip fundamentals with inflation-resistant characteristics. Read on to discover which Dow dividend stocks top the list.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.