Stock Market Today: Stocks Sizzle on Russian Troop Withdrawal Reports

Oil prices, on the other hand, plummeted on news Moscow is pulling back some troops from the Ukrainian border.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks soared at the open Tuesday after Russian President Vladimir Putin said Moscow had begun to withdraw some troops from the Ukrainian border – raising hopes that military conflict between the two countries might yet be avoided.

"Ukraine headlines continue to drive the day-to-day volatility," says Michael Reinking, senior market strategist for the New York Stock Exchange. "As there are reports of some Russian troop withdrawal, there is an unwind of much of the movement seen across financial markets over the last few days."

This included a big drop in energy stocks, which fell 1.1% as U.S. crude futures retreated from seven-year highs (declining 3.6% to end at $92.07 per barrel).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the other hand, technology was the biggest gainer today – jumping 2.6% – on news that Intel (INTC, +1.8%) is buying Israeli chip manufacturer Tower Semiconductor (TSEM, +42.1%) for roughly $5.4 billion.

"While we have no incremental knowledge as to the validity of these reports, we would not be surprised to see INTC taking such a step to bolster its foundry aspirations," says Deutsche Bank analyst Ross Seymore (Hold). "We expect to learn more about the company's foundry strategy at its upcoming analyst meeting on Feb. 17, regardless of if Tower is part of those plans."

Also in focus today was the latest inflation update, with the Labor Department reporting the producer price index – which measures how much suppliers are charging businesses for goods – rose a seasonally adjusted 1% month-over-month in January. On an annualized basis, producer prices surged 9.7%.

"The big picture is that inflation has gained momentum and broadened in the economy," says Bill Adams, chief economist for Comerica Bank. "The Russia-Ukraine conflict was a factor behind January's increase in prices; energy prices rose amid fears that the conflict would slow Russian deliveries of natural gas and oil to global markets. But prices of other goods also rose rapidly in January, as did prices of services."

Smith adds that omicron likely played a role too, with the variant causing many Americans to be out of work because they were either sick or quarantining.

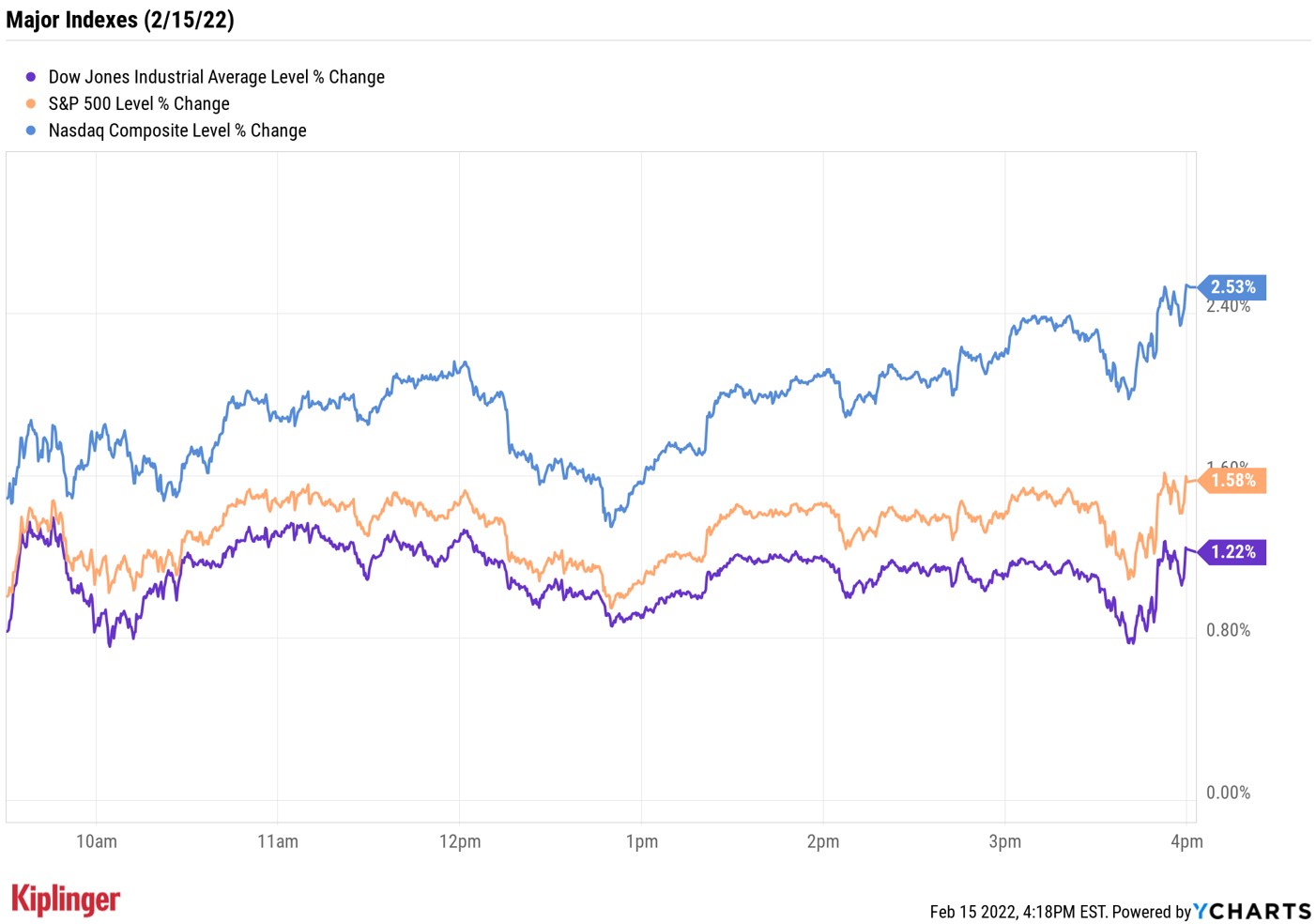

At the close, the Nasdaq Composite was up 2.5% at 14,139, the S&P 500 Index was 1.6% higher at 4,471 and the Dow Jones Industrial Average had added 1.2% to finish at 34,988.

Other news in the stock market today:

- The small-cap Russell 2000 surged 2.8% to 2,076.

- Gold futures shed 0.7% to settle at $1,856.20 an ounce, marking their first loss in eight days.

- Bitcoin caught a bid too, spiking 4.7% to $44,191.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- The Intel news was a shot in the arm for the rest of the semiconductor industry, too. Nvidia (NVDA) was out in front, jumping 9.2% ahead of its fourth-quarter earnings report, which was due out after Wednesday's close. Also making significant advances were Advanced Micro Devices (AMD, +6.3%), Micron (MU, +6.8%) and Qualcomm (QCOM, +4.8%). The relief rally was no doubt welcomed with open arms by chip-stock investors; the S&P Semiconductors Select Industry Index was off by more than 18% year-to-date heading into today's session.

- Restaurant Brands International (QSR, +3.6%) – the Canadian parent company of Burger King, Popeyes and Tim Hortons – headed higher on the back of a strong fourth-quarter earnings report. Revenues of $1.55 billion and adjusted profits of 74 cents per share each topped analysts' estimates. A particular point of progress were global digital sales, which popped by 67% year-over-year across 2021, to $10 billion, accounting for 30% of overall revenues.

Buffett's Latest Buys and Sells

M&A news was likely on the mind of Buffettologists last night following the release of Berkshire Hathaway's (BRK.B) latest holdings list.

Warren Buffett, chairman and CEO of Berkshire, unveiled his latest transactions Monday evening via a 13F filing with the Securities and Exchange Commission. While the filing showed the famed investor ended 2021 much like he started it – with lots of selling – it also revealed he made some interesting additions to the Berkshire Hathaway equity portfolio in the fourth quarter as well.

Most notably was Buffett's new stake in Activision Blizzard (ATVI) in the final quarter of 2021. The well-timed purchase came just ahead of Microsoft's (MSFT) late-January $68.7 billion bid for the video game maker.

But that was far from the Oracle of Omaha's only change. All told, Uncle Warren initiated three new stakes, completely exited two positions and adjusted his exposure to eight other stocks. Read on to see Buffett's complete list of stock buys and sells from Q4 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.