Stock Market Today: S&P 500 Swings Higher After Fed Minutes

The major market indexes spent most of the day lower on the latest Russia-Ukraine news.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

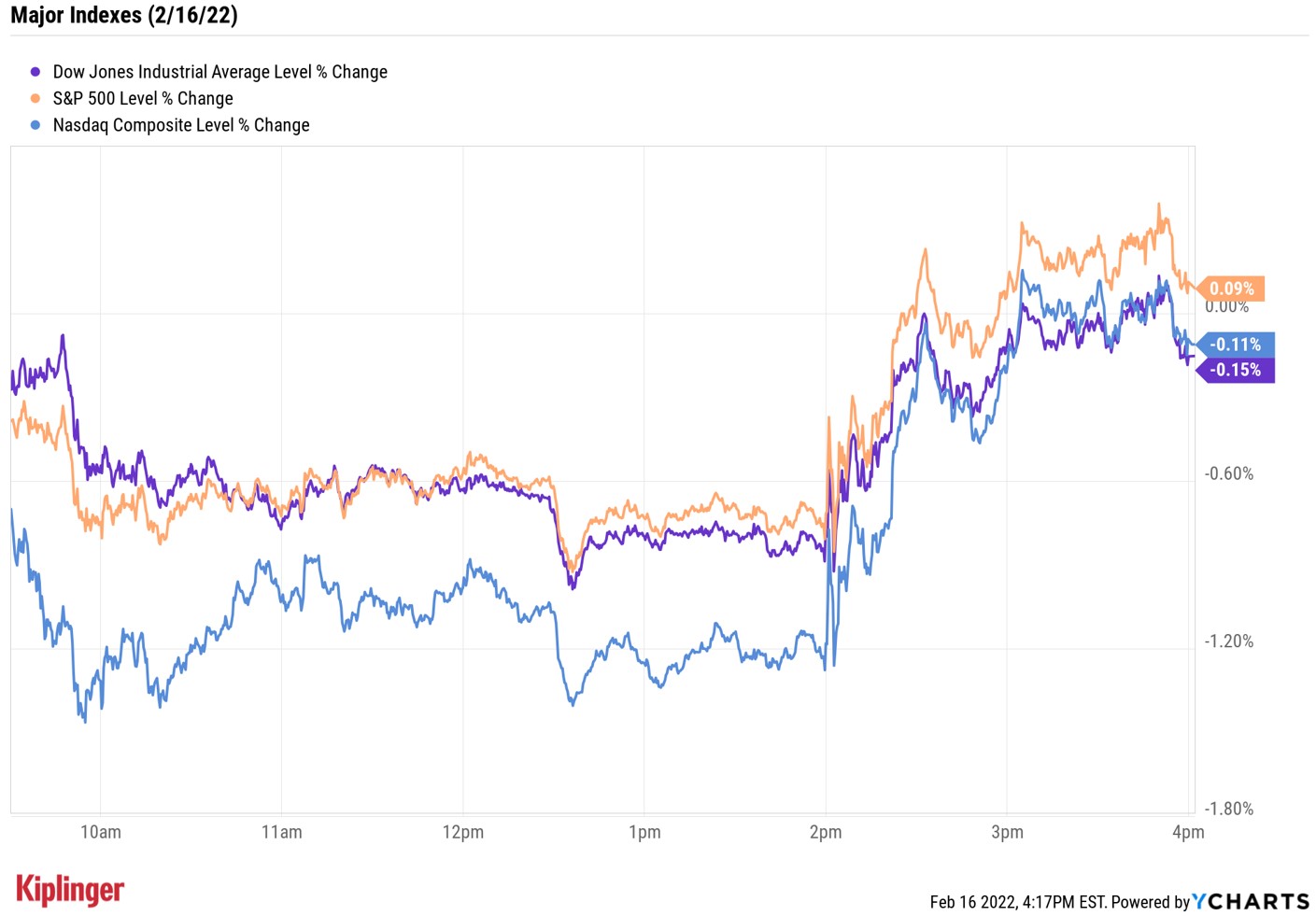

Stocks spent most of Wednesday in negative territory as investors mulled the latest Russia-Ukraine headlines.

Following Tuesday's reports that Russia was withdrawing some troops from Ukraine's border (which gave markets a boost), NATO Secretary-General Jens Stoltenberg on Wednesday said his organization has not seen any de-escalation. "On the contrary, it appears that Russia continues its military buildup," Stoltenberg told a group of defense ministers from NATO's member states at a meeting in Brussels.

But the major benchmarks erased their earlier losses after the release of the minutes from the Federal Reserve's January policy meeting.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"In markets, timing is everything, and the delayed reaction [to raise rates] from the Fed has investors convinced that aggressive policy tightening is on the horizon," says Charlie Ripley, senior investment strategist for Allianz Investment Management.

And although today's minutes did indicate the central bank is poised to raise rates at a quicker pace than it did during the last tightening cycle in order to combat surging inflation, "there was nothing in the minutes that suggested the Fed would be more aggressive than what the market has already priced in," Ripley adds.

While the Dow Jones Industrial Average (-0.2% at 34,934) and Nasdaq Composite (-0.1% at 14,124) still ended the day in the red, the S&P 500 Index (+0.1% at 4,475) managed to hang on for a win.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.1% to end at 2,079.

- The Russia-Ukraine news sparked a fire under U.S. crude futures, which ended up 1.7% at $93.66 per barrel.

- Gold futures rose 0.8% to settle at $1,871.50 an ounce.

- Bitcoin slipped 0.2% to $44,120.38. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Also in focus today was the latest retail sales data, which showed retail sales jumped by a seasonally adjusted 3.8% in January, much higher than forecast (though Kiplinger economist David Payne says the results come with an asterisk). "Retail sales and core retail sales both increased by more than expected in January, reflecting strong spending even after allowing for a boost from residual seasonal factors, and only a modest drag from Omicron on spending at eating and drinking establishments," Goldman Sachs economists wrote in a note.

- Roblox (RBLX) shares plunged 26.5% after the open gaming platform reported a fourth-quarter loss of 25 cents per share and bookings of $770 million. Analysts, on average, were expecting a slimmer per-share loss of 13 cents on $772 million in bookings. Still, RBLX reported 49.5 million daily active users, up 33% year-over-year. CFRA Research analyst John Freeman says he expects losses to "continue until 4Q22, driven by a somewhat troubling doubling of G&A and R&D expenses (ex-stock comp.) and a 47% higher expense related to the labor-intensive monitoring and security enforcement to ensure safe interactions on the platform, a key imperative given the majority of daily active users are still under 18." However, he kept a Strong Buy rating on the metaverse stock.

- Shopify (SHOP) was another post-earnings loser, sinking 16% after its results. While the e-commerce platform reported higher-than-expected earnings per share and revenue in its fourth quarter, it warned fiscal 2022 revenue growth would slow compared it 2021. "We expect merchant solutions to continue to benefit from strong growth in merchant sales, up 35%, and as Shopify Payments see greater penetration (49% of GMV vs. 45% a year ago)," says CFRA Research analyst Angelo Zino (Hold). "We also think Shop Pay Installments (buy now, pay later product) is seeing greater traction as it has proven to boost repeat purchases among first time customers by 23%. Despite decelerating growth, we remain encouraged by e-commerce trends and new growth opportunities."

A Special Breed of Dividend Payers

With geopolitical uncertainty front and center, markets are likely going to remain volatile.

"In the short term, stocks are moving in lockstep with headlines from the Russia/Ukraine situation," says David Bahnsen, chief investment officer at wealth management firm The Bahnsen Group.

He counsels investors to make sure their portfolios are well-constructed, with "high-quality stocks with strong cash flows and a long history of dividend growth." There are many different corners of the market investors can look to find solid dividend growers.

The Dividend Aristocrats – companies that have raised their dividend payments annually for the last 25 years – is certainly a good place to start, as are the yield-friendly real estate, healthcare and energy sectors.

Another strategy is to home in on companies that consistently pay "special dividends," or additional one-time payouts on top of their regular dividends. In any given year, there are typically only a handful of companies that reward shareholders with these bonus dividends, and these 10 names are shining examples of this special breed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.