9 Best Green Energy Stocks to Buy Now

The future for renewable energy remains bright, and these green energy stocks are poised to profit on a durable trend toward sustainability.

David Dittman

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Green energy stocks got a lift thanks to the clean energy incentives in the Inflation Reduction Act of 2022 (IRA), along with the dual catalysts of rising demand and lower costs.

Rising demand driven by leading AI data center operators is now the No. 1 factor supporting green energy stocks, despite President Donald Trump's effort to eliminate renewable and electric vehicle (EV) tax credits.

As Deloitte explained in its 2024 renewable energy industry outlook, the IRA extended wind and solar tax credits for projects that started construction before 2025 through at least 2032.

But state-level clean-energy legislation has also provided a boost, with 22 states and Washington, D.C., targeting 100% renewable energy or 100% carbon-free electricity by 2040 to 2050.

In addition, 43 of the 45 largest U.S. investor-owned utilities have committed to reducing their carbon emissions by raising the use of renewables.

"We expect little impact to U.S. utility-scale solar demand from corporate sustainability goals with or without tax credits," writes UBS analyst Jon Windham in a recent note on energy intensity and electricity costs for leading AI data centers and the impact on electric utility stocks.

According to Windham's analysis, the loss of renewable tax credits would have minimal impact on operating margins across tech stocks. "A detailed review of their sustainability reports reveals continued deep commitment to carbon free energy sourcing," Windham concludes.

Reuters reported less than 10 days after the election that Trump's transition team planned to kill the $7,500 consumer tax credit for electric-vehicle purchases as part of broader tax-reform legislation that we now know as the "big, beautiful" bill.

Such a law would have a deep but disparate impact on the EV market. Most EV stocks continue to trade on simple supply and demand in an increasingly global market.

Meanwhile, the main driver is elsewhere: U.S. corporations' demand for clean power has surged 100-fold in the past decade, according to a recent report from the trade group American Clean Power, as solar and wind power costs have fallen substantially due to increased competition and efficiencies.

As S&P Global reported in a June 2024 note, "As of this year, corporate renewable procurement capacity continues to show momentum, with 15.8 GW (gigawatt) contracted in the first quarter, growing 36% year on year. Europe led in capacity, while the Asia-Pacific region led in the number of deals. In terms of countries, corporates have been particularly active in the U.S., Australia and India."

With that in mind, here are nine of the best green energy stocks for investors looking to profit on the still-growing trend toward sustainability.

Data is as of June 11. Price target data is provided by S&P Global Market Intelligence.

GE Vernova

- Sector: Industrials

- Industry: Specialty industrial machinery

- Market value: $132.0 billion

- Median price target: $451.24 (6.7% implied downside)

The name "General Electric" does not exactly evoke the image of renewable energy. But the April 2024 division of the venerable industrial conglomerate's remains into two separate businesses has changed all that.

GE Vernova (GEV, $483.47) incorporates the old General Electric's operations in renewables, power, digital and energy financial services under the leadership of CEO Scott Strazik.

The spinoff accomplished GE's goal of dividing itself into three companies focused on energy, aviation and health care.

The other entity created a little more than a year ago, GE Aerospace (GE), includes the aviation assets. The spinoff of GE HealthCare Technologies (GEHC) was completed in early 2023.

Vernova's focus, Strazik says, is on addressing climate change and fostering sustainable development.

Its businesses include onshore wind turbines with rated capacities of two to six megawatts (MW) for different environments, offshore wind with six- to fourteen- MW capacities for tougher conditions, hydropower generation, hybrid renewable energy and storage, grid solutions and related solutions.

The Inflation Reduction Act provided a lift for Vernova, as it did for other green energy stocks, despite questions about its long-term viability in a second Trump administration.

As Morningstar analyst Joshua Aguilar noted at the time of the spinoff, "Favorable U.S. legislation provides a backdrop of more certainty around timing of wind-related projects, and a combination of better project selectivity, a focus on the North American market, and rightsizing should help drive the profits GE investors have long been clamoring for."

Since its spring 2024 debut on the New York Stock Exchange, GEV stock is up more than 255%.

Noting GE Vernova is "well positioned to capitalize on growing electricity demand" in a note on the stock's recent performance, Morningstar's Brett Castelli observes, "Shares are up nearly 50% year to date, handily outperforming the broad market, as outer-year financial expectations continue to increase."

Explaining that its current valuation "adequately reflects future revenue growth and margin expansion," Castelli concludes GEV shares are "overvalued following the rally in recent weeks."

Brookfield Renewable Partners

- Sector: Utilities

- Industry: Utilities – renewable

- Market value: $7.37 billion

- Median price target: $28.46 (9.9% implied upside)

Brookfield Renewable Partners (BEP, $25.92) is a renewable energy company that operates hydroelectric, wind, utility-scale solar and storage facilities in North and South America, Europe and Asia.

Brookfield Renewable has a track record of investing in and operating high-quality renewable energy assets. It's part of Brookfield Asset Management, which manages more than $1 trillion in assets.

"The fundamentals for energy remain very strong, with digitalization and re-industrialization driving accelerating demand that far outpaces supply," management notes in its first-quarter interim report.

"This imbalance persists despite weaker market sentiment due to uncertainty of the impacts of tariffs globally. Despite this, renewables represent the most viable solution to meet the insatiable demand for energy given their low-cost position, mature supply chain and ability to be deployed quickly in almost any region"

Brookfield has also positioned itself to benefit from a renaissance in the nuclear power industry promised by Trump.

Brookfield and its institutional partners formed a strategic partnership with Cameco (CCJ) to acquire Westinghouse, one of the world's largest nuclear services businesses, for $7.9 billion in 2023.

According to Brookfield, nuclear power and hydroelectricity are "the only forms of clean, dispatchable, baseload power generation and will be a key enabler of the rapid growth of intermittent solar and wind."

Westinghouse services about half the global nuclear power generation sector and is the original equipment manufacturer to more than half of the global nuclear reactor fleet. Brookfield and its partners own 51% of Westinghouse, while Cameco holds 49%.

"Westinghouse is well positioned to capture the increasing global tailwinds for nuclear," according to Brookfield.

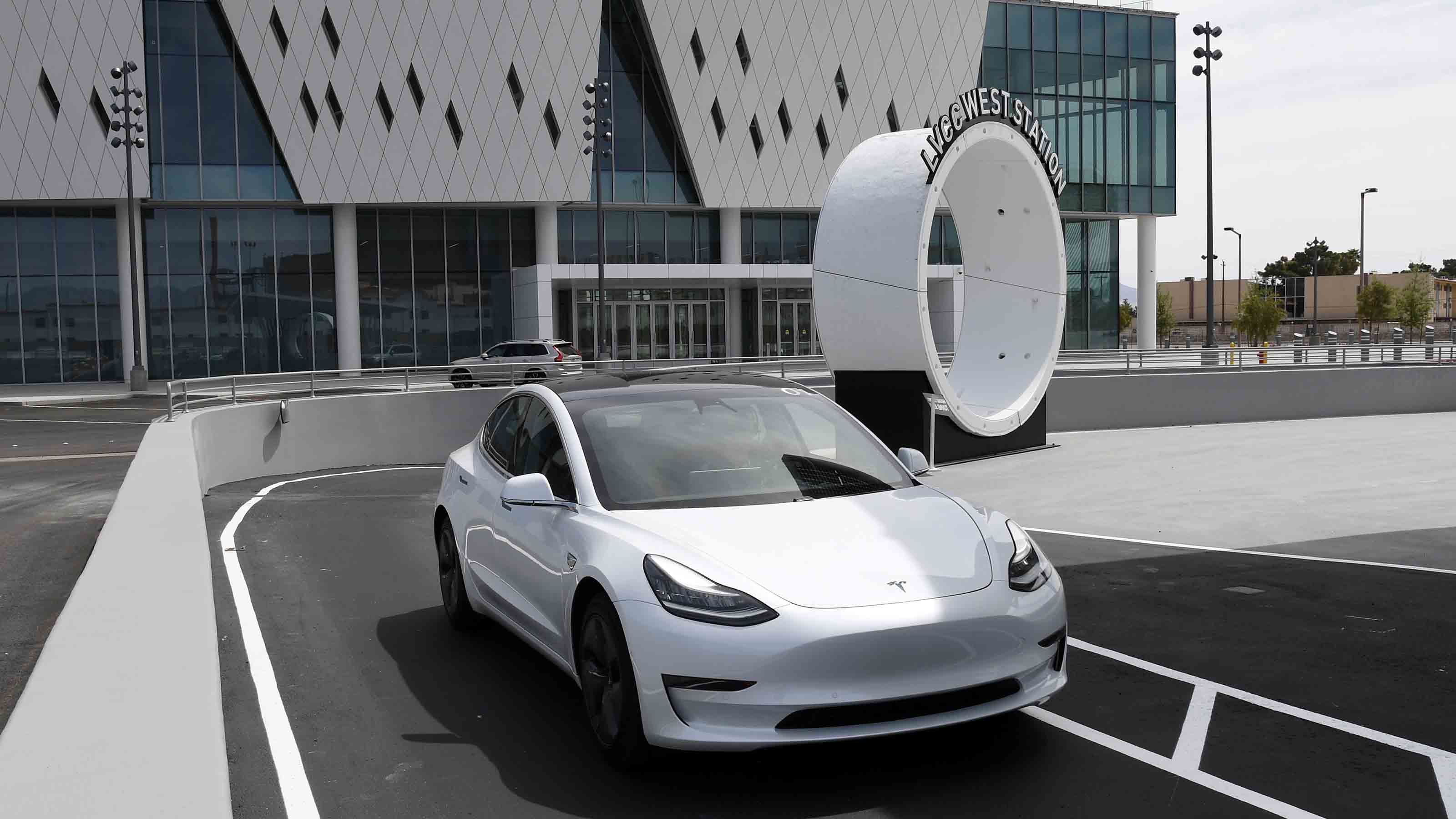

Tesla

- Sector: Consumer discretionary

- Industry: Auto manufacturers

- Market value: $1.1 trillion

- Median price target: $299.14 (8.4% implied downside)

The share price of Tesla (TSLA, $326.43) surged in the aftermath of Donald Trump's victory in the 2024 U.S. presidential election, with CEO Elon Musk playing a prominent role in both the campaign and the transition period ahead of the January 20, 2025, inauguration.

TSLA suffered some as Musk acquired Twitter, turned it into X and extended his reach into social media and politics. His bet on Trump — "a poker move for the ages," according to Dan Ives of Wedbush Securities — appears to another volatile venture.

The Trump administration plan to eliminate tax credits for EV purchases would likely benefit Musk's company, as Kiplinger's Kelley Taylor writes. "Tesla representatives have expressed support for ending the subsidy to Trump's transition committee. This may seem counterintuitive but seems to align with CEO Elon Musk's previous statements."

Still, TSLA has traded as high as $429.80 (January 15) and as low as $214.25 (April 7) so far in 2025.

Some of that price action is about Tesla's operational progress, including the anticipated release of its robotaxi. A lot of TSLA volatility is simply about CEO Elon Musk and his up-and-down relationship with Trump.

One of the largest battery electric vehicle automakers in the world, Tesla is well positioned to grow its solar panel and storage businesses in similar fashion.

But Tesla stock has other drivers now.

"We believe Trump in the White House changes the landscape for Elon Musk and Tesla," Ives said during a post-election appearance on CNBC.

Ives said then Musk's "major strategic bet" could prove "very bullish for Tesla’s AI/autonomous story."

Reflecting his bullish view on Trump's victory and its potential impact on Musk's company, Ives raised his price target for TSLA from $300 to $400.

Ives has raised that target as high as $550 in 2025. He's also cut it as low as $315 amid a "massive feud over social media" between the CEO and the president.

"The vast majority of valuation upside for Tesla depends on the success of its autonomous vision," Ives emphasized in a June 6 note. "Therefore, a cooperative relationship with Trump will be essential for securing the federal framework needed to support that vision."

Ives believes Tesla has a path toward a $2 trillion valuation driven by full self-driving, widespread adoption of autonomy, and the U.S. rollout of its Cybercab service.

NextEra Energy

- Sector: Utilities

- Industry: Utilities – regulated electric

- Market value: $150.7 billion

- Median price target: $80.71 (10.6% implied upside)

NextEra Energy (NEE, $73) is typically found on lists of the best green energy stocks to buy.

The world's largest producer of wind and solar energy, NextEra also owns Florida Power & Light, the biggest electric utility in the U.S., providing clean electricity to more than 12 million people.

It's a corporate leader in sustainability, having been awarded the S&P 500 Global Platts 2020 Energy Transition Award for ESG leadership.

The utility stock was a primary beneficiary of the IRA, which CEO John Ketchum described as "transformational for our industry and our business" when it was passed.

Ketchum and NextEra Energy expected tax credits for wind, solar and storage to remain in place. But management continues to find ways to grow its business.

NextEra Energy Resources continues to add new renewable and storage projects to its backlog.

Management also completed agreements with two Fortune 50 customers for the potential development of renewables and storage projects totaling up to 10.5 gigawatts between now and 2030.

NextEra Energy Transmission has also secured contracts to build transmission projects in the PJM Interconnection, California Independent System Operator and Southwest Power Pool footprints that will roughly double the size of its transmission investments. Management expects rapid growth in electricity demand from data centers supporting generative AI.

Highlighting the opportunity that increased power demand is bringing to the utility sector, management said NextEra "will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges each year through 2027, while maintaining our strong balance sheet and credit ratings."

NEE has enjoyed a solid 2025 despite the political uncertainty of the IRA, rising 3.5% amid surging data-center demand for power and outperforming the S&P 500 year to date.

NextEra is also one of the best dividend stocks, with Ketchum saying the company expects to raise its dividend by 10% a year through "at least" 2026.

Canadian Solar

- Sector: Technology

- Industry: Solar

- Market value: $734.7 million

- Median price target: $12.97 (18.1% implied upside)

Canadian Solar (CSIQ, $10.98) has had a rough couple of years but remains one of Wall Street's best green energy stocks for the long term.

CSIQ is a solar power company that provides integrated solutions that include solar-power products, services and systems. It's one of the world's largest makers of solar photovoltaic products, as well as one of the largest solar-power plant developers. Canadian Solar sells to utilities, businesses and consumers.

Canadian Solar says it's delivered more than 125 GW of solar modules to thousands of customers in more than 160 countries with another 26 GW of solar projects and 56 gigawatt hours (GWh) of storage projects in the pipeline.

A combination of high interest rates making new projects prohibitively expensive plus policy changes at the state level has limited growth in residential solar demand.

Changes to California's Net Energy Metering program and similar moves by other states reduced financial incentives for going solar. With those impacts now priced in, the Solar Energy Industries Association forecast annual growth for the residential solar market will average 9% from 2025 through 2030.

CSIQ's revenue has doubled since 2019, from $3.2 billion to $6.5 billion for fiscal 2024.

The share price reached a multiyear low in April amid the broader post-"Liberation Day" stock market sell-off and the aftermath of another less-than-stellar earnings report.

CEO Shawn Qu remains optimistic. Noting operational and financial headwinds created by "intense" competition and ongoing policy and trade-related uncertainty, Qu said in the company's fiscal 2024 fourth-quarter earnings announcement that Canadian Solar's modules business helped it "maintain relatively stronger profitability compared to the broader market."

Qu added that the green energy stock remains "fully committed to the U.S. market" and continues to expand solar module, solar cell and energy storage manufacturing capacity at three facilities.

SolarEdge Technologies

- Sector: Technology

- Industry: Solar

- Market value: $1.2 billion

- Median price target: $15.40 (26.1% implied downside)

SolarEdge Technologies (SEDG, $20.83) is featured among the best green energy stocks because it's the largest maker of solar inverters. Solar inverters convert direct current from solar panels into alternating currents used in homes and electrical grids.

According to Morningstar analyst Brett Castelli, SolarEdge's DC optimizer is the leader in solar residential rooftop installations; the company has expanded its sales to include business and utility clients.

Because a majority of the company's revenue comes from Europe, SolarEdge was well-positioned to navigate a slowdown in U.S. residential solar demand "as California NEM 3.0 takes effect," Castelli said in a research note.

California's Net Energy Metering (NEM) policy calls for homeowners to get credit when their solar panels push excess electricity onto the grid when the sun is shining. This credit offsets the cost of electricity they use at nightfall.

Under NEM 3.0, the rates homeowners receive are 75% lower than before. This means less savings for the homeowner and a drag on solar panel sales.

Beyond inverters, SEDG has expanded into e-mobility and uninterrupted power supply markets. The analyst notes that e-mobility might be a big and growing market, but it requires more capital, carries execution risk and takes a long time to generate meaningful revenue.

It was a difficult 2024 for SolarEdge stock, which shed nearly 75% of its value before CEO Zvi Lando announced his resignation in August.

SolarEdge named a new CEO, Shuki Nir, in December. Nir had been the company's chief marketing officer since June 2024.

The appointment followed a November 28 announcement that SolarEdge closed its utility-scale battery storage division to focus on solar photovoltaics (PV) and cut its employee headcount by about 12%.

The green energy stock has responded, rising more than 50% in 2025.

Castelli says SolarEdge will suffer less harm than other solar companies from legislation that would eliminate rooftop solar incentives and accelerate the phaseout of other renewables incentives.

General Motors

- Sector: Consumer discretionary

- Industry: Auto manufacturers

- Market value: $47.9 billion

- Median price target: $54.15 (8.6% implied upside)

Why is General Motors (GM, $49.87) on this list of the best green energy stocks to buy? Because the carmaker is going all in on an electric future.

The company said that it plans to invest $35 billion in electric vehicle and autonomous vehicle (AV) production through 2025. By mid-decade, GM plans to sell a million EVs a year in North America.

GM also deepened its investment in AV company Cruise, buying SoftBank's stake for $2.1 billion and pouring in another $1.4 billion. Cruise develops self-driving cars for ridesharing and delivery.

In December, GM announced a plan to scrap the Origin robotaxi project and combine Cruise with its existing technical teams for a focused effort on autonomous and assisted driving

GM, which sells vehicles under the Chevrolet, Buick, Cadillac, Baojun and Wuling brands, also jointly developed its Ultium battery platform with South Korea's LG Energy Solution to mass produce battery cells.

GM is projecting that its next-gen Ultium packs will cost 60% less than existing batteries in use today with double the energy density. GM is reusing or recycling these batteries.

GM continues to transition to a fully electric future and still plans to phase out gas and diesel engines and offer only EVs by 2035.

Its strategy involves significant investment in EV technology, infrastructure and manufacturing.

Amazon.com

- Sector: Consumer discretionary

- Industry: Internet retail

- Market value: $2.3 trillion

- Median price target: $239.22 (12.2% implied upside)

E-commerce giant Amazon.com (AMZN, $213.20) joins the list of green energy stocks to consider because it is far and away the largest buyer of clean energy in the U.S., according to trade group American Clean Power.

"Corporate buyers are a critical part of the energy transition" in America from fossil fuels to clean energy, the trade group's report said.

"Their accelerated buying of clean energy provides an important source of demand, while their efforts to decarbonize their products and services puts pressure on their supply chain to do the same."

In 2023, Amazon invested in more than 100 new wind and solar projects. Its renewable power purchase agreement capacity in 2024 was 34 GW.

Once its more than 500 wind and solar projects are operational, Amazon expects to produce 77,000 GWh of clean energy on an annual basis, enough to power 7.2 million homes.

Moreover, Amazon said it is on track to meet its 100% clean energy goal five years earlier than the 2030 it previously projected.

What's more, Amazon co-founded The Climate Pledge in 2019, which commits companies to achieving net-zero carbon emissions by 2040 or a decade earlier than the Paris Agreement.

Ørsted

- Sector: Utilities

- Industry: Utilities – renewable

- Market value: $18.1 billion

- Median price target: $13.17 (8.5% implied downside)

Ørsted (DNNGY, $14.40) is the largest multinational power company in Denmark. After selling its oil and gas fields in 2017, the company is now focused on renewables.

The company develops, constructs and operates wind farms, solar farms, energy storage facilities, renewable hydrogen and green fuels facilities and bioenergy plants.

Ørsted operates 9.9 GW of offshore wind farms, with the biggest concentration of operations in the U.K.

It has the largest portfolio of offshore wind farm projects in Europe and continues to ramp up its American presence.

Ørsted owns and operates the first U.S. offshore wind project, the Block Island Wind Farm, which replaced five diesel generators and now powers 17,000 homes in Rhode Island.

It's developing 5 GW of offshore wind capacity in Connecticut, Maryland, New Jersey and New York, as well as 4 GW of onshore wind, solar and storage projects in Texas, the Midwest and the Southeast.

In addition to being one of Wall Street's best green energy stocks, DNNGY was also named the world's most sustainable company in 2022 by Corporate Knight's 2022 Global 100 Index.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Deborah Yao is an award-winning journalist, editor, and personal finance columnist who has held editorial roles at Kiplinger, The Wharton School, Amazon, The Associated Press, S&P Global (SNL Kagan) and MarketWatch. She specializes in writing and editing articles on finance and technology, with particular expertise in the areas of stock analysis, monetary policy, fintech, blockchain, macroeconomics, financial planning, taxes, among others. She has been published in The New York Times, USA Today, CBS News, ABC News, Wharton Magazine, and many other news outlets.

- David DittmanInvesting Editor

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.