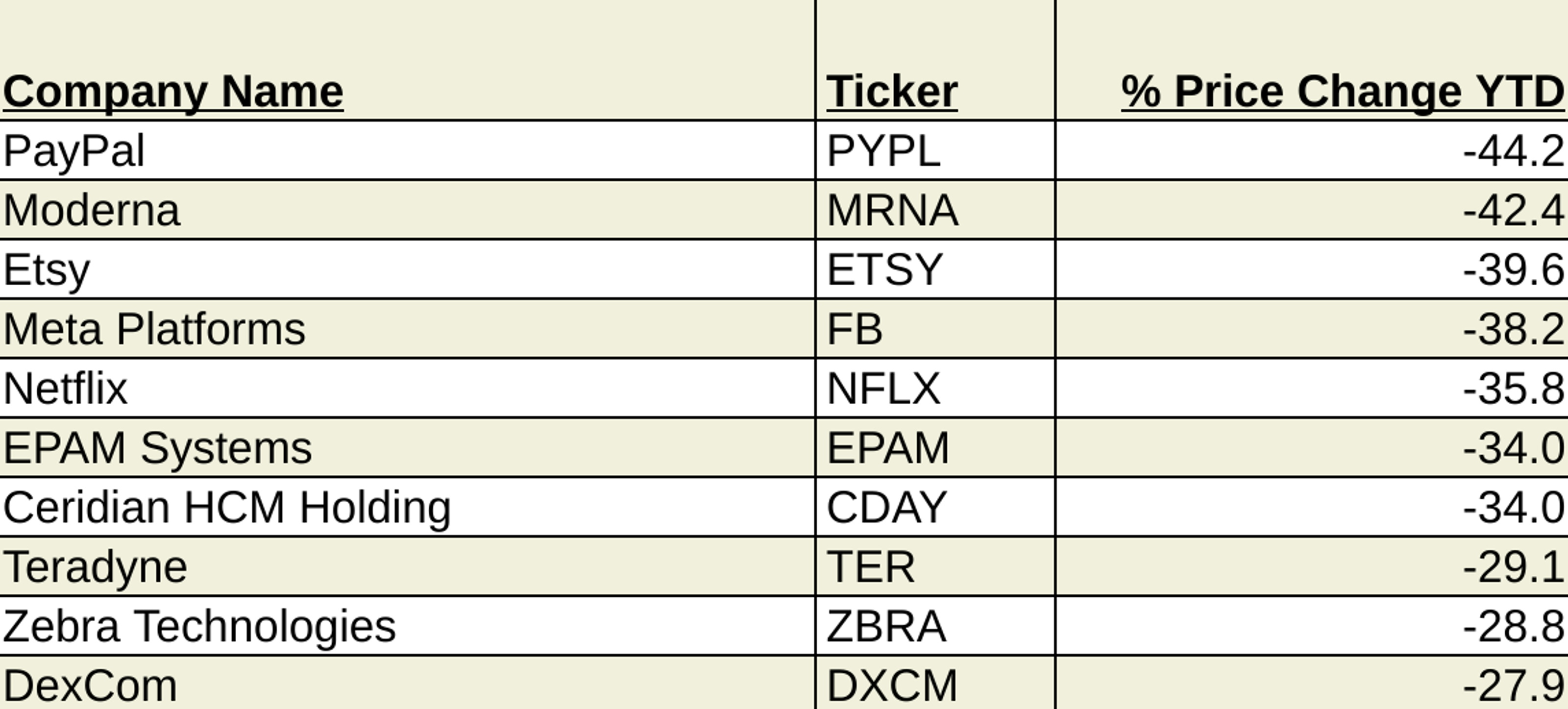

10 Biggest Losers in the S&P 500 This Year

The S&P 500 hasn't yet crossed over into correction territory, but many of its components are in far worse shape.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The S&P 500 is off almost 9% for the year-to-date, but the biggest decliners in the main benchmark of U.S. equity performance are faring far, far worse.

From small, somewhat obscure members of the index to the planet's best-known and biggest stocks, the S&P 500's most beaten-down names do have at least a few commonalities.

For one thing, they're all well into bear-market territory, down at least 27% on a price basis for the year-to-date. Some of these stocks are suffering the flip side of having been among last year's biggest winners. Plenty of stocks that rallied as pandemic or COVID-19 recovery plays in 2021 have seen much of their gains evaporate this year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Additionally, inflation, interest-rate anxiety and geopolitical tension have been particularly hard on pricey growth stocks in 2022. This tense background and an abrupt shift in sentiment made for an unusually punishing earnings season. Woe to any company that missed Wall Street estimates – or worse – issued downbeat guidance.

Those are just some of the factors driving the price declines of the S&P 500's biggest losers this year, which we list in the table below. But first, let's take a quick look at some of the more notable entries.

- Shares in Facebook parent Meta Platforms (FB, $207.71) lost more than 38% for the year-to-date through Feb. 17 after posting a disastrous fourth-quarter report. We learned that changes to Apple's (AAPL) iOS privacy settings clobbered FB's core advertising business. Meta users are fleeing its platforms for the likes of TikTok and other rivals. Making matters worse, the company issued a dismal outlook. And it's plowing billions of dollars into the metaverse – a perhaps decade-long project with no guarantee of a payoff. FB has shed $356 billion in market value in 2022, dealing a big blow to the market-cap-weighted S&P 500.

- PayPal Holdings (PYPL, $105.20) was the S&P 500's biggest loser through Feb. 17, declining more than 44%. Quarterly earnings that missed Wall Street's consensus estimate hurt, but more damaging was its shortfall in user growth. Worst of all, however, was PYPL's scaled-back revenue and profit forecasts. High-priced growth stocks stand no chance in this market when they can't deliver on expectations, both past and future. A series of analyst downgrades and price-target cuts only added to the selling pressure. "It will likely take several quarters of better results to restore investor confidence," says Argus Research analyst Stephen Biggar, who recently lowered his 2022 profit estimate and price target but maintained a Buy rating on shares.

- Moderna (MRNA, $146.36) was one of the S&P 500's best stocks in 2021, gaining 140%. But the higher they fly, the harder they fall. Shares are off more than 40% year-to-date as investors weigh the company's fortunes on the other side of the pandemic. UBS Global Research initiated coverage of MRNA at Neutral (the equivalent of Hold) in late January, citing the potential of its drugs under development. "We think MRNA's platform has significant applications beyond COVID-19, but that current levels reflect this potential based on the science to date," analyst Eliana Merle says in a note to clients. "In the near-term, we think COVID-19 remains the key focus and a source of near-term volatility for shares."

Have a look at the table below for the 10 worst stocks of the S&P 500 for the year-to-date through Feb. 17:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.