Stock Market Today: Stocks Slip Further as Sanctions Mount

The U.S. and U.K. announced additional sanctions as the Russia-Ukraine crisis continued to ramp up, sending the major indexes further into the red Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The S&P 500 dipped deeper into correction territory Wednesday amid additional fallout of Russia's attacks on Ukraine.

A U.S. official told NBC News that Russia has "nearly 100 percent of all the forces we anticipated [Russian President Vladimir Putin] would need" to launch a full-scale invasion of Ukraine, which has declared a state of emergency and called up its military reserves.

Meanwhile, a day after announcing sanctions targeting two of Russia's largest banks, President Joe Biden announced new measures against Nord Stream 2 AG, a company responsible for the Nord Stream 2 natural gas pipeline stretching from Russia to Germany. And U.K. Prime Minister Boris Johnson promised military support (including weapons) for Ukraine.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"If Russia goes deeper into Ukraine, the conflict could be longer and the West's reaction could be more severe. As a result, sanctions could be more biting," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments. "Higher commodity prices and slower growth could have a meaningful impact on the global economy, including emerging-market economies and by making the Fed's job even more difficult."

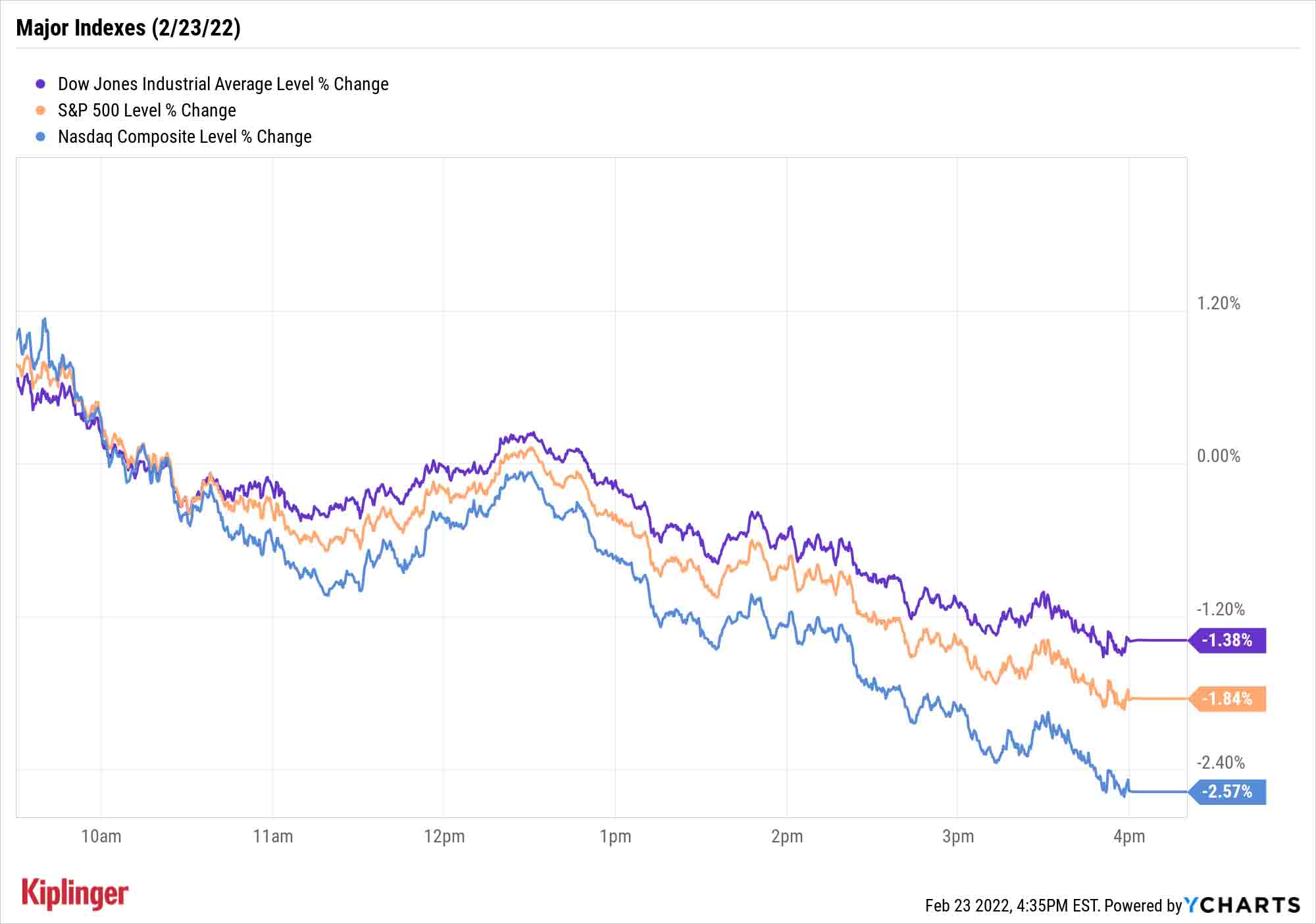

Stocks teased investors by opening in the green, but the trap door quickly opened. The S&P 500 (-1.8% to 4,225) suffered its fourth consecutive decline, while the Dow Jones Industrial Average (-1.4% to 33,131) and Nasdaq Composite (-2.6% to 13,037) each posted their fifth straight losses.

Other news in the stock market today:

- The small-cap Russell 2000 sank 1.8% to 1,944.

- U.S. crude oil futures gained 0.2% to end at $92.10 per barrel.

- Gold futures rose 0.2% to settle at $1,910.40 an ounce.

- Bitcoin slid modestly, off 0.6% to $37,702.21. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- TJX (TJX) stock slipped 4.2% after the off-price retailer reported earnings. In its fourth quarter, TJX reported earnings of 78 cents per share on revenue of $13.9 billion, falling short of the 91 cents per share and $14.2 billion analysts were expecting. The TJ Maxx parent also reported a 10% jump in same-store sales for the three-month period and hiked its dividend by 13%. "Although this was a disappointing quarter in our view, nothing has changed in our 12-month thesis, as we see TJX outperforming as the consumer weakens and becomes more aware of higher costs across all aspects of retail," says CFRA Research analyst Zachary Warring (Strong Buy). "We see more and more consumers returning to off-price retailers over the next 12-months as stimulus fades, and we expect TJX to be the biggest beneficiary."

- In its fourth quarter, Lowe's (LOW, +0.2%) reported earnings of $1.78 per share – up 34.8% year-over-year and coming in well above analysts' consensus estimate for earnings of 71 cents per share. Revenue was up 4.8% from the year prior to $21.3 billion, also exceeding forecasts for $20.9 billion in sales. "LOW is improving its processes to enhance store product offerings, operational improvement, and widen margins," writes CFRA Research analyst Kenneth Leon (Buy). "We think the PRO segment will outperform the Do-It-Yourself (DIY) segment in fiscal 2023, given affluent households boosting remodeling contracts with PRO customers, and DIYs face inflation pressures and reduce disposable income."

The Coming Days, Weeks Are Pivotal

Bluntly speaking, the market is now at a "put up or shut up" moment.

More specifically, says Sam Stovall, chief investment strategist at independent research firm CFRA, now is a point at which a garden-variety correction either begins to sort itself out … or signal a bear market is nigh.

"For corrections, the S&P 500 posted average price gains of 1.1%, 1.8%, 2.9% and 4.7% one, seven, 30 and 60 days later, respectively," he says. "Conversely, price changes and frequencies of advance continued to slide under declines that eventually became bear markets. Specifically, while the market was typically flat in the day after falling into a correction, the S&P 500 continued to record price declines averaging 0.4%, 2.9% and 4.8% seven, 30 and 60 days later."

More simply put, if the market shows signs of recovery in the coming days and weeks, the correction might be over. If not, "the worst is yet to come."

While we're stuck in something of a Schrodinger's stock market, most investors are better off focusing on long-term quality rather than speculative upside. You can start with the best-rated blue chips of the S&P 500 or the Dow's most promising dividend-yielding stocks.

And those able to fix their eyes far down the horizon might be best off reviewing these 22 retirement-minded stocks – a group of companies that deliver secure, high-yielding dividends backed by ample cash flow and bulletproof balance sheets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.