Stock Market Today: Russian Invasion Sparks Roller-Coaster Day for Stocks

Stocks initially opened deep in the red on news of Russia's full-scale attack on Ukraine.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

News of Russia's full-scale invasion of Ukraine sent stocks plummeting out of the gate today.

"We're clearly in risk-off mode in the market right now given the uncertainty regarding the military operations in Ukraine," says Brian Price, head of investment management for Commonwealth Financial Network.

"There seems to be some element of surprise that the events have escalated so quickly and I would expect that we'll continue to see volatility in the near term."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

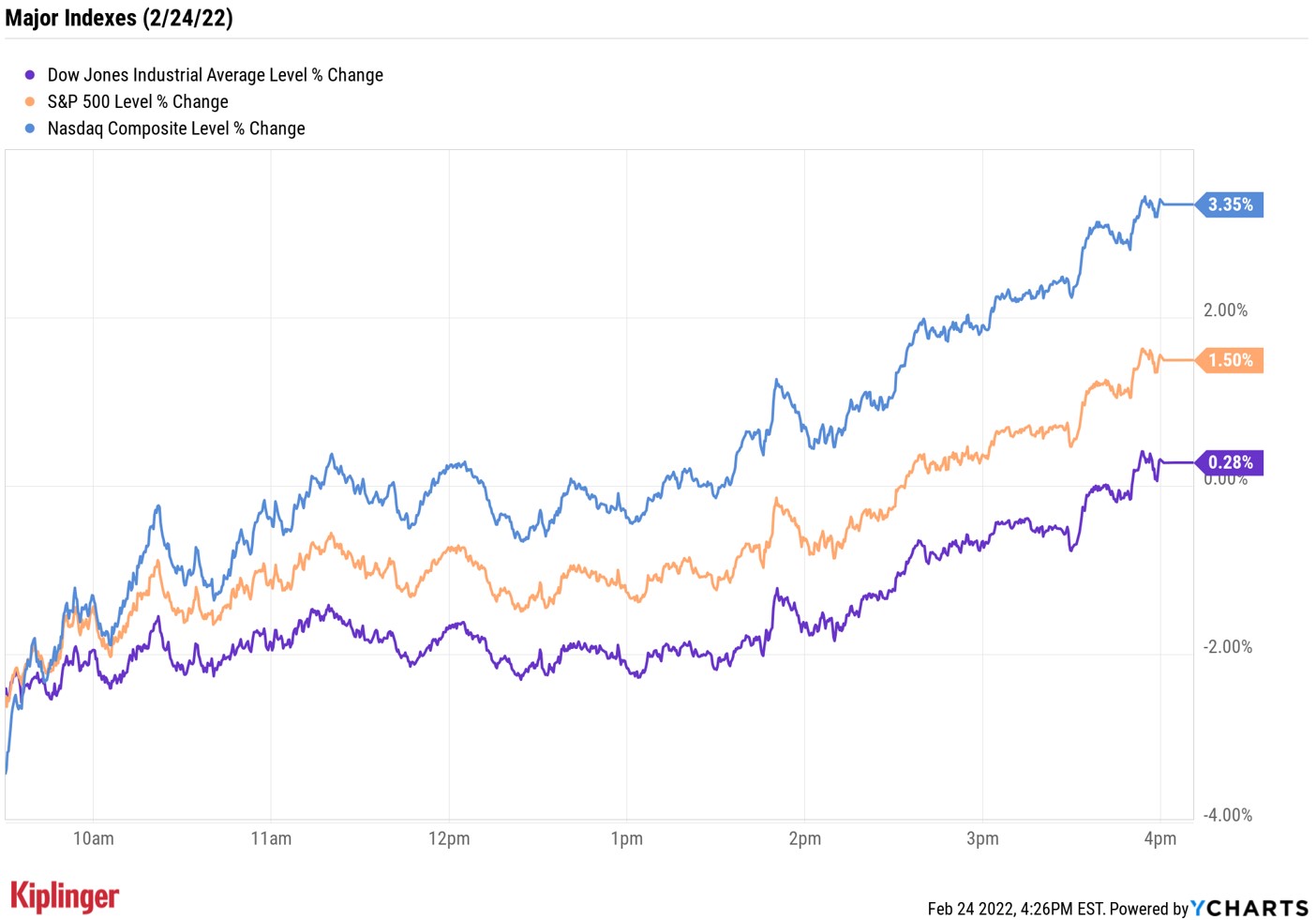

Indeed, after the Dow Jones Industrial Average flirted with correction territory and the Nasdaq Composite slipped below its bear-market level on an intraday basis, the major market indexes reversed course as President Joe Biden announced a new round of sanctions against Russia, including freezing trillions of dollars in Russian assets, and said he is sending additional U.S. troops to Eastern European countries that are in NATO.

By the close, the Nasdaq – which was down 3.4% at its session low – was up 3.3% at 13,473. The S&P 500 Index also finished in positive territory, gaining 1.5% to end at 4,288. The Dow, meanwhile, ended with a 0.3% gain at 33,223, after trading as low as 32,272 earlier.

Other news in the stock market today:

- The small-cap Russell 2000 joined in on the roller-coaster ride, ending the day up 2.6% at 1,995, after being down as much as 2.6% in intraday trading.

- Gold futures gained 0.8% to settle at $1,926.30 an ounce, their highest finish in 17 months.

- Bitcoin rose 2% to $38,466.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Moderna (MRNA) was a big winner today, jumping 15.1% after earnings. In its fourth quarter, the drugmaker reported adjusted earnings of $11.29 per share on $7.2 billion in revenue, exceeding the $9.90 per share and $6.8 billion expected by analysts. The company also said it sold $17.7 billion of its COVID-19 vaccine and expects to sell at least $19 billion in fiscal 2022.

- Booking Holdings (BKNG), on the other hand, slumped 7.1% after its quarterly results. The online travel reservation company reported adjusted earnings of $15.83 per share and revenue of $3.0 billion in its fourth quarter, beating out analysts' expectations for earnings of $13.30 per share on $$2.9 billion in sales. The company also said gross travel bookings for the three-month period were up 160% year-over-year to $19.0 billion. Still, Booking CEO David Goulden warned of "a potentially volatile environment with high COVID infection rates in some part of the world and geopolitical uncertainty that could impact our business, especially in Europe," in the company's earnings call. UBS Research analyst Lloyd Walmsley maintained a Buy rating on BKNG. "Looking ahead, we see scope for a stronger-than-expected recovery in 2022 and into 2023 in terms of room nights and bookings which we think would flow through at attractive incremental margins," he writes in a note.

One Way to Hedge Geopolitical Risk

One way to hedge international turmoil: commodities. This is according to a team of Goldman Sachs Commodities Research strategists.

"With news of Russia's invasion of Ukraine emerging, commodity markets have rallied aggressively, acting as the clear geopolitical hedge of first resort," they write.

This was seen in the price action for several commodities today, most notably U.S. crude oil futures, which topped the $100 per-barrel mark in intraday trading – their first move above this level since 2014 – before settling up 0.8% at $92.81 per barrel.

And prices are likely going to head even higher, with many experts predicting oil could hit the $125 per-barrel mark. "Uncertainty around potential sanctions is beginning to create a potential supply shock," the team says. "In our view, until the uncertainty around the rapidly escalating situation is resolved, commodity price risk remains skewed to the upside."

Not only would a continued rise in oil prices spell good news for traditional energy stocks and energy exchange-traded funds, but also master limited partnerships (MLPs). These firms, which are largely responsible for pipeline infrastructure and storage facilities, offer both exposure to the booming energy market and high dividend yields to boot.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.