Stock Market Today: Dow Dashes to Best Gain Since November 2020

Russia reportedly is opening the door to negotiations, sparking a broad-based rally Friday that saw all 11 sectors finish well in the green.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

News about the conflict in Eastern Europe was contradictory as the trading week came to a close, but markets surged as Wall Street grasped for good news.

On Friday, Russian troops reportedly were closing in on the Ukrainian capital of Kyiv. Yet on the same day, the Kremlin said Russian President Vladimir Putin had agreed to send a delegation to the Belarusian capital of Minsk to negotiate with Ukraine.

Chinese President Xi Jinping reportedly also gave a nod toward a peaceful resolution, saying "China supports Russia and Ukraine to resolve issues through negotiations" after a conversation with Putin, according to state-owned CCTV.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But some of Friday's bullishness might also have come from changing expectations for Federal Reserve action this year.

"Wall Street anticipates central bank reluctance to go overly aggressive with tightening monetary policy, so they could provide a cushion for a growth hit that will stem the Russia-Ukraine developments," says Edward Moya, senior market strategist at currency data provider OANDA.

Back on the homefront, America's core personal consumption expenditures price index showed consumer spending up 5.2% in January, according to the Commerce Department. That was slightly better than expectations for 5.1%.

"The strong consumer numbers come at a time when many economists were worried about an economy that was weaning itself of government stimulus in the latter part of 2021, and whether the consumer would be able to carry the torch in 2022," says Peter Essele, head of portfolio management for Commonwealth Financial Network.

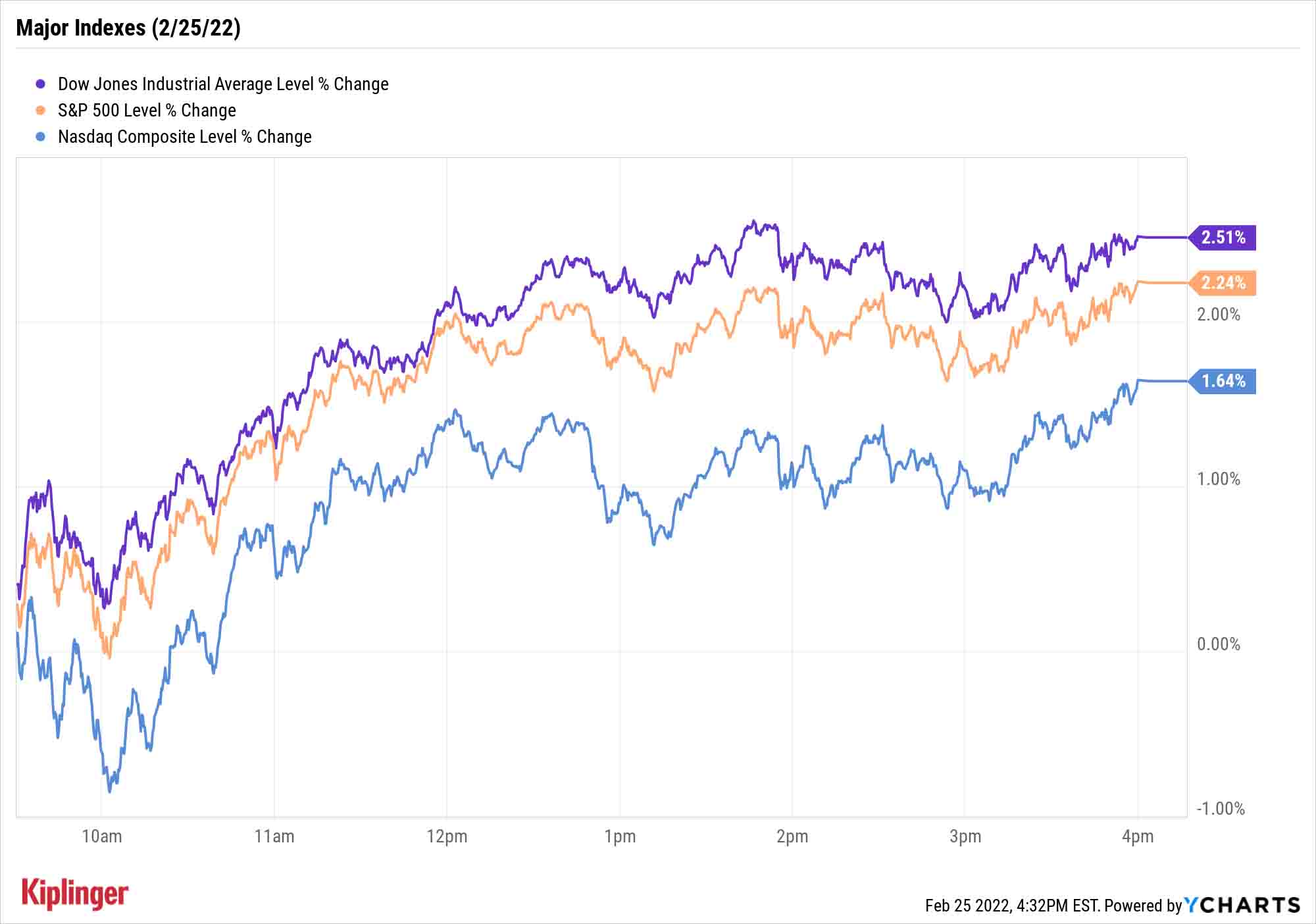

The Dow Jones Industrial Average – led by advances in Johnson & Johnson (JNJ, +5.0%), 3M (MMM, +4.7%) and Procter & Gamble (PG, +4.3%) – jumped 2.5% to 34,058, its best performance since a roughly 3% gain on Nov. 9, 2020. The S&P 500 (+2.2% to 4,384) and Nasdaq Composite (+1.6% to 13,694) also posted sizable gains, putting both indexes into positive territory for the week.

Still, the impressive market comeback of the past couple of days doesn't mean the market is out of the woods yet.

Yesterday, the CBOE Volatility Index, or VIX, crossed above 30 amid Russia’s invasion of Ukraine. “VIX above 30 indicates that investors are unusually anxious about what comes next, and that they are hedging stock portfolios to protect against further declines,” say Michael Oyster and Steven Sears of asset-management firm Options Solutions. “Market fears have abated somewhat, with the CBOE VIX below 30, but as it remains near the highest 10% level of all time, the options market is hardly signaling an all-clear.”

Other news in the stock market today:

- The small-cap Russell 2000 popped 2.3% to 2,040.

- U.S. crude oil futures slumped 1.3% to finish at $91.59 per barrel, but still ended the week up 1.5%.

Gold futures shed 2% to settle at $1,887.60 an ounce, bringing its weekly decline to 0.6%. - Bitcoin continued clawing its way back to $40,000, rising 1.7% to $39,130.32. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Etsy (ETSY) stock soared 16.2% after the online marketplace reported top- and bottom-line beats in its fourth-quarter. For the three-month period, ETSY brought in earnings of $1.11 per share on $717 million. While the company did offer lower-than-expected current-quarter revenue and gross merchandise sales guidance, Chief Financial Officer Rachel Glaser said this was due to tough year-over-year pandemic-related comparisons. "ETSY is one of few names surviving the pandemic online bubble with initiatives to drive top line at core brand and the subs," says Needham analyst Anna Andreeva, who reiterated a Buy rating on the retail stock.

Foot Locker (FL) sat out today's broad-market rally, shedding 29.8% after earnings. In its fiscal third-quarter, the athletic apparel retailer reported adjusted earnings of $1.67 per share on $2.34 billion in revenue, higher than the $1.44 per share and $2.33 billion expected by analysts. However, FL also warned that revenue will likely be down between 4% and 6% and same-store sales will contract 8% to 10% in fiscal 2022. This is due in part to the company selling less products from Nike (NKE). "In Q4 '21 Nike represented 65% of vendor spend which FL plans to reduce to 55% moving forward," says CFRA Research analyst Zachary Warring (Hold). "We do not like the positioning of FL as companies shift to direct-to-consumer and they continue to have higher exposure to malls but see limited downside as FL currently trades at 6.0x 2023 EPS and a clean balance sheet."

Where Can Opportunists Put Money to Work?

In times of market crisis, some people look for protection, while others scout out opportunities.

Rhys Williams – chief strategist at Spouting Rock Asset Management and a former journalist at the Moscow office of The Sunday Times – has a dour outlook on the geopolitical situation:

"Putin seems to have made his choice, and it looks like he has settled on regime change," Williams said, adding that in the medium-term, he's not quite sure how business gets back to usual.

But there are some market implications for investors looking to buy on this dip.

"I think Big Tech will get a bid after a significant correction, as they have a lot of cash and consumer staples-like qualities. They also don't lose much business in Russia and the Ukraine relative to overall revenues," he says. These 12 stocks represent some of our best ideas in the broader sector, though specific industries such as cybersecurity are becoming a trendy pick.

Rhys also likes higher-dividend-yielding stocks, "as perhaps this caps interest rates for a while."

You can start with this nine-pack of stocks dishing out 5% or more in annual income – though more importantly, they haven't been selected only for their large headline yields. These picks broadly feature conservative payout ratios, stronger balance sheets and business models that generate predictable cash flow, meaning their dividends aren't just generous … they're sustainable over the long haul.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.