Stock Market Today: Dow Drops 597 Points as Russia Escalates Attack

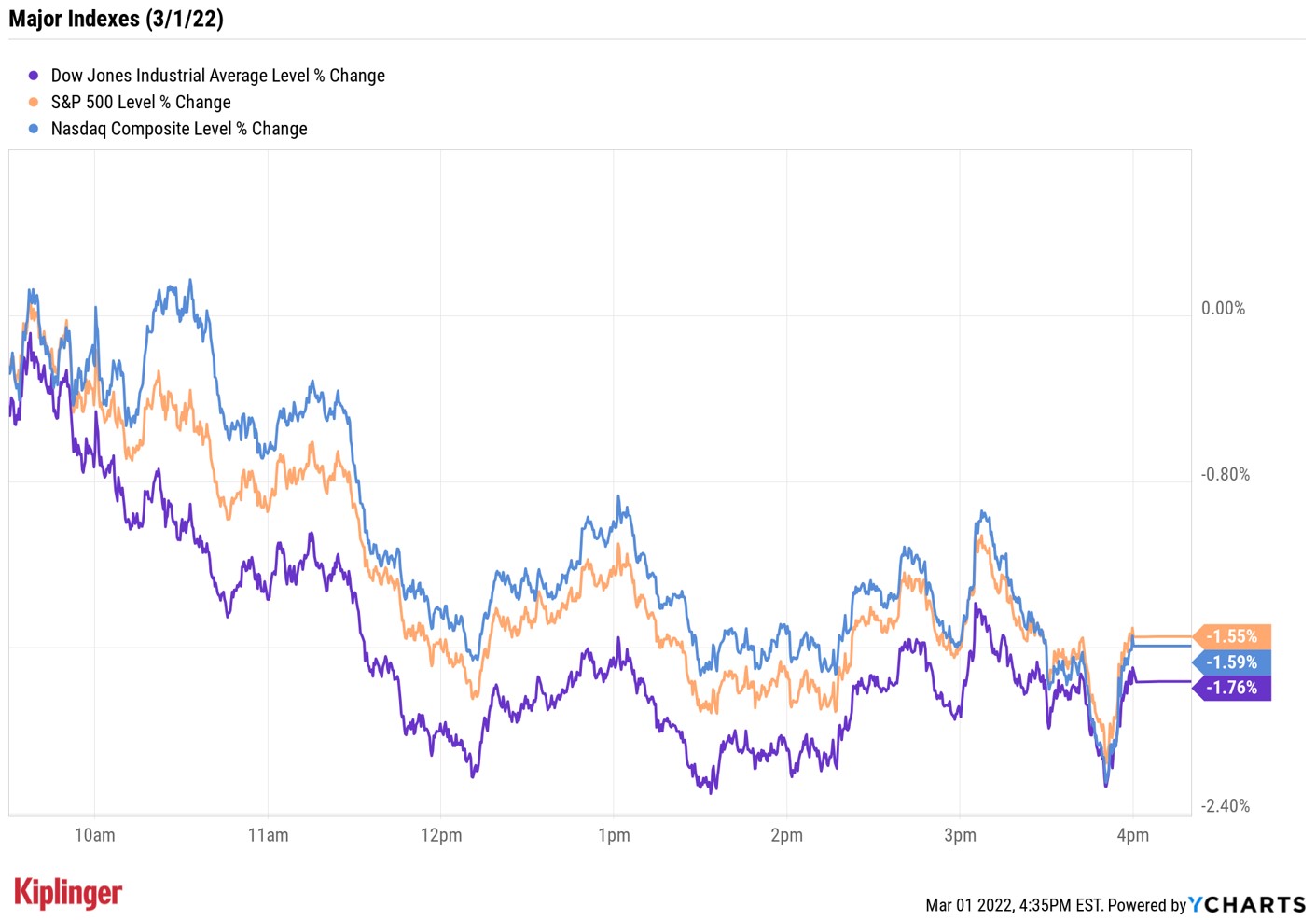

The major market indexes opened lower and losses accelerated as the session wore on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The major market benchmarks opened lower and losses accelerated amid reports that Russia is targeting civilian areas in Ukraine, including Kharkiv, the country's second-largest city. Additionally, after warning of "high-precision strikes," Russian forces on Tuesday hit a TV tower in Kyiv.

"The crisis in Ukraine is evolving rapidly, and with it so are investor expectations for international relations, commodity prices, inflations, the corporate operating environment and company margins," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

"As the crisis unfolds, equities could bounce if developments point to contained conflict and lighter sanctions, while equities could deteriorate in moments of escalation."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Today, stocks crumbled as the attacks intensified, with financials (-3.7%) the worst-performing sector amid notable losses in blue chips American Express (AXP, -8.5%), Goldman Sachs (GS, -3.2%) and JPMorgan Chase (JPM, -3.8%).

Not surprisingly, the Dow Jones Industrial Average (-1.8% at 33,294) was the biggest decliner, followed by the S&P 500 Index (-1.6% at 4,306) and the Nasdaq Composite (-1.6% at 13,532).

One bit of encouraging news today was this morning's Institute for Supply Management's (ISM) manufacturing purchasing manager's index (PMI), which rose to a higher-than-expected 58.6 in February.

"Manufacturing growth was solid in February, the inflation-sensitive prices component dipped on the month, and the index component reflecting supplier delivery performance noted better supply chain conditions than in January and December," says Bill Adams, chief economist for Comerica Bank.

"Falling coronavirus cases should help the domestic side of the economy improve further in the spring months, but spillover from higher energy and food prices and international shipping disruptions related to the Russia-Ukraine war are a downside risk to manufacturing near-term," he adds.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 1.9% to end at 2,008.

- Gold futures spiked 2.3% to settle at $1,943.80 an ounce.

- Bitcoin rallied 5.5% to $44,252.28. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Target (TGT) jumped 9.8% after the big-box retailer reported adjusted earnings of $3.19 per share and revenue of $31 billion in its fourth quarter, beating analysts' estimates for earnings of $2.86 per share and sales of $31.4 billion. TGT also offered up higher-than-expected guidance for the upcoming fiscal year. "TGT continues to find ways to keep traffic and sales momentum strong, which is allowing the retailer to continue making investments in price, labor, etc. while also growing the bottom line," says CFRA Research analyst Arun Sundaram (Buy). "Fiscal 2023 results will be choppy quarter-over-quarter, but should generally get better as the year progresses."

- Foot Locker (FL) fell 7.6% after B. Riley analyst Susan Anderson downgraded the athletic apparel retailer to Neutral (Hold) from Buy and slashed her price target by $30 to $34 (FL closed today at $29.23). "We believe FL will be in a transition phase for at least a year as their exposure to Nike (NKE) is lowered, which creates limited visibility on future sales/margins," Anderson writes. "This transition could open up ~$900M in shelf space annually which we expect will benefit other footwear and apparel manufacturers including Crocs (CROX), New Balance and Adidas, but will create a void for FL until that space can be filled."

Why We're Still Watching Inflation

Oil prices, on the other hand, swung notably higher in today's trading, even after the International Energy Agency (IEA) agreed to release 60 million in emergency crude reserves.

U.S. crude futures were up more than 11% at their session peak before finishing up 8% at $103.41 per barrel – their highest settlement since July 2014. And these rising energy prices could keep the fire burning under already sizzling inflation.

"The Russia/Ukraine conflict is driving oil and other commodity prices higher, which does present the possibility of inflation remaining higher for longer," says Lindsey Bell, chief investment strategist for Ally Invest. "Medium-term inflation will be important to keep an eye on. Consumer confidence has already taken a hit and a survey by Ally shows that 77% of Americans believe inflation will increase over the next 12 months."

There are several options for investors looking to mitigate the effects of red-hot inflation on their portfolio, including seeking out high-quality stocks from sectors that are considered more "inflation-proof" than others: consumer staples, utilities and healthcare, for instance. You can also play the hot hand with energy stocks or increase exposure to rising commodity prices with these exchange-traded funds (ETFs). Each of the funds featured here provide investors access to a wide variety of commodities futures and hard assets that can often work as a hedge against inflation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.