Stock Market Today: Nuclear Fears Overshadow Stellar February Jobs Number

Last month's job additions vastly exceeded estimates, but an attack on a Ukrainian nuclear power plant dictated the market's direction Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street couldn't have asked for any more out of the February jobs report, but a fresh escalation of danger in Eastern Europe was more than enough to keep stocks grounded to end the week.

The Bureau of Labor Statistics on Friday said that 678,000 jobs were created last month, blowing past expectations for 423,000. Moreover, the unemployment rate ticked down even further, to 3.8%, while average hourly wages shot 5.1% higher.

But casting a long shadow over that news were late Thursday reports that Russia's military fired upon Ukraine's Zaporizhzhia nuclear power plant, sparking a fire that was later extinguished. While the International Atomic Energy Agency reported that radiation levels remained normal, the reports revived memories of the 1986 Chernobyl disaster (remember, that happened in Ukraine).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

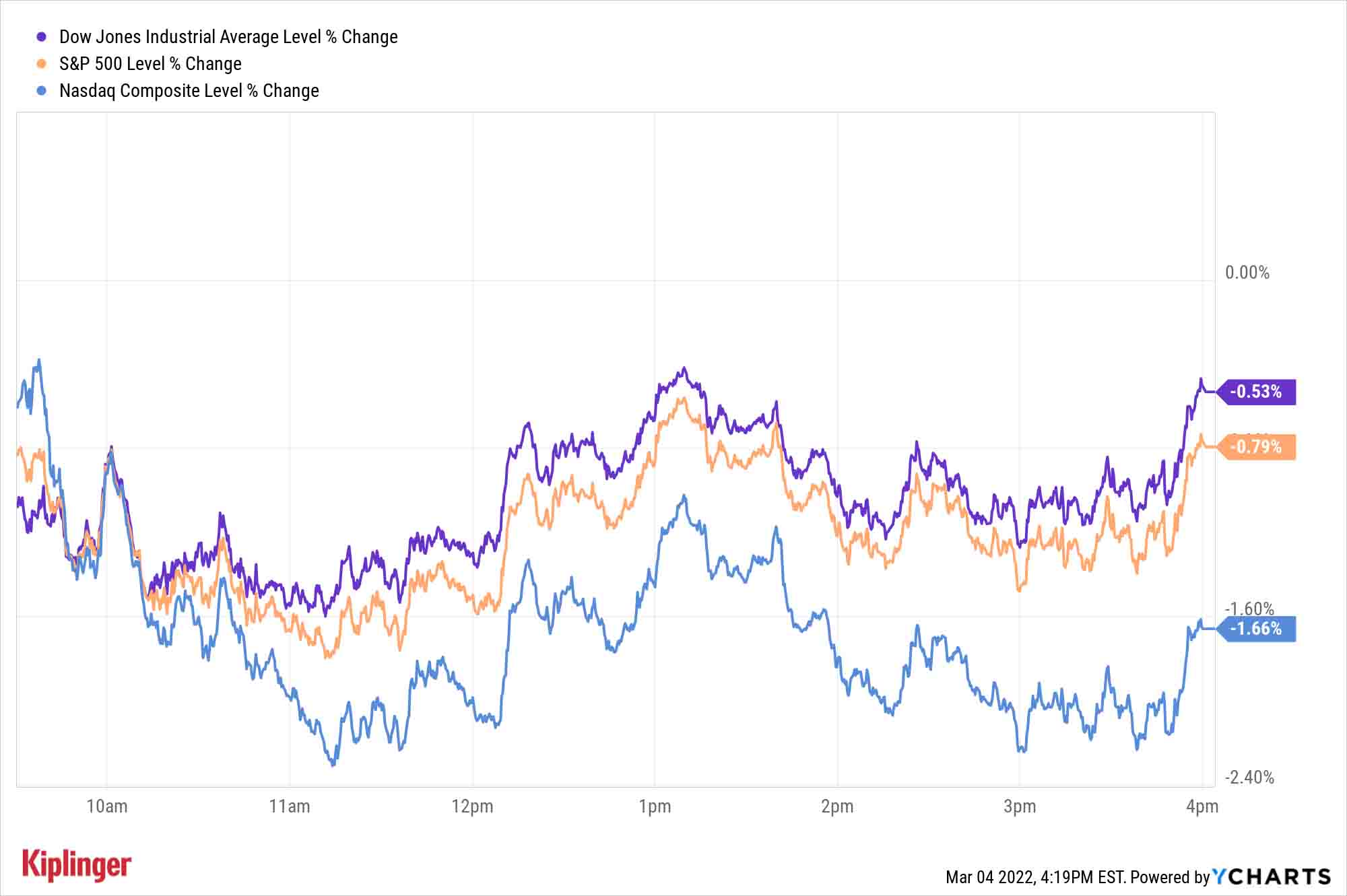

Those concerns appeared to hold equity markets down from the get-go, and the major indexes never recovered. The Nasdaq Composite again led the way lower, off 1.7% to 13,313, while the S&P 500 (-0.8% to 4,328) and Dow Jones Industrial Average (-0.5% to 33,614) also closed solidly in the red.

The "fear trade" was alive and well, however. Gold futures gained another 1.6% to $1,966.60 per ounce, while U.S. crude oil futures rocketed 7.4% higher to $115.68 per barrel – a closing level not seen since September 2008.

"Events in Ukraine … are causing risk aversion and a flight to safety as the attack on a nuclear power plant illustrates how dangerous the war is to the entire world, and not just the tremendous suffering of the Ukrainian people," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

Other news in the stock market today:

- The small-cap Russell 2000 declined again, losing 1.6% to 2,000.

- Bitcoin suffered another steep decline, off 5.6% to $39,486.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Rivian Automotive (RIVN) – which is on next week's earnings calendar – slid 6.9% after Baird analyst George Gianarikas cut his price target on the electric vehicle (EV) maker to $100 from $150, though this is still more than double the stock's Friday close at $47.39. "On March 1, Rivian increased prices on its consumer vehicles based on inflationary impacts to its cost structure, only to reverse the changes to its pre-existing order book [on March 3]," Gianarikas writes in a note. While the financial impact to the roll back will be "material," or around $15,000 per each of the 71,000 book orders, he has "full confidence that Rivian has gathered one of the best management teams and top industry talent to fully capitalize on mobility's EV revolution." As such, the analyst maintained an Outperform (Buy) rating on RIVN.

- Costco Wholesale (COST) saw its fiscal second-quarter revenue jump 16% year-over-year to $51.9 billion, while earnings per share increased 36% to $2.92 per share. The figures were higher than the $2.74 per share and $51.5 billion analysts were expecting. Still, shares slipped 1.4% today. "Investors are likely concerned about merchandise gross margins falling 30 basis points [a basis point is one one-hundredth of a percentage point] to 10.6% vs. 10.9% consensus," says CFRA Research analyst Arun Sundaram, who maintained a Hold rating on COST. "While it is difficult for us to be more constructive on the shares at current valuation, especially given the recent carnage to high multiple growth stocks, we think COST shares have support from a few potential catalysts this year, including 1) membership fee hike (potentially as early as June) and 2) special dividend payment (COST has paid four over past 10 years – latest was November 2020 for $10/share)."

- Travel stocks took a hit today – possibly as a result of spiking oil prices. "We see limited direct impact from disruption to select commercial flight routes due to the Ukraine-Russia conflict," says Truist Securities analyst Naved Khan. "However, we see a larger indirect impact from a potential double-digit increase in average airfare due to record-high fuel prices + inflationary pressures." Among those selling off today were Delta Air Lines (DAL, -5.6%), American Airlines (AAL, -7.1%) and United Airlines (UAL, -9.1%).

Big Stock Buys of the Billionaires

Today, we're finishing up our regular examination of the "smart money's" recent comings and goings.

Our final look explores the top stock picks of 15 billionaire money managers – a group that includes David Tepper, Ray Dalio, Daniel Loeb, Seth Klarman and numerous other elite names.

From Kiplinger's Dan Burrows: "Studying which stocks they're chasing with their capital (or which stocks the billionaires are selling off, for that matter) can be an edifying exercise for retail investors. There's a reason the rich get richer, for one thing. But it's also helpful to see where billionaires sometimes make mistakes – at least in the short term. All investors are fallible, after all."

Read on as we look at 15 stock picks that make up outsized portions of these 15 billionaires' portfolios – including several household names, but a few well-off-the-radar equities as well.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.