Stock Market Today: Nasdaq Falls Into Bear-Market Territory

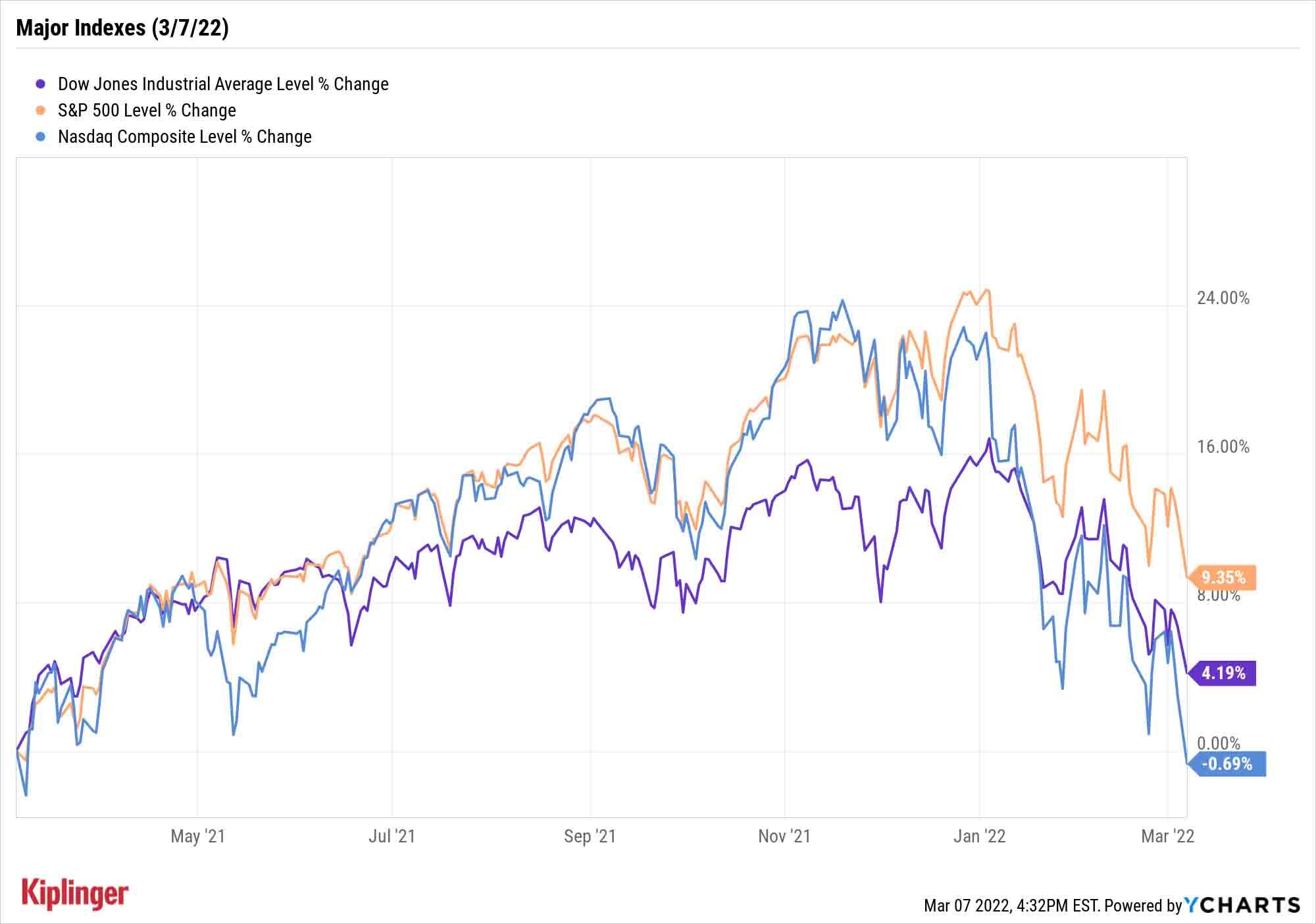

The Nasdaq Composite is now off more than 20% from its November highs after progress toward more Russia sanctions sent stocks even lower Monday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Governments and private businesses alike continued to put more distance between themselves and Russia, sending commodities higher but triggering a slump in equities that sent the tech-heavy Nasdaq Composite into a bear market.

Oil soared on Monday as both Congress and the White House reportedly were in favor of moving ahead with banning Russian oil, even if Europe fails to implement similar measures. U.S. crude oil futures jumped 3.2% to a 13-year-high settlement of $119.40 per barrel.

Gold futures, meanwhile, enjoyed their highest finish since August 2020, climbing 1.5% to settle at $1,995.90 per ounce after trading above $2,000 intraday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also, over the weekend, Adobe (ADBE), Netflix (NFLX), PayPal (PYPL) and others joined a growing list of companies at least partially shutting down operations in Russia. U.S. equities continued to feel the weight of these moves, however. The financial (-3.6%) and consumer discretionary (-4.9%) sectors suffered the deepest losses in a bright-red day for the broader markets.

The Nasdaq was worst off among the major indexes with a 3.6% decline to 12,830 that put it into bear-market territory, off more than 20% from its Nov. 19 high. The S&P 500 (-3.0% to 4,201) and the Dow Jones Industrial Average (-2.4% to 32,817) also finished well in the red.

"The S&P 500 posted the worst day since October 2020," says Cliff Hodge, chief investment officer for financial planner Cornerstone Wealth. "Fear is palpable. There seems to be no evidence of improvements in Ukraine, and the rhetoric out of D.C. continues to get more hawkish.

"While it’s impossible to know where the ultimate bottom may be, from a risk-reward standpoint, the market looks very reasonable. We’re using weakness to add exposure as we continue to see very little chance of recession over our forecast horizon."

Other news in the stock market today:

- The small-cap Russell 2000 declined by 2.5% to 1,951.

- Bitcoin tumbled by 5.1% to $37,560.26. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bed Bath & Beyond (BBBY) was a rare splash of green in today's trading, jumping 34.2% on news that Ryan Cohen – founder of online pet company Chewy (CHWY) and chairman of video game retailer GameStop (GME) – took a 9.8% stake in the home goods retailer via his investment firm RC Ventures. Cohen believes BBBY needs to explore strategic options, which include separating its baby division, buybuy Baby, according to a letter he wrote to RC Ventures' board members. Wedbush analyst Seth Basham maintained a Neutral (Hold) rating on BBBY. "While BBBY shares could move higher on new activist involvement and high short interest, we remain sidelined without more visibility to market share sustainability for the core Bed Bath business," the analyst says.

- Surging oil prices once again weighed on airline stocks. United Airlines (UAL, -15.0%), Delta Air Lines (DAL, -12.8%) and American Airlines (AAL, -12.0%) were some of the day's biggest decliners.

- Uber Technologies (UBER, -4.2%) lifted its first-quarter adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) to a range of $130 million to $150 million from its previous guidance of $100 million to $130 million. The upwardly revised guidance comes amid increased demand for rides and food delivery, according to the company. "We find Mobility trends in February very encouraging, with trips at 90% and gross bookings at 95% recovered vs. pre-pandemic levels (February 2019), while Delivery annualized run rate gross bookings reached new highs," says CFRA Research analyst Angelo Zino (Strong Buy).

Protect Yourself Against Stagflation

We're increasingly hearing the "S" word being thrown around Wall Street. Stagflation, that is.

Yes, the unemployment rate has recovered to near pre-pandemic lows, but the other two hallmarks – red-hot inflation and slowing economic growth – are certainly at the front door. Several economists have been lowering their U.S. GDP estimates of late, including LPL Financial Chief Economist Jeffrey Roach.

"We currently expect the U.S. economy to grow 3.7% in 2022," he says, down from 4% to 4.5% in LPL's 2022 outlook. (Kiplinger currently forecasts 4.0%.)

"The risks are to the downside since the Fed may err on tightening too fast, the recent commodity spike may trickle down to the U.S. consumer, and supply-and-demand imbalances may last longer than expected."

Commodities are considered to be among the best defenses against potential stagflation, and you can access them in a number of ways. Exchange-traded funds, such as these 14 ETFs, allow you to invest in baskets of commodity stocks, futures and sometimes the physical goods themselves.

But those wanting a more concentrated bet might consider individual stock picks. From energy producers to miners, these five "stagflation stocks" represent a short list of commodity-tethered plays that should provide protection should the economy continue to cool while inflation keeps heating up.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.