Stock Market Today: Stocks Suffer Whiplash After Russian Energy Ban

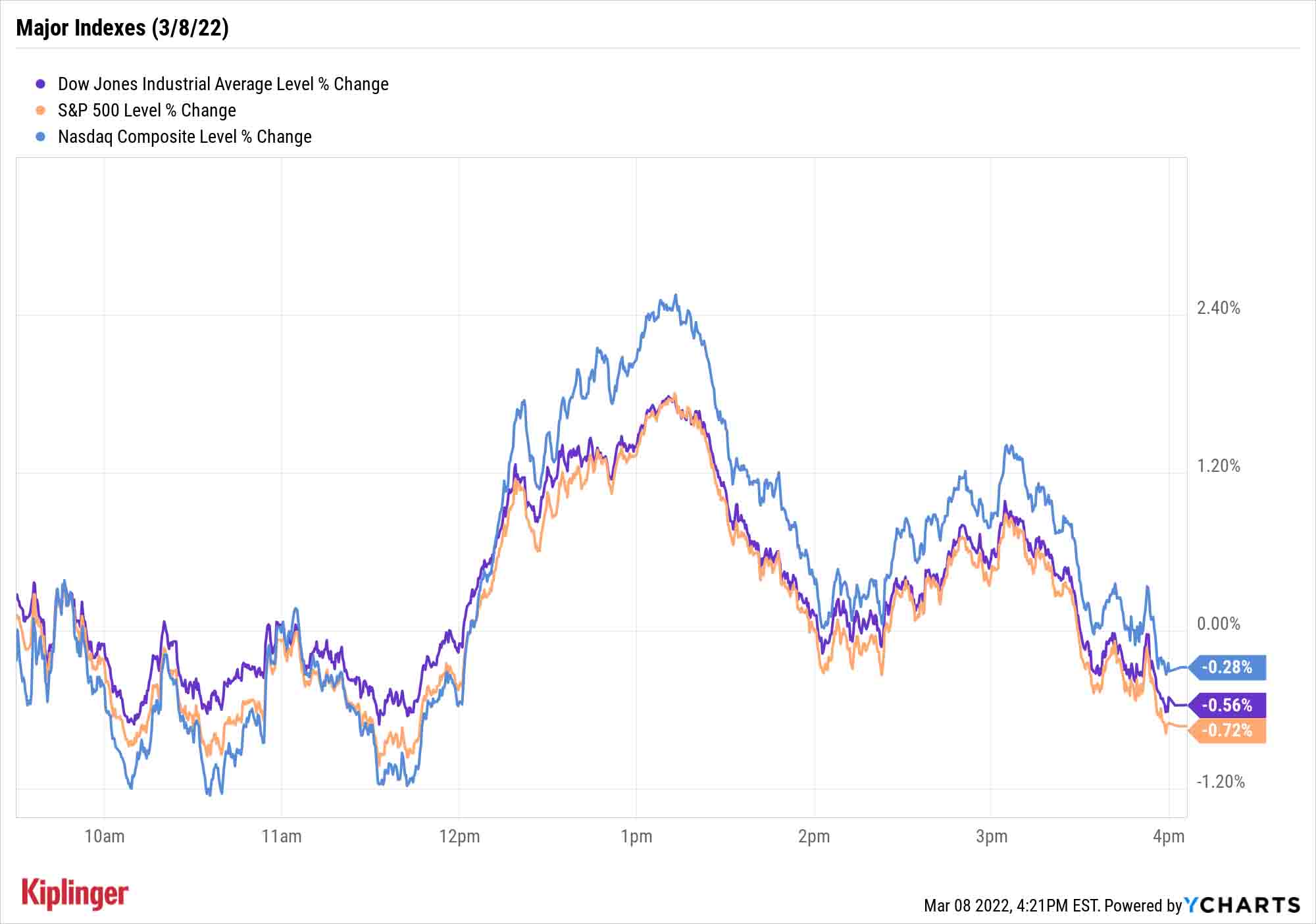

The market went round-trip on Tuesday, bouncing from modest losses to significant gains before slipping back into the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Mr. Market's roller-coaster ride continued apace Tuesday, as indications that the U.S. would ban the import of Russian energy became real.

After days of speculation about whether America would take this next step, President Joe Biden announced the U.S. would cease imports of Russian crude oil, natural gas and coal.

"The decision today is not without cost here at home," Biden said. "Putin's war is already hurting American families at the gas pump. Since Putin began his military build-up at Ukrainian borders … the price of gas at the pump in America went up 75 cents. And with this action, it's going to go up further."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. crude oil prices unsurprisingly continued their recent climb, settling up 3.6% to $123.70 per barrel – a closing level not seen since August 2008, but also well off intraday highs above $129.

"The crude supply outlook will struggle to make up for Russian supplies over the next few months, so whatever pricing dips occur could be short-lived," says Edward Moya, senior market strategist at currency data provider OANDA.

The prospect of sustained high crude prices helped the energy sector (+1.6%) score another win, with the likes of Valero Energy (VLO, +7.8%) and Schlumberger (SLB, +7.1%) leading the pack. A few battered areas of the market, including travel, also rebounded – Booking Holdings (BKNG, +4.5%), United Airlines (UAL, +3.3%) and Carnival (CCL, +2.3%) all finished well in the green.

The major indexes were all over the place throughout the day, swinging from modest losses early to robust gains, then pulling back into the red by the closing bell. The Dow Jones Industrial Average was off 0.6% to 32,632, the S&P 500 declined 0.7% to 4,170 and the Nasdaq Composite slipped 0.3% further into bear-market territory to 12,795.

Other news in the stock market today:

- The small-cap Russell 2000 bucked the trend, finishing up 0.6% to 1,963.

- Gold futures rose 2.4% to settle at $2,043.30 an ounce.

- Bitcoin recovered after a difficult Monday, gaining 2.5% to $38,515.23. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Dick's Sporting Goods (DKS, +2.1%) reported adjusted earnings of $3.64 per share in its fourth quarter on $3.35 billion in revenue, more than the $3.43 per share and $3.31 billion analysts were expecting. Same-store sales also rose a higher-than-expected 5.9% for the three-month period. "Shares of DKS now trade well under 10.0x fiscal 2023 consensus estimates, which we see as significantly undervalued for a retailer with a strong omni-channel strategy and capital return program," says CFRA Research analyst Zachary Warring (Buy). "We continue to like DKS's exposure to Golf which is seeing unprecedented growth, brand partnerships, omnichannel execution and growing market share in the sporting goods market."

- Dish Network (DISH) jumped 5.1% after UBS Global Research analyst John Hodulik upgraded the communications services stock to Buy from Neutral (Hold). DISH has "an attractive risk/reward bounded by spectrum value on the downside and optionality of the next-gen, cloud-based, 5G wireless network on the upside," the analyst writes in a note. "Questions remain regarding DISH's wireless business model, but we believe DISH's network build protects the company's spectrum licenses, whose value serves as a backstop."

- Caterpillar (CAT) gained 6.8% on the back of an upgrade. Jefferies analyst Stephen Volkmann lifted his outlook on the construction equipment company to Buy from Hold, calling CAT a "long-term inflation hedge." Volmann notes that the "recent turmoil in Eastern Europe fundamentally reshapes global commodity markets, driving structurally higher pricing and after years of underinvestment capacity additions and supply diversification will be necessary in both mining and oil & gas sectors," though he concedes that "new projects will take time."

Beat Back Volatility With Cold, Hard Cash

One of the best pieces of advice for fading the market's current volatility hearkens to a basic tenet of the buy-and-hold crowd: Sit back and collect dividends.

"If you are looking for less volatility these days, shares of dividend paying companies can often offer some stability when the volatility index (VIX) spikes," says Lindsey Bell, chief markets and money strategist for Ally Invest. "Perhaps now more than ever, prioritizing profitability and steady operations might be a safe move for your portfolio. As inflation fears persist, owning shares in firms that generate strong cash flows today could help buffer your risk of higher consumer prices over the next year."

Any list of sturdy dividend stocks is going to begin with the Dividend Aristocrats – 66 companies that have raised their payouts annually, without interruption, for at least 25 years (but often much longer). But investors can go after dividends in myriad other ways.

Oil and gas master limited partnerships (MLPs), for instance, can help you enjoy energy-market gains while netting yields in the 8%-9% range.

Or, you can specifically target dividend stocks of different stripes that have gone on sale this year. These seven income plays are hanging from the bargain rack right now, and each of them provides a better yield (by varying amounts) than the S&P 500 average.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.