Stock Market Today: Stocks Down, Cement Another Week of Losses

Mixed signals out of Russia and the Fed's much-anticipated March meeting next week kept investors on the defensive Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

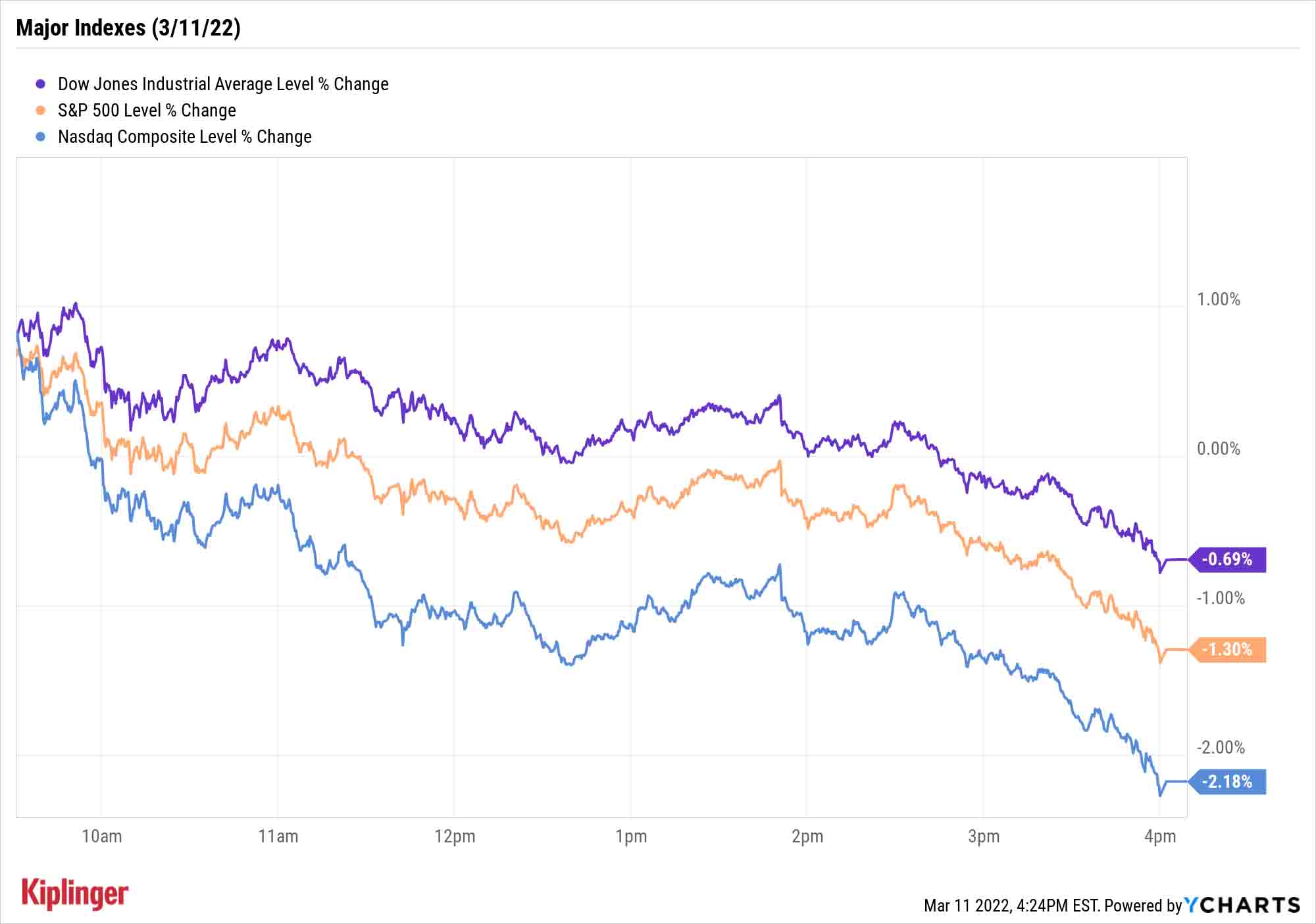

Wall Street's major indexes struggled to find direction during the week's final session as investors tried to interpret various signals concerning Russia's war with Ukraine, and perhaps, looked ahead to next week's Federal Reserve decision.

Early Friday, Russian President Vladimir Putin said that his negotiators claimed there were "certain positive shifts" in peace talks, although no concrete progress had been made. However, hours later, President Joe Biden announced a pair of economic volleys on Russia.

More significantly, the U.S. will join the European Union and the Group of Seven in revoking the country's "most favored nation" status, allowing them to slap higher tariffs on the nation's goods. America also will ban the export of luxury goods to Russia (bourbon is popular there).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors might also have one eye looking ahead to next week, when the Fed is widely expected to announce its first benchmark rate hike in more than three years – an assumption that has weighed on sentiment over the past few months, but that Lindsey Bell, chief markets and money strategist for Ally Invest, says is hardly a death knell for stocks.

"Since 1955, the S&P 500 typically performs well in the nine months after the initial interest rate increase before performance begins to moderate," she says. "This is likely because the initial rate increases are more easily absorbed as they come from low levels. Thinking longer term, remember that over the last four decades, the S&P 500 produced positive returns through six tightening periods."

The Dow Jones Industrial Average suffered a modest 0.7% decline to 32,944, putting the cap on its fifth consecutive weekly loss. The S&P 500 (-1.3% to 4,204) and Nasdaq Composite (-2.2% to 12,843) also finished in the red on the week.

Other news in the stock market today:

- The small-cap Russell 2000 was off 1.5% to 1,979.

- U.S. crude futures jumped 3.1% to settle at $109.33 per barrel.

- Gold futures slipped 0.8% to finish at $1,985.00 an ounce.

- Bitcoin fell 3.2% to $38,356.42. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- DocuSign (DOCU) plunged 20.1% after the electronic signature firm reported fourth-quarter earnings. DOCU announced a better-than-expected profit of 48 cents per share, revenue of $580.8 million and billings of $670.1 million. However, the company gave lower-than-anticipated revenue guidance for the current quarter and full fiscal year. In response, Oppenheimer analyst George Iwanyc downgraded DOCU to Perform from Outperform, the equivalents of Hold and Buy, respectively. "Guidance shows that the challenges seen then with respect to sales execution and resetting post-COVID consumption patterns remain near- to medium-term headwinds," Iwancy writes in a note. "We believe it could take several quarters for consumption to fully reset and for recent sales adjustments to show results."

- Rivian Automotive (RIVN, -7.6%) reported an adjusted fourth-quarter loss of $2.43 per share, wider than the $1.97 per share analysts were expecting. Revenue of $54 million also missed the consensus estimate. The company maker said it expects to produce 25,000 electric vehicles this year and reported 83,000 reservations as of March 8 – up 16.9% from December. However, CEO RJ Scaringe warned supply-chain issues have hampered production ramp-up and will likely "continue through at least 2022." CFRA Research analyst Garrett Nelson chimed in after earnings. "The combination of the earnings miss, slower-than-expected production ramp and weak guidance was very disappointing, and the stock's 12% after-hours drop reflected it," Nelson writes in a note. "We remain at a Hold."

There's More Than One Way to Invest Around Inflation

As Americans bemoan rocketing prices for gas, groceries and just about everything else, corporate America also seems to have inflation on the brain.

On Friday, John Butters, senior earnings analyst for FactSet, revealed the results of a Factset Document Search probing for mentions of the term "inflation" in S&P 500 fourth-quarter earnings conference call transcripts from Dec. 15 through March 11.

"356 cited the term 'inflation' during their earnings calls for the fourth quarter, which is well above the five-year average of 144. In fact, this is the highest number of S&P 500 companies citing 'inflation' on earnings calls going back to at least 2010 (using current index constituents going back in time)," he says.

These pressures threaten to keep defining Wall Street's landscape for several more months to come – something more active investors can defend against with stock picks centered on sizzling inflation or even the possibility of stagflation.

But buy-and-holders aren't entirely without their own countermeasures.

While a typical index fund will keep on buying what its benchmark says it must, come hell or high water, actively managed funds are run by teams that, should they deem it prudent, tailor their investments to better combat pressing macroeconomic issues. Those who prefer a human hand at the wheel might consider several options from Vanguard. While the fund provider has made a name for itself in low-cost indexing, it's also responsible for a number of well-regarded actively managed vehicles. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.