Stock Market Today: Stocks Slip After Powell Talks Rate Hikes

Powell indicated the central bank could get more aggressive with rate hikes to combat inflation that is "too high."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

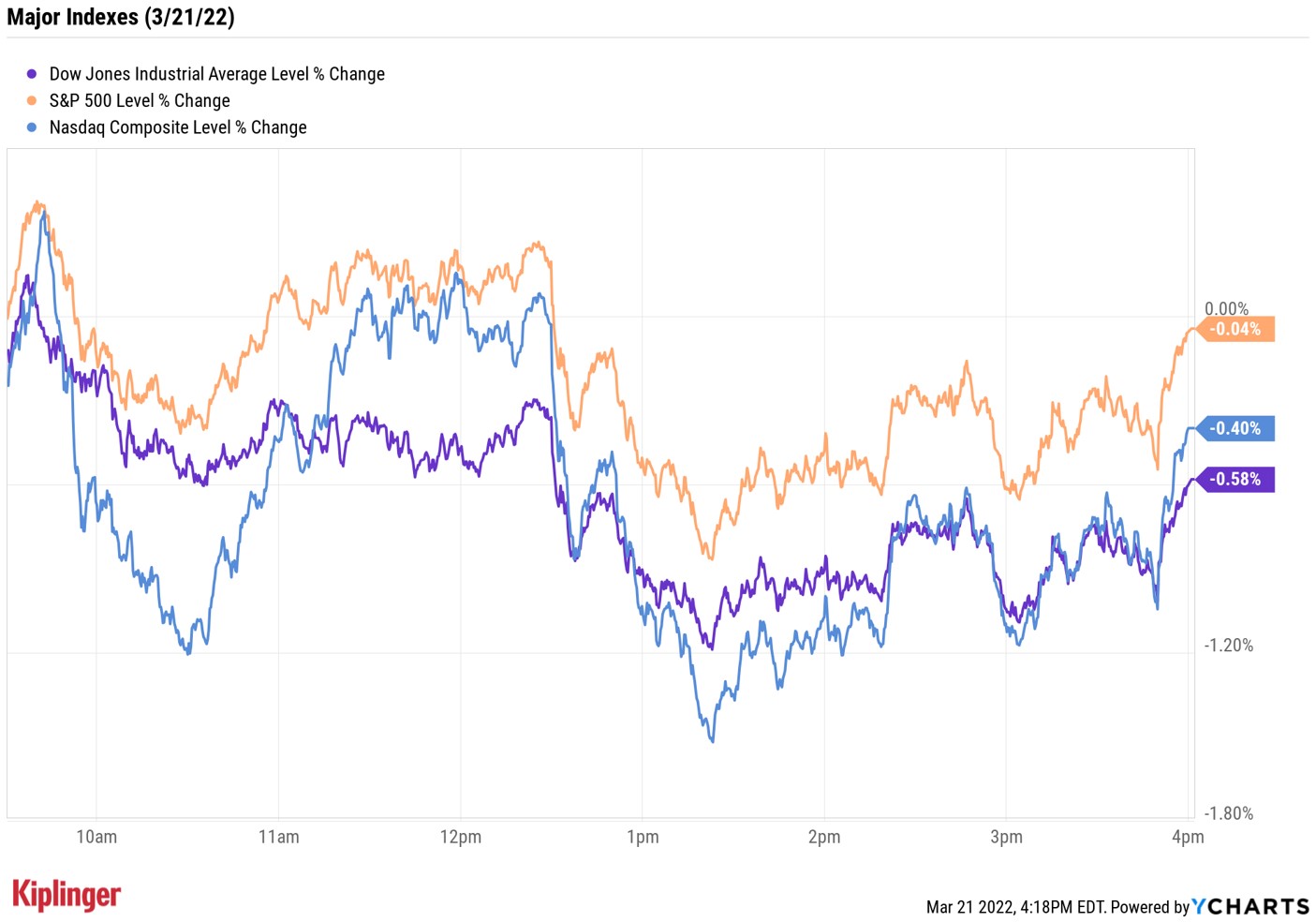

Stocks' positive momentum faded to start the new week after Federal Reserve Chair Jerome Powell said the central bank is prepared to move "expeditiously" towards tighter monetary policy in order to fight inflation.

"We will take the necessary steps to ensure a return to price stability," Powell said in prepared remarks for a speech today at the National Association for Business Economics.

In addition to taking a more hawkish tone, the Fed chief warned that the war in Ukraine could continue to disrupt global supply chains and raise commodities prices at a time when inflation is already "too high."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The consumer discretionary sector took the hardest hit today, giving back 0.8%. Energy, on the other hand, jumped 4.0%, as U.S. crude futures surged 7.1% to $112.12 per barrel amid reports the European Union is considering a ban on Russian oil.

As for the major benchmarks, the Nasdaq Composite ended the day down 0.4% at 13,838, the Dow Jones Industrial Average shed 0.6% to 34,552 and the S&P 500 Index finished 0.04% lower at 4,461 – though a burst of late-day buying power brought all three indexes off their session lows.

Other news in the stock market today:

- The small-cap Russell 2000 fell 1% to 2,065.

- Gold futures eked out a marginal gain to settle at $1,929.50 an ounce.

- Bitcoin backtracked 2.5% to $41,176.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) "The market is going to stay in a trading range until we see crypto regulation clarity in the U.S.," says Charlie Silver, CEO of Permission.io, a cryptocurrency-enabled provider of e-commerce permission advertising. "The bull market will return when trillions of institutional dollars looking for a home have a regulatory green light."

- Boeing (BA, -3.6%) was the worst Dow Jones stock after a China Eastern Airlines Boeing 737-800 passenger jet crashed earlier today. There were 132 people on board the aircraft, which has a strong safety record. China's Civil Aviation Administration said it will investigate the crash.

- Alleghany (Y) surged 24.8% after Warren Buffett's Berkshire Hathaway (BRK.B, +2.1%) said it would buy the insurer for $11.6 billion in cash, or $848.02 per Y share. Berkshire's acquisition of Alleghany marks the holding company's biggest buyout since 2016.

- In other M&A news, private-equity firm Thoma Bravo said it will buy cloud-based connected planning platform Anaplan (PLAN, +27.7%) for $10.7 billion in cash, or $66 per PLAN share. The deal is expected to close in the first half of this year, and Anaplan CEO Frank Calderoni will maintain his role.

Another Inflation Hidey-Hole

We've spent much of the past few months touting the ways in which investors can protect their portfolios from inflation and the rising interest rates that come with it.

Among the many corners of the market that can help mitigate the effects of both higher prices and rising rates are reliable dividend payers, such as the Dividend Aristocrats, or defensive plays like consumer staples stocks.

But CFRA Research's thematic research team recently identified a group within the latter sector that looks particularly attractive right now: beverage stocks.

"Similar to other consumer staples companies, soft drink equities tend to be more defensive, value/income-oriented, have relatively stable sales and earnings, strong margins and free cash flow, as well as attractive dividends, which these companies have a history of increasing regardless of economic conditions," the CFRA team says.

Indeed, current market conditions make the investment case for beverage stocks "the strongest it has been in some time," they add.

Investors seeking safety may want to take a look at these top-rated names, which could be a great place to hide amid rapidly rising prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.