Stock Market Today: Markets Rebound Despite Higher Rate Expectations

Investors weigh potential for Fed to deliver a 50-basis-point hike, and Nike earnings boost confidence in consumers' spending power.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

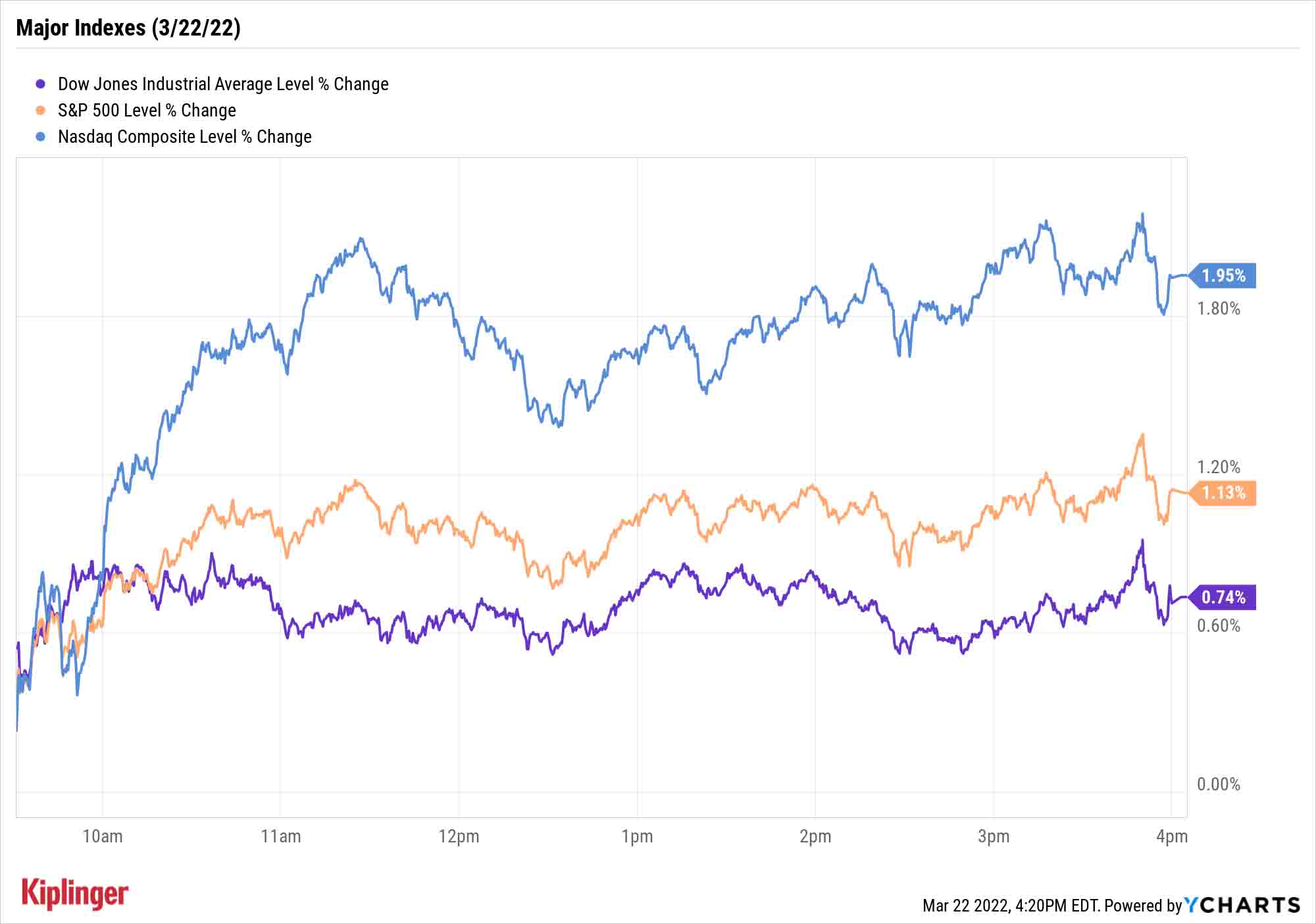

Stocks broadly recovered Tuesday as investors continued to weigh Federal Reserve Chair Jerome Powell's more hawkish tone on inflation and its potential impact on the size and pace of future interest rate hikes.

Kristina Hooper, chief global market strategist for Invesco, says the Fed might be hoping to influence the yield curve more by words than by deeds:

"It's easy to release an aggressive dot plot and it's easy to talk tough in press conferences and speeches," she says. "But it's a lot harder to actually raise rates seven times in the course of one year and four times in the following year and increase the risk of choking off the economic cycle. Hopefully the Fed will not have to be that aggressive."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In other Tuesday news, Nike (NKE, +2.2%) provided an encouraging signal on consumer sentiment, reporting much-better-than-expected quarterly results on the back of strong demand in North America.

"The consumer remains quite healthy despite [recent] sentiment readings," says Lindsey Bell, chief markets and money strategist for Ally Invest. "They continue to have excess savings and low debt levels, and spending expectations remain high according to the New York Fed."

The Nasdaq led the way higher thanks to gains in consumer discretionary (+2.5%) and communication services stocks (+1.9%), finishing up 2.0% to 14,108. The S&P 500 (+1.1% to 4,511) and Dow (+0.7% to 34,807) also closed well in the green.

Other news in the stock market today:

- The small-cap Russell 2000 closed 1.1% higher to 2,088.

- U.S. crude oil futures slid 0.3% to $111.76 per barrel.

- Gold futures declined 0.4% to $1,921.50 per ounce.

- Bitcoin pared some of its gains near the end of Tuesday's regular stock-market trading hours, but still climbed 2.8% to $42,345.91. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Want to Benefit From Rate Hikes? Think Regional.

Wall Street strategists are keeping a close eye on Treasury yields. That's not just because the Fed's benchmark rate is heading higher – it's because of growing worries over what the yield curve is doing (and more importantly, what it signals).

"The U.S. yield curve, or 2- and 10-year U.S. Treasury spread, is flattening," say BofA Securities strategists. "If this continues, the risk is for an inverted yield curve. 2-10 inversions have preceded the last eight recessions and 10 out of the last 13 recessions."

That makes for a precarious situation for financial stocks. In general, they benefit from rising interest rates, as they're able to charge borrowers wider spreads over what they pay depositors for loans.

Although an inverted yield curve (and the economic backdrop that would cause it) would be less than ideal for the industry, investors should by no means panic. Morgan Stanley analyst Betsy Graseck notes that even a shallow inversion shouldn't be a major drag on financials.

"Banks generated positive loan growth in each of the 11 periods of (two-year/10-year) curve inversions since 1969," she says. Even better, if the Fed is able to steer through this rate-hike cycle without triggering a recession, financials could be off to the races.

That's especially true for regional bank stocks, which are more sensitive to interest rates than shares in their bigger, more diversified peers. Have a look at the stocks of four regional lenders, all of which get strong seals of approval from Wall Street's experts:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.