Stock Market Today: Stocks Retreat as Oil Prices Spike

A storm-damaged pipeline running from Kazakhstan to the Black Sea could take a big bite out of global oil exports in the near term.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

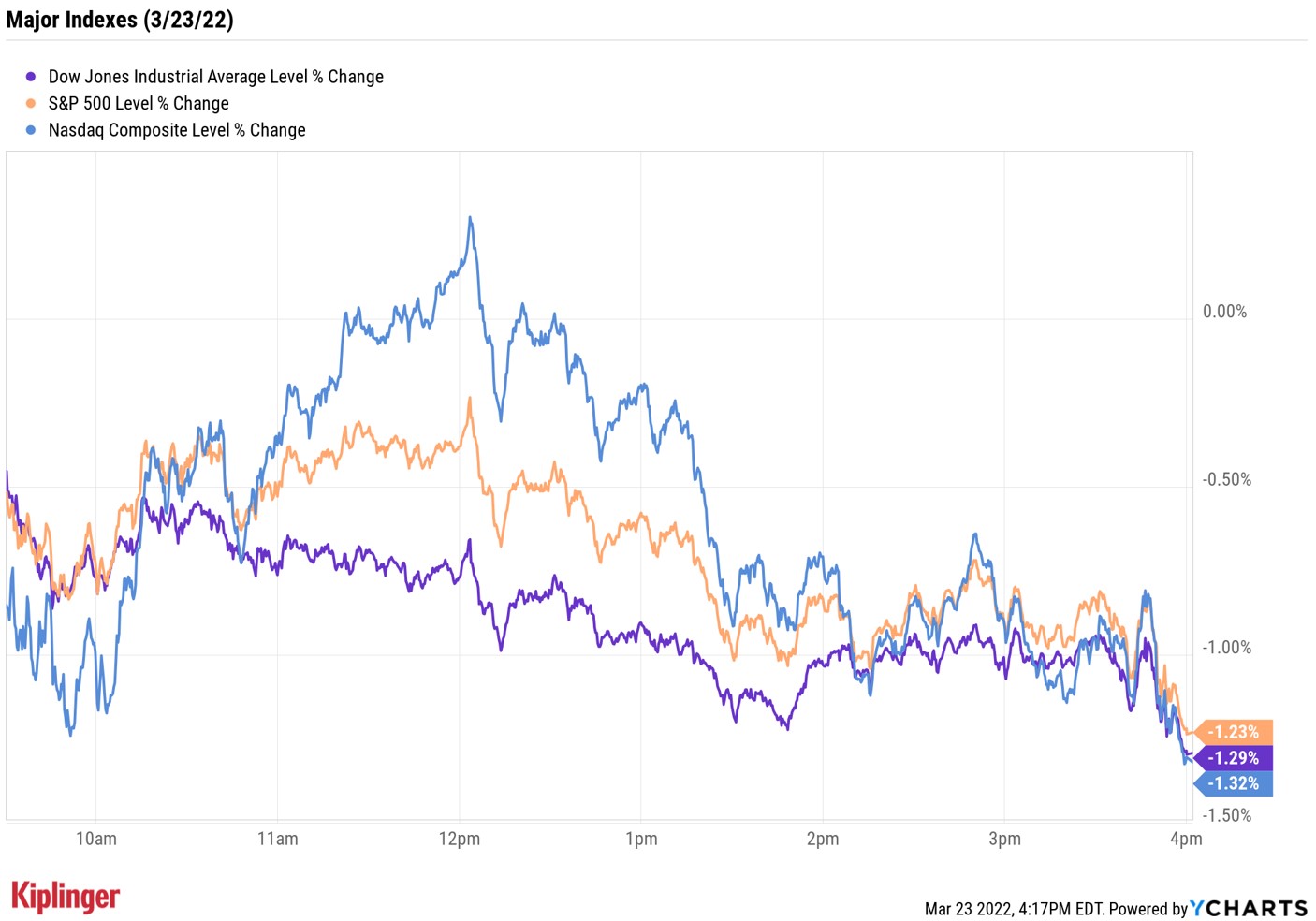

Stocks traded lower on the two-year anniversary of the pandemic market bottom as familiar worries weighed on investor sentiment.

For starters, sizzling energy prices kept inflation concerns front and center. U.S. crude futures jumped 5.2% to $114.93 per barrel after Russia said a storm-damaged pipeline running from Kazakhstan to the Black Sea could cut exports by roughly 1 million barrels per day in the near term.

Rising interest rates also remained in focus as speeches from several Federal Reserve speakers indicated support for taking a more hawkish approach on inflation.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Among them was Cleveland Fed President Loretta Mester – a voting member of the central bank's rate-setting committee – who told reporters that she thinks "we're going to need to do some 50-basis-points moves." (A basis point is one-one hundredth of a percentage point.)

Elsewhere on the economic front, data from the Census Bureau showed new home sales fell by a bigger-than-expected 2% in February to an annual rate of 772,000.

Additionally, mortgage applications are down around 8% this week, says Michael Reinking, senior market strategist for the New York Stock Exchange. "As we approach the ever-important spring selling season, this is a dynamic to pay close attention to," he adds.

At the close, the Dow Jones Industrial Average was down 1.3% at 34,358, the Nasdaq Composite was off 1.3% to 13,922 and the S&P 500 Index had given back 1.2% to 4,456.

Other news in the stock market today:

- The small-cap Russell 2000 plunged 1.7% to 2,052.

- Gold futures climbed 0.8% to $1,937.30 per ounce.

- Bitcoin slipped 0.3% to $42,234.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Adobe (ADBE, -9.3%) plunged at the open and remained grounded throughout the session following the company's Tuesday night earnings report, during which it lowered full-year sales forecasts to reflect the stoppage of operations in Russia. Its quarterly revenues of $4.26 billion and adjusted profits of $3.37 per share were both slightly better than expected. However, Adobe reduced its 2022 annual recurring revenue forecasts from Russia and Ukraine by a total of $87 million. "While Adobe is clearly going through a revenue deceleration and is the first large software firm to flag European weakness as a result of the conflict, the pending price increase will help to soften the blow," says UBS analyst Karl Keirstead, who remains on the sidelines with a Neutral rating (equivalent of Hold).

- Apple (AAPL, +0.8%) represented some rare green ink in a sea of red Wednesday. Multiple reports, citing people familiar with the matter, said Apple bought British financial technology startup Credit Kudos in a deal worth $150 million. The company is a competitor of "big three" credit reporting agencies Experian (EXPGY, -1.8%), Equifax (EFX, -1.2%) and TransUnion (TRU, -1.3%). "Credit Kudos' intelligent products enable businesses to leverage Open Banking to enhance affordability and risk assessments," according to Credit Kudos' website. "Our predictive insights are built by combining transaction and loan outcome data."

Stock Buybacks Could Have a Big Year

Don't let the market's daily noise distract you from its long-term signal. After all, investing is a marathon, not a sprint – and there are many reasons to be upbeat toward stocks, especially those that return cash to shareholders.

Companies that reliably grow their dividends, or gift investors with special one-time payments, are always worth paying attention to. And then there are those firms that have generous buyback programs, which can help boost earnings per share and stock prices to boot.

Indeed, the breadth of buybacks is currently running near a record high, according to the Goldman Sachs Portfolio Strategy Research team. As a result, GS recently raised its S&P 500 buyback forecast by 12% to $1 trillion for 2022.

"Looking ahead, our previously assumed headwinds to buybacks from higher effective corporate tax rates and a buyback excise tax no longer look likely," the team says. "Based on our forecast, buybacks will continue to represent the largest use of cash for S&P 500 companies, followed by capital expenditures."

Read on as we explore six companies that are repurchasing impressive amounts of their own stock.

Karee Venema was long AAPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.