Stock Market Today: 53-Year-Low Jobless Claims Lift the Market

Weekly unemployment claims add to a bevy of positive economic data points, driving a wide rebound across the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks logged a broad advance Thursday in the wake of the smallest weekly jobless claims number since John Lennon called it quits with the Beatles.

The Labor Department reported just 187,000 initial unemployment claims for the week ended March 19. That was 28,000 less than last week's revised claims report and the lowest such figure since September 1969.

"Before the pandemic, the number was hovering around 220,000, and we saw a complete recovery to these levels in the previous four weeks," says Alex Kuptsikevich, senior market analyst for forex broker FxPro. "The fresh data has marked a move into uncharted territory, indicating a further tightening in the labor market."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In other Thursday news, U.S. durable-goods orders for March fell by 2.2%. That was far below expectations for growth of 0.6% and represents the first decline in five months. Nevertheless, various economic readings are "still showing positive momentum overall on an absolute basis with the economy well above pre-pandemic highs," says Peter Essele, head of portfolio management for Commonwealth Financial Network.

Semiconductor stocks were at the fore of Thursday's rally, led by Nvidia (NVDA, +9.8%), which said late Wednesday that it would explore using Intel (INTC, +6.9%) as a foundry for the manufacture of its chips.

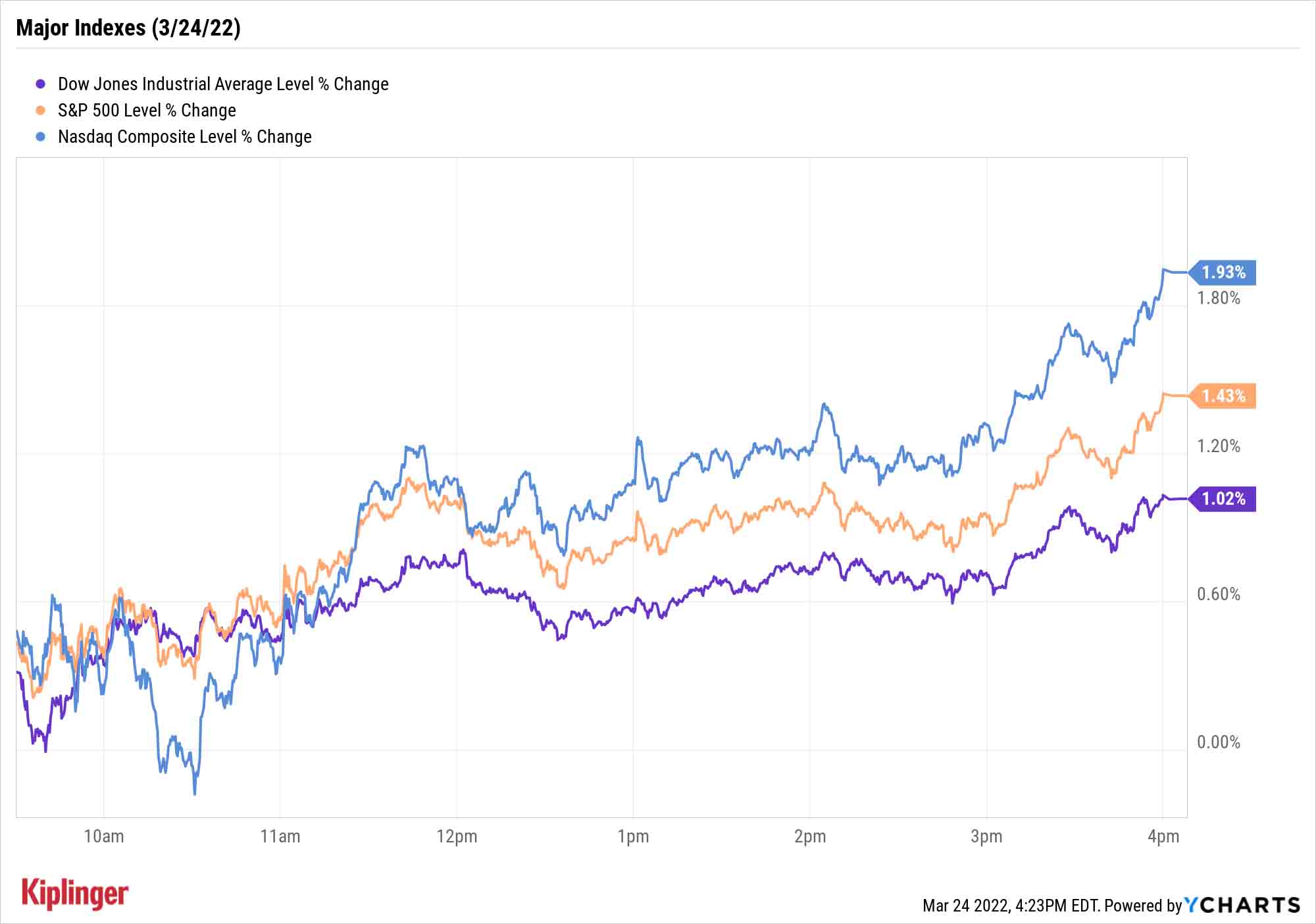

NVDA helped the Nasdaq Composite (+1.9% to 14,191) pace the major indexes, with the S&P 500 (+1.4% to 4,520) and Dow Jones Industrial Average (+1.0% to 34,707) also finishing well in the green.

Other news in the stock market today:

- The small-cap Russell 2000 gained 1.1% to 2,075.

- U.S. crude futures fell almost 2.3% to settle at $112.34 per barrel.

- Gold futures rose 1.3% to end at $1,962.20 an ounce.

- Bitcoin joined in Thursday's rally, jumping 4.1% to $43,946.42. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- KB Home (KBH) slid 4.6% after the homebuilder reported fiscal first-quarter adjusted earnings of $1.47 per share on $1.40 billion in revenue – lower than the $1.52 per share and $1.49 billion analysts were expecting. Still, the figures were up 44% and 23$, respectively, year-over-year, and CEO Jeffrey Mezger said KBH is well-positioned to hit its full-year financial targets. "KB Home is not seeing a slowdown in demand despite price increases and the recent spike in mortgage rates," says BofA Securities analyst Rafe Jadrosich, who reiterated a Buy rating. He also said KBH's valuation "looks very compelling with shares trading at a 12% discount to our year-end 2022 tangible book value forecast."

- Freeport-McMoRan (FCX) rose 3.3% after Jefferies analyst Christopher LaFemina chimed in on the mining stock. "Freeport is in a strong competitive position in the midst of an earnings upgrade cycle that will take years to play out," LaFemina says. "The company has a clear path to grow its cash flow and capital returns and can create additional shareholder value by developing its unique organic growth pipeline." The analyst has a Buy rating on FCX, adding " the market continues to underappreciate the likely magnitude and duration of the ongoing cyclical upturn in copper." Several other basic materials stocks also traded higher today, including Cleveland-Cliffs (CLF, +12.0%), U.S. Steel (X, +6.5%) and Nucor (NUE, +4.3%).

The Third Year of the Bull Market

Yesterday marked the end of the bull market's second year, but investors might be in for a trying year three.

The post-COVID-19 bull market is the fastest bull market to double, at just under 18 months. However, "as this bull market reaches the third year of life, investors need to remember that year three of bull markets tend to be a little tamer, with the larger gains happening in year one and two," says Ryan Detrick, chief market strategist for LPL Financial.

"In fact, out of the 11 bull markets since World War II, we found that three of them ended during year three, while the ones that didn't end saw an average gain of only 5.2%."

In other words, at least historically speaking, we can expect some turbulence in the year to come.

The good news is that prepared investors can make the most of these challenges. Stocks that stave off sizzling inflation, for instance, or stocks that excel during periods of rising interest rates, afford investors relief from two of the market's biggest present pressures.

Meanwhile, a host of exchange-traded funds (ETFs) built to withstand this year's myriad challenges will also serve folks well. Our 22 best ETFs for 2022 include a little something for everyone: all-weather funds, ETFs constructed with inflation and rising interest rates in mind, and funds designed to withstand any additional complexities that could pop up soon enough.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.