Will a Second Tesla Stock Split Spark Another Rally?

The 2020 TSLA split sparked an 80% run in shares. But is Tesla set up for another rally after its proposal for a new share split?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tesla (TSLA, $1,010.64) on Monday signaled its second stock split in less than two years and became the third company in the trillion-dollar market cap club to propose a split in the past couple of months. Shares in the electric vehicle maker predictably popped at the opening bell.

The company's notice of a Tesla stock split follows Amazon.com's (AMZN, $3,295.47) proposed 20-for-1 AMZN stock split announced earlier this month, as well as Google parent Alphabet's (GOOGL, $2,833.46) 20-for-1 GOOGL stock split disclosed in early February.

Tesla's announcement came in a regulatory filing that was light on details, but that didn't stop shares from adding well more than 6% in the first 15 minutes of trading.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

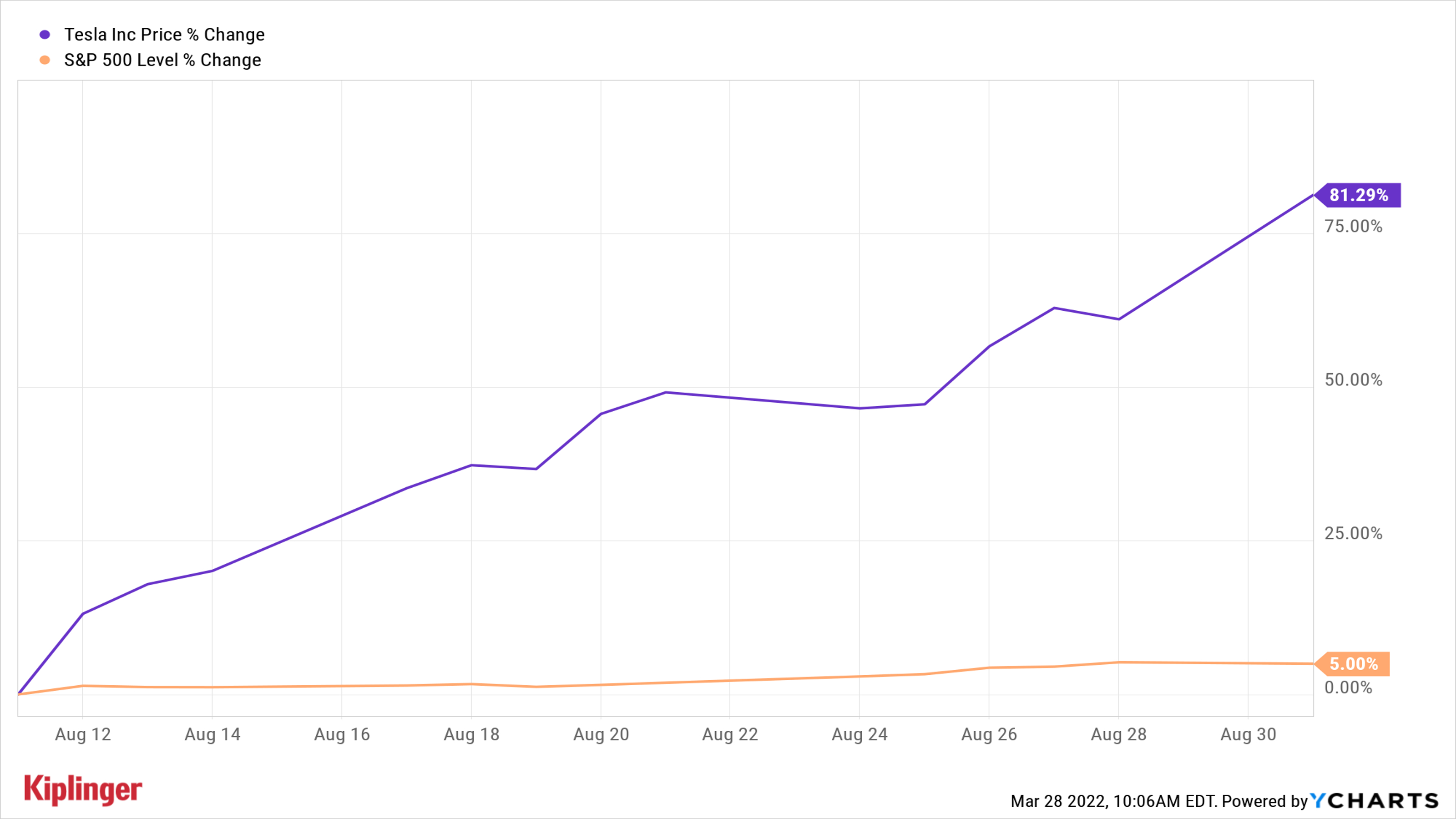

Fair enough. The last time Tesla split its stock, TSLA shares gained more than 80% between the early August 2020 announcement and the day the 5-for-1 split went into effect at the end of that month:

If shares don't go quite as crazy this time around, that will be understandable. After all, TSLA actually said very little in its filing.

What (Little) Is Known About the Tesla Stock Split

Here's the deal: The company plans to request stockholder approval at its upcoming annual meeting "for an increase in the number of authorized shares of common stock … in order to enable a stock split of the Company's common stock in the form of a stock dividend."

That's it. The date of the annual meeting has yet to be disclosed, but in 2021 it was held in October, if that's of any help.

The almost certain outcome, however, is that the Tesla stock split will make shares more accessible to retail investors who currently balk at the four-figure sticker price. True, brokers are happy to sell their clients fractional shares for free, but a stock with a high dollar price is simply tougher for traders, investors and insiders to sling around.

Slicing the price of admission to any stock helps increase liquidity and volume. Those are not necessarily bad things. Just be aware that volatility will likely increase as a result, too.

The Last Split Triggered Buying. Will History Repeat?

The downside to stock splits is that a company's stock usually goes up even though nothing under the hood has changed. A stock split is essentially the same thing as making change: swapping, say, a $5 bill for five $1 bills. A company's fundamentals, its prospects and its shares' valuation remain the same.

That's why some strategists are telling investors they should take any pop from the Tesla stock split as a chance to get out while the getting is good.

"Tesla's desire to pursue a stock split doesn't change the fact that its stock is still trading at a valuation completely disconnected from fundamentals," says David Trainer, CEO of New Constructs, an investment research firm based in Nashville.

Trainer fears that by dramatically reducing its price post split, TSLA will become even more attractive to "unsuspecting" retail investors.

"This could further fuel the bubble in Tesla's stock that has been brewing over the past two years," he adds. "We advise investors to sell the rally in Tesla shares, as the stock faces no fundamental upside catalysts."

For context, here's how TSLA stock has fared against the S&P 500 over the past two years:

After a 900% run vs. just 86% for the border market over the past couple of years, Trainer isn't alone in his concerns. Wall Street gives TSLA stock a consensus recommendation of Hold, per S&P Global Market Intelligence. A number of less optimistic or even bearish analysts do cite valuation as a major worry.

Indeed, Tesla's stock trades at nearly 95 times analysts' fiscal 2022 earnings per share (EPS) estimate. True, the Street forecasts the company to generate average annual EPS growth of almost 40% over the next three to five years, but TSLA still commands a pretty hefty premium. That's especially true if you buy the bears' argument that an onslaught of electric vehicle industry competition isn't being adequately priced into TSLA shares.

Here's the pros' bottom line: Of the 35 analysts issuing opinions on Tesla stock surveyed by S&P Global Market Intelligence, 11 rate it at Strong Buy, six say Buy and nine call it a Hold. Notably, TSLA also gets six Sell recommendations and three Strong Sells.

Sell calls are remarkably rare on the Street, so make of that what you will.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.