20 High-Volatility Stocks for the Market's Next Swing

Active or tactical investors and traders might want to lean into the market's volatility via high-quality, high-vol stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If there's been one constant through the first few months of 2022, it's that volatility has come back with a vengeance. And yet as counterintuitive as it might sound, investors should think twice before dumping high-volatility stocks from their portfolios.

That's because all those high-vol stocks doing outsized damage to your returns in a down market are likely to be your biggest outperformers in an up market.

Indeed, if equities' mid-March pivot really does mark a new trend – one in which the major indexes manage to keep grinding higher – many of your worst market laggards should become your best market-beating leaders.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Volatility Cuts Both Ways

Embracing high-volatility stocks is easier said than done. Gyrating asset prices are generally contraindicated for getting a decent night's sleep. (If anything, investors are often told to gobble up low-volatility stocks to maintain their sanity). Volatility is also a proxy for risk. It increases the odds of buying high and selling low.

But strategists say roller-coaster price action isn't going away anytime soon, which means investors must learn to live with it, at least for now.

Heightened volatility "is the name of the game," says David Rosenberg, chief economist and strategist at Rosenberg Research. And his peers, both bearish and bullish, pretty much agree.

For one thing, even if the uncertainty unleashed by the war in Ukraine were miraculously resolved overnight, the Federal Reserve's increasingly hawkish stance on inflation should continue to create waves.

"If markets survive Putin, they'll still have to deal with [Fed Chair Jerome] Powell," writes Richard Saperstein, chief investment officer at Treasury Partners, a New York City wealth manager with $9 billion in assets under management. "Even prior to Russia's invasion of Ukraine, there were growing risks to the investment backdrop that had already precipitated increased market volatility."

That said, volatility isn't the same thing as returns. Returns are what you get; volatility is how you get there.

One pernicious aspect of heightened volatility is that it feeds into investors' unfortunate tendency to focus on short-term market noise at the expense of longer-term signals.

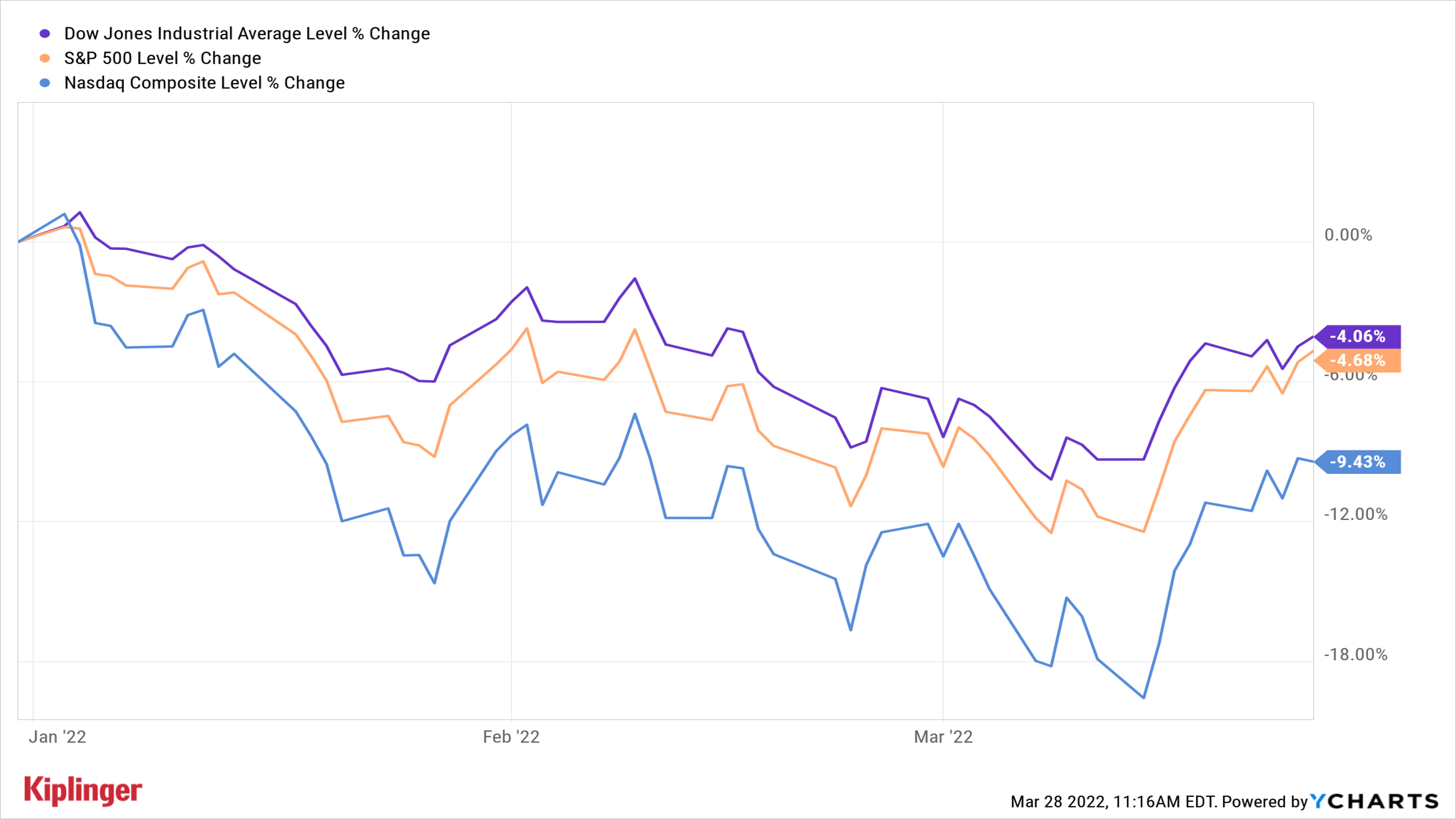

Perhaps that's why 2022 thus far feels like a disaster, even if the tape shows it really has been nothing of the sort:

Through March 25, the Nasdaq Composite was off 9.4% for the year-to-date (and just barely in correction territory, or down 10.5%, from its Jan. 3 high). The S&P 500 and Dow Jones Industrial Average were down 4.7% and 4.7%, respectively.

To be sure, that's a bad start to any year. None of it has been fun. But we're hardly talking about a wipeout in equities here.

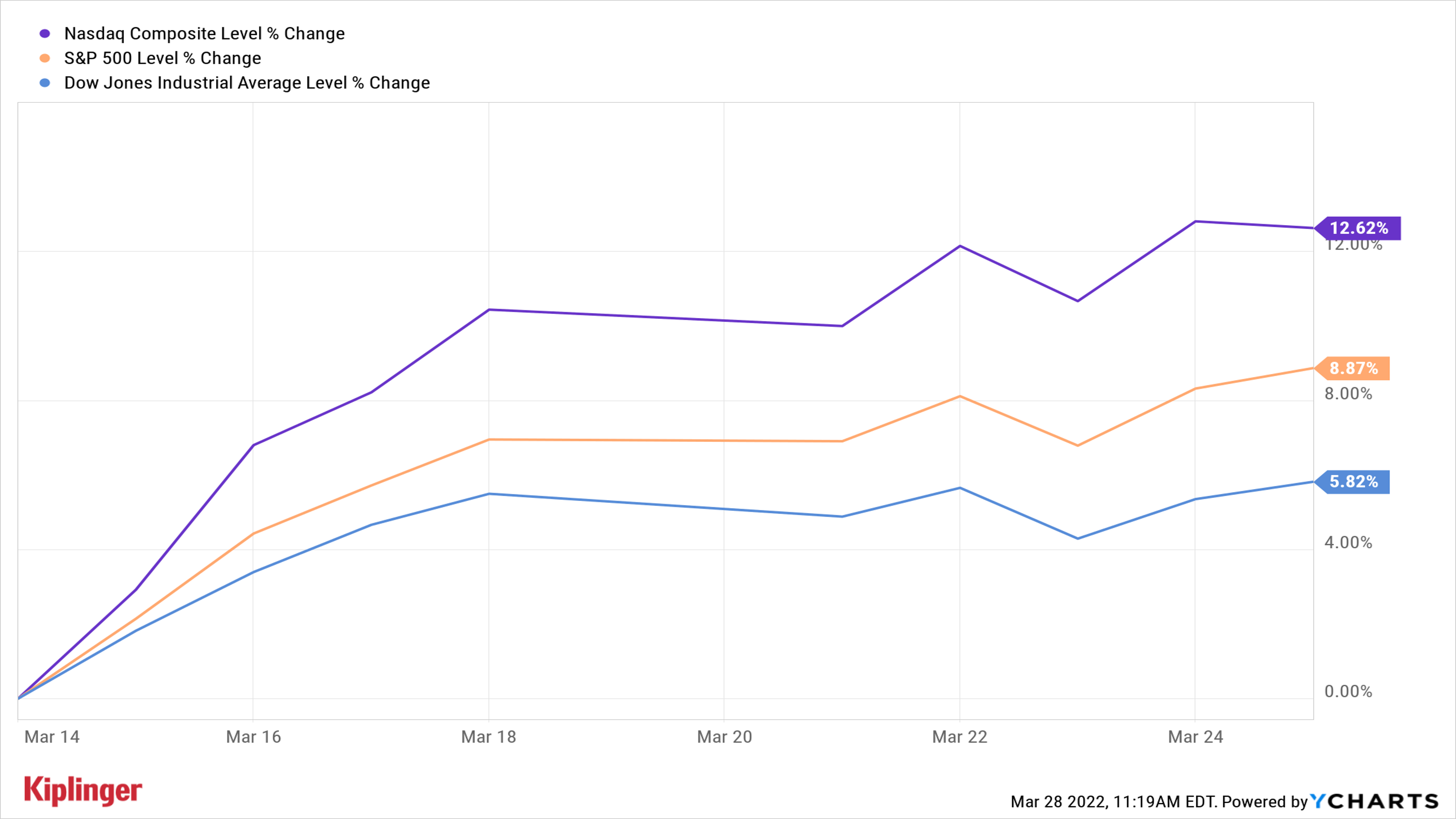

More importantly, markets have reversed trend since March 14 – the day the Fed announced the first of what is expected to be a series of interest rate hikes. Have a look at how the major indexes have performed since Powell pulled the Fed's trigger:

"The volatility that we've seen in markets since the start of the year has continued," says Michael Reinking, senior market strategist for the New York Stock Exchange. "It just cuts in the opposite direction."

High-Volatility Stocks for the Market's Next Swing

Past performance, as we all know ad nauseam, is not indicative of future returns. But if past is anything similar to prologue, investors should actually want more exposure to high-volatility stocks in an otherwise diversified portfolio.

Buy-and-hold investors probably shouldn't try this at home, but active or tactical investors and traders might want to try adding some quality, high-volatility stocks to their holdings.

To find the best stocks for the situation, we screened the S&P 500 for stocks with the highest betas. To oversimplify a bit, beta measures how a stock moves relative to the S&P 500. It's a volatility metric, and something of a proxy for risk.

The S&P 500 has a beta of 1.0. Any stock that trades with a beta greater than 1.0 can be said to be more volatile than the broader market. In practice, that means it tends to outperform the benchmark index when stocks are rising, and underperform it when stocks are going down. A stock with a beta of, say, 2.0 can kind of be thought of as twice as volatile as the S&P 500.

Be aware that beta is backward looking. It measures how a stock has traded relative to the S&P 500 in the past, commonly over a one-, two- or five-year period.

For that reason, we screened the S&P 500 for stocks with the highest one-year betas, or most volatile names of the recent past. We then narrowed down our list to high-volatility stocks with the strongest Buy recommendations from industry analysts.

Here's how that process works. S&P Global Market Intelligence surveys analysts' stock calls and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Any score equal to or below 2.5 means that analysts, on average, rate the stock at Buy. The closer a score gets to 1.0, the stronger the consensus Buy recommendation.

Have a look at the table below of the 20 S&P 500 stocks with the highest betas and strongest conviction Buy recommendations from Wall Street analysts. Among the highlights:

- Nvidia (NVDA, $276.92), with a beta of 2.4, has been far more volatile than the broader market over the past 52 weeks. Little wonder there: The semiconductor stock is emblematic of the way investors ditched last year's pricey growth darlings in favor of value names in 2022. NVDA outperformed the S&P 500 by a wide margin last year, but then seriously lagged the index for much of 2022. At its nadir, NVDA was off nearly 28% for the year-to-date as of March 14. It has since come roaring back to close its gap with the S&P 500, and now trails by only about a single percentage point. Analysts give the stock a consensus recommendation of Buy, with high conviction.

- Etsy (ETSY, $132.32) has traded as high as $307.75 over the past 52 weeks and as low as $109.38. Shares are down by more than a third for the year-to-date, but analysts say they're set to reverse trend and deliver market-beating returns. The global e-commerce platform for jewelry, apparel, home décor and other crafts supplies get a consensus recommendation of Buy, with high conviction. "As the leader in the niche market of artisanal goods, we believe Etsy has carved out a favorable competitive position with formidable barriers," writes Stifel analyst Scott W. Devitt (Buy). "The company is exiting a transition period where operations were streamlined, resources refocused and a number of initiatives implemented to reinvigorate growth."

- KLA Corp. (KLAC, $366.44), like any company connected with the semiconductor industry, has been whipsawed around by the global chip shortage, supply chain snafus and geopolitical uncertainty. But KLAC continues to build on its industry-leading market share in process control and metrology, says Argus Research analyst Jim Kelleher (Buy). "With demand strengthening and now exceeding pre-pandemic production levels in many markets, KLAC shares appear attractive at current levels," the analyst writes. The Street largely concurs, giving KLAC a consensus recommendation of Buy, with strong conviction. Indeed, analysts forecast the company to generate average annual earnings per share growth of 16% over the next three to five years. KLAC might offer investors a bumpy ride, but the potential for outperformance can't be denied, bulls say.

Here's the full list of high-volatility stocks:

| Company Name | Ticker | One-Year Beta | Average Broker Recommendation |

|---|---|---|---|

| Nvidia | NVDA | 2.43 | 1.62 |

| Etsy | ETSY | 2.36 | 1.63 |

| Align Technology | ALGN | 2.18 | 1.73 |

| KLA Corp. | KLAC | 2.06 | 1.79 |

| Teradyne | TER | 1.95 | 1.70 |

| DexCom | DXCM | 1.89 | 1.40 |

| Bath & Body Works | BBWI | 1.76 | 1.48 |

| ServiceNow | NOW | 1.75 | 1.40 |

| Adobe | ADBE | 1.72 | 1.63 |

| Caesars Entertainment | CZR | 1.66 | 1.29 |

| PayPal Holdings | PYPL | 1.65 | 1.75 |

| Monolithic Power Systems | MPWR | 1.58 | 1.31 |

| Bio-Techne | TECH | 1.57 | 1.64 |

| Meta Platforms | FB | 1.56 | 1.66 |

| Micron Technology | MU | 1.56 | 1.51 |

| D.R. Horton | DHI | 1.56 | 1.67 |

| Synopsys | SNPS | 1.52 | 1.57 |

| Intuit | INTU | 1.49 | 1.57 |

| Salesforce.com | CRM | 1.47 | 1.50 |

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.