Stock Market Today: Stocks' Win Streak Snapped Despite Good Jobs News

Optimism about peace in Eastern Europe faded Wednesday, chilling a stock market that had recently heated up.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Positive momentum in the major indexes ran out Wednesday as a resurgence in Russian military activity overshadowed good news on the employment front.

Less than a day after pledging to pull back operations in Kyiv, Russian forces reportedly shelled the Ukrainian capital and attacked several areas on the country's eastern border. The resurgent violence propelled energy prices, with U.S. crude oil futures up 3.4% to $107.82 per barrel. That in turn fueled energy stocks (+1.2%), the top-performing sector of the day.

Investors showed little interest in an ADP report that showed 455,000 new private payrolls in March – some 5,000 jobs higher than estimates, albeit the smallest gains since August of last year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Of particular interest was job growth witnessed in the natural resources and mining sector," says Peter Essele, head of portfolio management for Commonwealth Financial Network. "The large expansion in payrolls in the sector is a reaction from producers looking to quickly ramp up output to take advantage of multi-decade highs in commodity prices while they last.

"The result should be more supply in commodity-related materials as the year progresses, which could help alleviate pricing pressures over the long term."

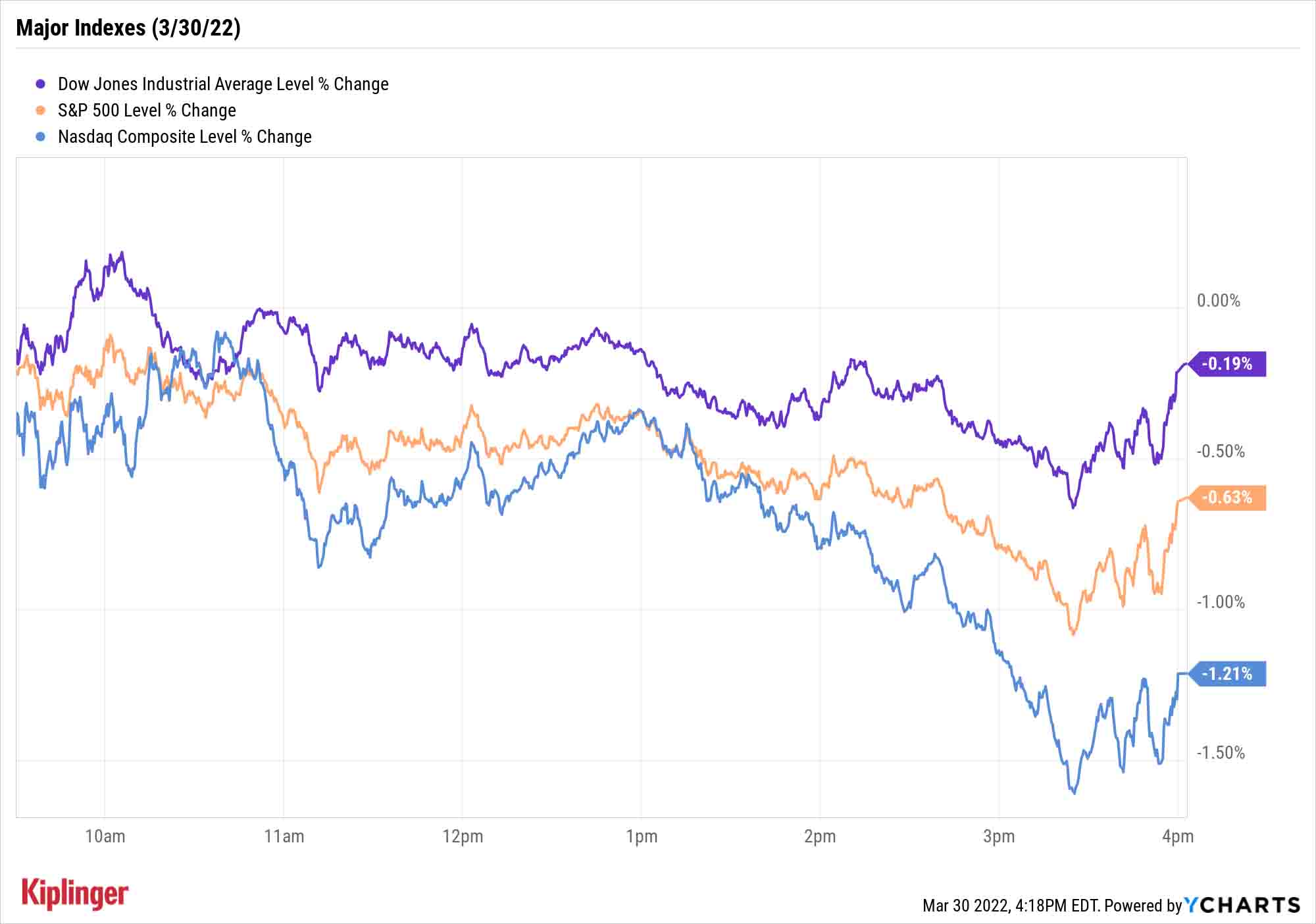

Regardless, stocks broadly retreated after several days of gains. The Nasdaq Composite dropped 1.2% to 14,442, the S&P 500 was off 0.6% to 4,602 and the Dow Jones Industrial Average slipped 0.2% to 35,228.

Other news in the stock market today:

- The small-cap Russell 2000 took a 2.0% haircut to 2,091.

- Gold futures rose 1.1% to settle at $1,939 an ounce.

- Bitcoin joined equities in retreating, with a 1.2% decline to $47,145.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Lululemon Athletica (LULU) jumped 9.6% after the athletic apparel maker reported fourth-quarter adjusted earnings of $3.27 per share on $2.1 billion in revenue. The company's bottom line beat analysts' consensus estimate, but its top line fell short. LULU also announced a $1 billion stock buyback program. "Lululemon has a strong brand and growing direct-to-consumer sales, which we expect will lead to higher margins over the next several years," says Argus Research analyst John Staszak, who maintained his Buy rating. "In addition, we expect revenue growth from the expansion of the company’s men's clothing line."

- Home furnishings retailer – and member of the Berkshire Hathaway equity portfolio – RH (RH) slumped 13.3% after earnings. In its fourth quarter, RH reported higher-than-expected adjusted earnings of $5.66 per share, but the $901.5 million in revenue it brought in over the three-month period missed the mark. The company also said it will undergo a 3-for-1 stock split this spring. CFRA Research analyst Kenneth Leon downgraded RH stock to Hold from Buy after earnings. "Demand for luxury home furnishings paused in February-March due to inflation worries and the Ukraine-Russia conflict, in our view. We think U.S. household disposable income is pulling back for RH's leading luxury home furnishings," Leon says.

Should You Fear the Yield Curve Inversion?

We mentioned yesterday that the bond market saw a potential "2-and-10" yield curve inversion. We say "potential" because not all data providers saw it that way, but Wall Street is nonetheless expressing worry about this respected market signal.

For the uninitiated: A 2-and-10 yield curve inversion is when the yield on the shorter-term two-year Treasury note actually exceeds the 10-year Treasury's yield – and it has predicted a host of U.S. economic recessions over the past century-plus.

But there are a few asterisks attached, and this inversion's particular circumstances have at least a few strategists saying this time, things really might be different.

"Don't fear yield curve inversion. It is not the standalone indicator of recessions as it once was," says Ethan Harris, head of global economics research at BofA Securities, who adds that this most recent signal is "heavily distorted by the Fed's massive balance sheet and extremely low bond yields overseas."

So, what exactly does this mean for the U.S. economy – and, by extension, for the U.S. stock market? We explore the history of the yield curve inversion and stocks' surprising track record in the wake of this ominous signal.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.