Stock Market Today: Stocks Close Out Worst Quarter Since Q1 2020

However, the three major benchmarks turned in solid performances for the month of March.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

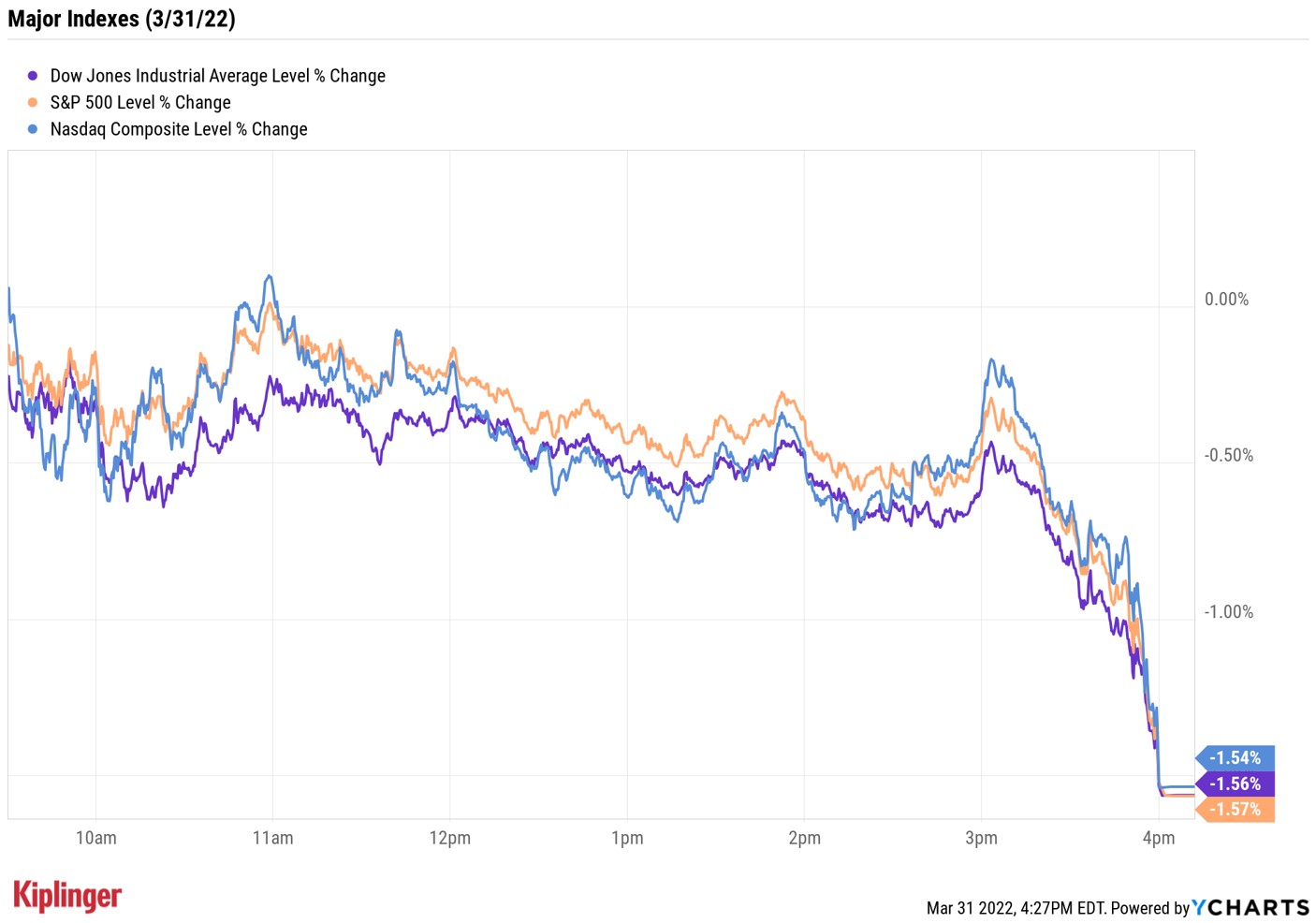

Stocks spent the last day of March much as they've spent the past few months – trading in negative territory.

Today's decline followed an onslaught of economic reports. On the inflation front, data from the Commerce Department showed that the personal consumption expenditures (PCE) index – which measures the price change of goods and services purchased by consumers – rose 0.6% month-over-month and 6.4% year-over-year in February, the quickest annual increase since 1982.

Meanwhile, consumer spending ticked up 0.2% from January, though this missed economists' consensus estimate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And ahead of tomorrow's monthly jobs data, a Labor Department report showed weekly jobless claims rose 14,000 last week to 202,000, slightly more than was expected.

Investors also eyed President Joe Biden's plan to tap into strategic oil reserves – releasing a record 180 million barrels – to combat red-hot gas prices. This sent U.S. crude futures down 7% to $100.28 per barrel – their lowest settlement since March 16.

Still, the " release of oil from the Strategic Petroleum Reserve will face two key logistical challenges," says Peter McNally, vice president of Global Sector Lead at Third Bridge. "The first is getting the oil out of the underground storage. This will take months to complete a release of 180 million barrels. The second challenge is converting the crude oil into fuel for consumers."

Selling picked up into the close, with the Dow Jones Industrial Average ending down 1.6% at 34,678, the Nasdaq Composite off 1.5% at 14,220 and the S&P 500 Index giving back 1.6% to 4,530.

For the month, the three indexes gained 2.3%, 3.4% and 3.6%, respectively. As for the first quarter of 2022, the Dow (-4.6%), Nasdaq (-9.1%) and S&P 500 (-5.0%) all finished solidly in the red, marking their worst quarter since Q1 2020.

Other news in the stock market today:

- The small-cap Russell 2000 shed 1% to 2,070. For the month, the index rose 2.1%, paring its first-quarter loss to 6.9%.

- Gold futures rose 0.8% to settle at $1,954 an ounce, bringing their quarterly gain to 6.9%.

- Bitcoin wasn't immune to today's selling, sinking 3.2% to $45,616.75. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Walgreens Boots Alliance (WBA) was the worst Dow Jones stock today, shedding 5.7% after earnings. In its fiscal second quarter, the drugstore chain reported adjusted earnings of $1.59 per share on $33.8 billion in revenue, beating analysts' consensus estimates. And while the company reiterated its full-year forecast, it warned of slowing demand for COVID-19 testing and vaccines and said investments it made to become more healthcare-oriented, like opening hundreds of doctor's offices, will take time to pay off.

- Advanced Micro Devices (AMD) tumbled 8.3% after Barclays analyst Blayne Curtis downgraded the semiconductor stock to Equalweight from Overweight (the equivalents of Hold and Buy, respectively). Curtis cited increasing competition from Intel (INTC). The analyst also questioned AMD's "growth trajectory coming out of this potential correction," and said he is staying on the sidelines until there is "better clarity as to the magnitude of these corrections and what the competitive landscape will look like as Intel catches up and ARM takes more share."

Energy Stocks, Oil Prices Rack Up Big Q1 Gains

Sure, it was an ugly quarter for most stocks, but not all. The energy sector surged 37.7% in the first three months of 2022 thanks in part to a 33% gain in U.S. crude oil futures. According to Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, this run in oil prices could have legs.

True, crude futures have pulled back recently from the $125-per-barrel mark touched earlier this month, but Wantrobski calls out a major theme driving inflation these days: "Too much liquidity relative to available assets and investment vehicles" – or, more simply put, "too much money chasing too little of anything."

And given that there's plenty of excess liquidity still lingering in the market, Wantrobski believes the longer-term outlook on oil prices remains bullish.

Investors looking to squeeze more profits from the oil patch aren't hurting for options – our top energy stocks for 2022 include a wide array of operators, or you can dig into specific niches such as these three refiners or these high-yielding midstream energy plays.

But those who prefer to spread their risk across 20 or 30 stocks rather than two or three might consider these seven exchange-traded funds (ETFs) amid rising oil prices. The funds featured here allow you to invest in the overall energy sector, in specific industries and even in oil futures.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.