Stock Market Today: Seesawing Stocks Start Q2 With Small Gains

The March jobs report was short of Wall Street expectations but not short on positive signals, leading to modest gains for the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A day after Wall Street closed the books on its worst quarter in two years, stocks vacillated between red and green following a March jobs report that was viewed as disappointing on some counts and encouraging on others.

The Labor Department said Friday that 431,000 nonfarm payrolls were added last month. That was shy of estimates for 478,000 jobs, and well off February's upwardly revised figure of 750,000.

The unemployment rate, however, dipped to a new post-COVID-19 low of 3.6%, just off the historic floor of 3.5% set in February 2020 and better than estimates for 3.7%. Average hourly earnings continued to swell too, up 5.6% year-over-year with significant gains made in lower-income positions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Importantly, the data suggest jobs growth can continue at a robust rate.

"We think it's likely that labor market gains, and further wage increases, could be sustained for a while," says Rick Rieder, BlackRock's chief investment officer of global fixed income. "For example, there is still a 1.5 million worker shortfall in the leisure and hospitality industry alone relative to the February 2020 level."

Rhea Thomas, senior economist at wealth services provider Wilmington Trust, doesn't expect the March jobs report to change the Federal Reserve's current policy, but it could offer the central bank a little more flexibility. "[It] still gives them the green light to hike in May, and we expect another hike in June, but we think if the wage and inflation data shows signs of deceleration on a month-over-month basis, it could give them room to assess before moving forward."

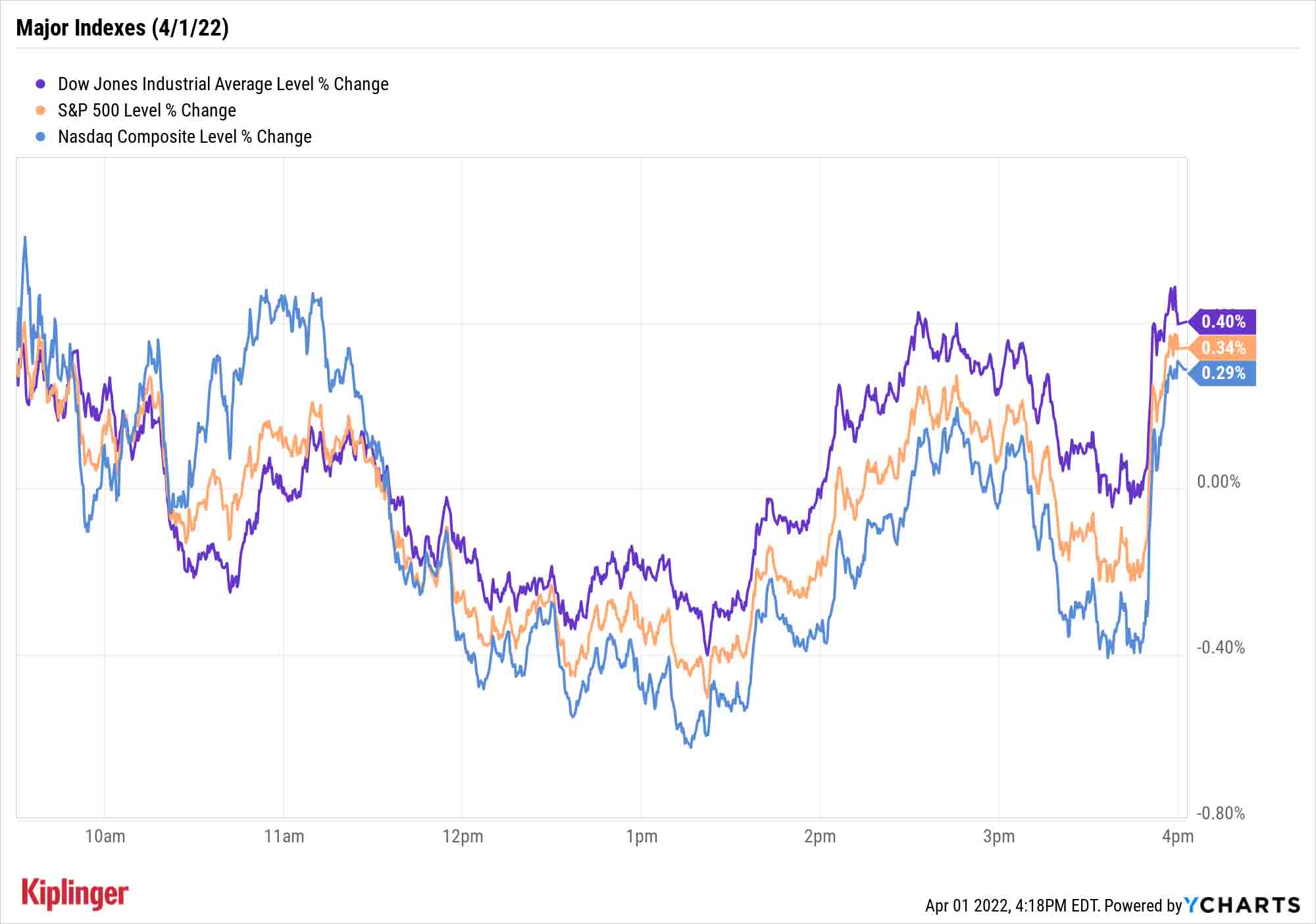

The major indexes finished an up-and-down session in positive territory. The Dow Jones Industrial Average managed a 0.4% gain to 34,818, the S&P 500 improved 0.3% to 4,545 and the Nasdaq Composite also closed 0.3% higher to 14,261.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1.0% to 2,091.

- U.S. crude futures fell 1% to end at $99.27 per barrel. For the week, crude oil lost nearly 13%, its biggest such decline since April 2020.

- Gold futures shed 1.6% to settle at $1,923.70 an ounce, bringing its weekly loss above 1%.

- Bitcoin rebounded 1.7% to $46,396.70. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- U.S.-listed Chinese stocks traded higher today. This came after a report in Bloomberg suggested the China Securities Regulatory Commission and other regulators are considering giving U.S. authorities access to auditing reports later this year – marking a sharp reversal from Beijing. This will allow the majority of Chinese firms to keep their listings on U.S. exchanges. Alibaba Group (BABA, +1.3%), Bilibili (BILI, +8.0%) and Pinduoduo (PDD, +6.3%) were among those that gained ground.

- Tellurian (TELL) surged 19.4% after Credit Suisse analyst Spiro Dounis upgraded the energy stock to Outperform from Neutral (the equivalents of Buy and Hold, respectively). " Three factors drive the upgrade," Dounis writes in a note. "First, we believe TELL is close to sanctioning the Driftwood LNG project. Second, we're ascribing value to future project phases given the strong demand for U.S. liquified natural gas (LNG). Third, LNG prices remain high and may be structurally higher for the foreseeable future." TELL has now more than doubled for the year-to-date.

- Amazon.com (AMZN, +0.4%) was little changed today after workers at its Staten Island warehouse voted to join a union. This marks a first for workers at any of the e-commerce giant's U.S. facilities.

High Yield With High Diversification

Dividends are probably doing more for your portfolio than you think.

Howard Silverblatt, senior index analyst for S&P Dow Jones Indices, released his latest data dive into the S&P 500 on Friday, looking into the index's valuation, yields and returns.

"From January 1926 through March 2022, the annualized total return for the S&P 500 [which includes both price gains and dividends reinvested] was 10.48% per year," he says.

Critically, a bit more than 38% of those returns were attributable to dividends. That might sound surprising, given that the S&P 500 currently yields 1.3% and has yielded a mere 1.9% on average over the past decade. But remember, many of the index's components have been growing their dividends over that time. The relentless rise of the S&P 500's level is what has kept the yield low. (Prices and yields move in opposite directions.)

The S&P 500 might have enough income-generating power for some investors. For those who would prefer collecting an even greater percentage of their returns in regular cash distributions, an array of high-yield options are at their disposal. These nine generous payers, for instance, yield at least 5%, easily outpacing the S&P 500 and most fixed-income options.

You can also take a more diversified approach to high-yield via exchange-traded funds (ETFs). The following 10 high-yield ETFs pursue strategies that will suit conservative and aggressive investors alike, but they all share one trait: plentiful yields of at least 4%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.