Stock Market Today: Soaring Twitter Spearheads Stocks' Success

Other big gains in technology and communication services lead the Nasdaq to a brisk improvement in Monday's session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A widespread rally in technology and tech-esque stocks started Wall Street's week off on the right foot.

Monday opened with a splash, with Twitter (TWTR, +27.1%) shares booming on news that Tesla (TSLA, +5.6%) CEO Elon Musk was taking a massive 9.2% stake in the stock.

While the move swirled up conversation about what Musk might do next – he has previously criticized both the social media platform and its current chief, Parag Agrawal – it was nonetheless also seen as a clear catalyst for the communication services firm's long-underperforming shares.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also booming were numerous large-cap tech companies such as semiconductor stock Qualcomm (QCOM, +4.6%) and software names Salesforce (CRM, +3.1%) and Intuit (INTU, +4.5%).

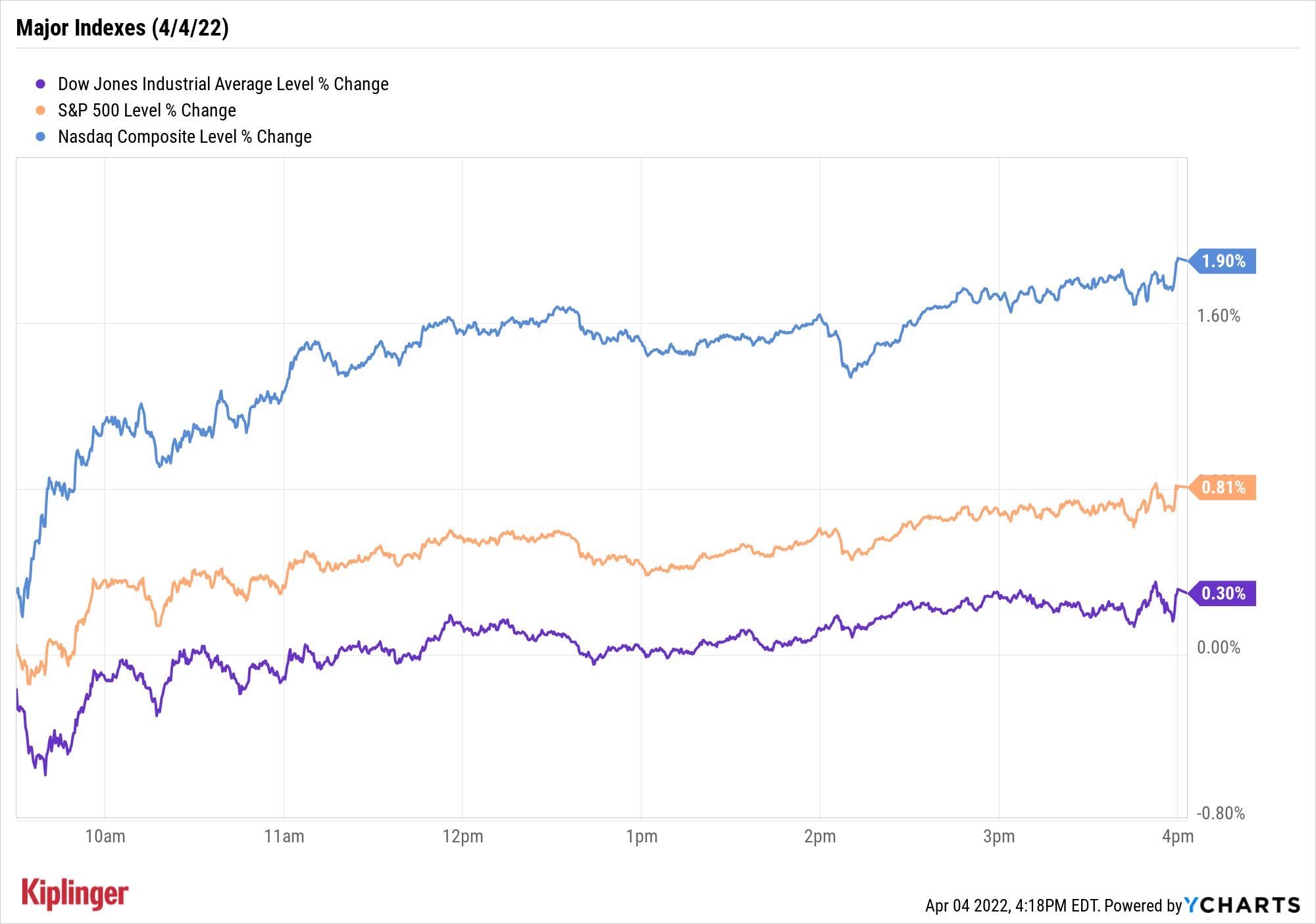

The surge in tech and communications names boosted the Nasdaq 1.9% higher to 14,532, while the S&P 500 (+0.8% to 4,582) and Dow Jones Industrial Average (+0.3% to 34,921) were more modestly in the green.

While Monday's advance was otherwise short on catalysts, Lindsey Bell, chief markets and money strategist for Ally Invest, points to a potential driver of additional second-quarter gains.

"What many people aren't talking about is the underappreciated opportunity the consumer presents," she says. "The job market is strong and excess cash has allowed consumers to absorb higher pricing. Companies and corporate profits have benefitted. I'm expecting earnings season will surprise the consensus, which expects guidance to fall significantly."

Other news in the stock market today:

- The small-cap Russell 2000 improved 0.2% to 2,095.

- Fresh calls from Europe for harsher sanctions on Russia sent U.S. crude futures (+4.0% to $103.28 per barrel) back above the $100 mark.

- Gold futures climbed 0.5% to $1,934.00 per ounce.

- Bitcoin slid 1.0% to $45,923.33. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Starbucks (SBUX, -3.7%) declined against the grain after interim CEO Howard Schultz announced the company would suspend share buybacks. “This decision will allow us to invest more profit into our people and our stores — the only way to create long-term value for all stakeholders,” said Schultz, who enters the company at a time where several locations have begun to unionize. Investors should note that SBUX did not repurchase any shares last year but had previously pledged $20 million toward both its dividend program (which will remain intact) and buybacks through 2024.

Rising Rates? These Stocks Don't Sweat 'Em

In a couple of days we'll get more clarity on the Federal Reserve's upcoming tightening measures.

"The big catalyst for this week is the Fed minutes on Wednesday afternoon, which is expected to shed some light on the balance sheet reduction process," says Michael Reinking, senior market strategist for the New York Stock Exchange. "There is still some uncertainty as to how aggressively Fed officials want to kick off this process.

"As I've laid out previously I'm looking for an initial announcement to start in the $60 billion to $85 billion range, which is less than some of the more aggressive projections out there."

From there, the market is likely to revert its focus back to the Fed's benchmark interest rate, which the central bank is expected to hike several more times this year. The exact number of increases (and their velocity) is still up in the air, but investors continue to tweak their portfolios to absorb more interest-rate pain – and in many cases, profit off it.

For instance, these seven exchange-traded funds (ETFs) hold either assets that are largely immune to rising rates or actually feed off it. But investors looking to make a more aggressive, concentrated bet to benefit from the Federal Reserve's expected hawkishness might do better in individual stocks.

Here, we look at 10 of the best stocks amid tighter monetary policy in 2022.

Kyle Woodley was long CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.