Stock Market Today: Signs of Fed Aggressiveness Spook Bulls

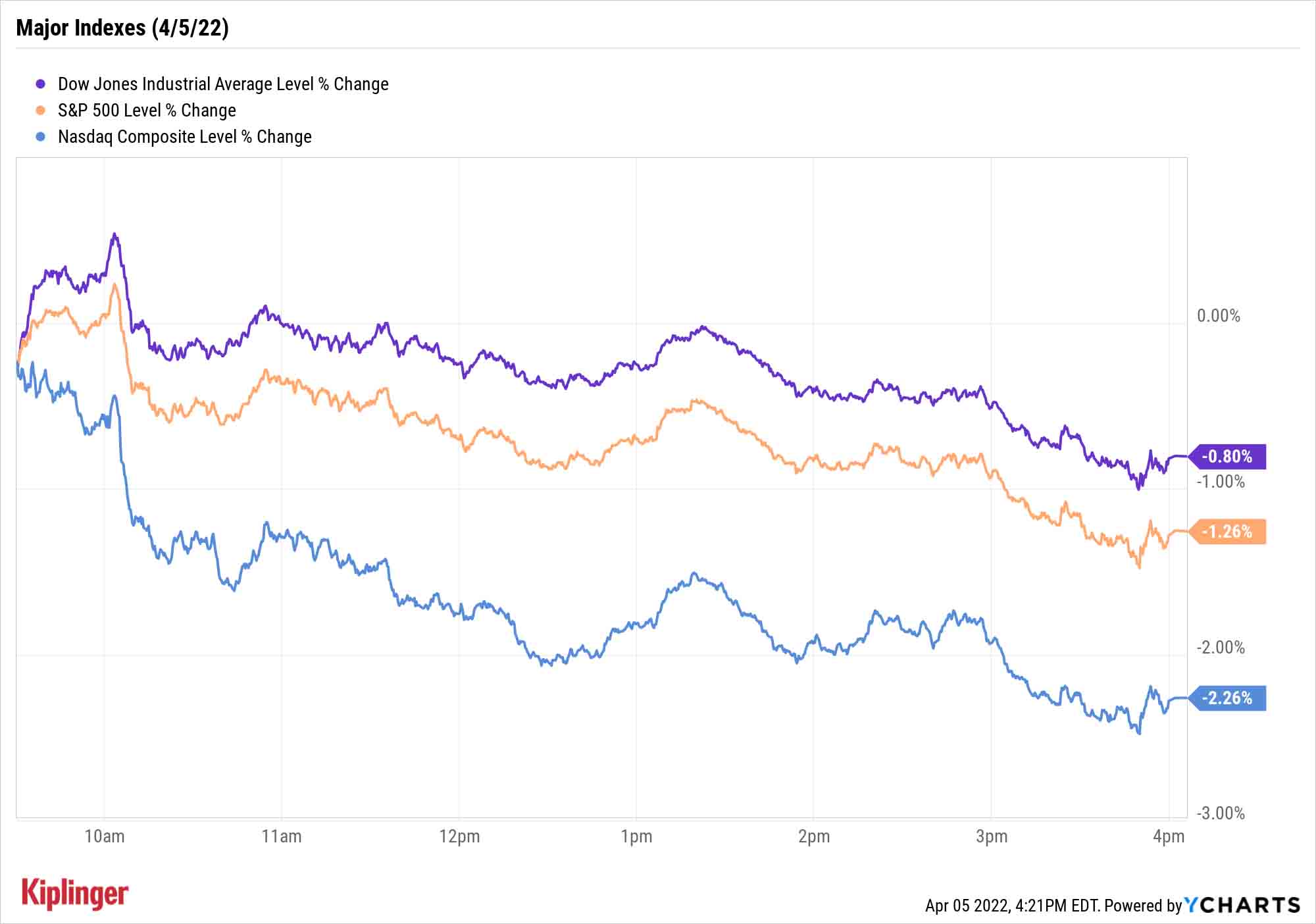

Fed Governor Brainard says a rapid shrinking of the central bank's balance sheet is in order, sending rates higher and stocks well into the red Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Fresh reason to believe that the Federal Reserve could put the pedal to the metal as it fights high inflation cooled U.S. equities Tuesday.

Ahead of tomorrow's Federal Open Market Committee minutes release, Fed Governor Lael Brainard – who typically espouses looser monetary policies – suggested the central bank needed swift and aggressive action to beat back rocketing consumer prices.

In addition to suggesting rate hikes could occur at greater than a quarter percentage point at a time, Brainard also stressed the Fed's need to quickly unload some of the nearly $9 trillion in Treasuries, mortgage-backed securities and other assets it previously bought up to stimulate the economy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"I expect the balance sheet to shrink considerably more rapidly than in the previous recovery," she said.

"It is undeniable that the Fed must rein in inflation, even with the risk of upsetting the stock market," says Greg Marcus, managing director at UBS Private Wealth Management. "The Federal Reserve under Jerome Powell has proven to be results-oriented and flexible. While it is a tall task, we believe the Fed is up for the challenge of engineering a 'soft landing.'"

Brainard's comments sent the 10-year Treasury yield to as high as 2.567%, snuffing rebounds in the very same technology (-2.1%) and communication services (-1.3%) sectors that anchored Monday's rally.

That in turn clipped the Nasdaq Composite (-2.3% to 14,204), Tuesday's worst-performing major index. The S&P 500 declined 1.3% to 4,525, while the Dow Jones Industrial Average was off 0.8% to 34,641.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 2.4% to 2,046.

- U.S. crude futures retreated 1.3% to end at $101.96 per barrel.

- Gold futures slipped 0.3% to settle at $1,927.50 an ounce.

- Bitcoin edged 0.2% higher to $46,021.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR, +2.0%) has a new board member: Elon Musk. One day after Musk disclosed a large stake in Twitter, the social media company announced the CEO of Tesla (TSLA) will join its board of directors. "We applaud the decision by TWTR to add him to the Board and believe the move was inevitable given Musk's sizable position and likely desire to do so," says CFRA Research analyst Angelo Zino (Buy). "Overall, we believe Musk is a true visionary who can add valuable input/provide idea generation to help support new initiatives." Zino adds that by adding Musk to the board, it removes the option for an all-out acquisition of Twitter by Musk, considering, as a Class II director, he can only hold a maximum 14.9% equity stake during his term (which will expire in 2024).

- Carvana (CVNA) plunged 8.7% after RBC Capital Markets analyst Brad Erickson downgraded the stock to Sector Perform from Outperform (the equivalents of Hold and Buy, respectively). The analyst believes investors are "discounting in significant long-term growth" – especially amid a slower-growth environment – which allows less room for potential upside in the shares. This could possibly tilt the risk/reward profile in a less favorable direction "in the event of execution mishaps," he adds.

Let's Get Ready to Travel!

U.S. consumers are ready to get out of the house. That's the predominant mindset, anyway, based on the recently released results of a BofA Securities online travel survey conducted in March to measure online travel agency and behavior trends.

Among the most salient findings:

- Travel will be elevated compared to 2019 (as in, pre-pandemic) levels over the next 12 months.

- 62% of respondents said they expect to travel more than usual over the next 12 months.

- 41% of respondents said they plan to make up for previously canceled travel either this year or next.

- While "alternative accommodations" (think AirBnb or Vrbo) are gaining acceptance, all age groups still favor hotels.

While there's certainly risks to these expectations – higher prices could dampen enthusiasm, and another COVID outbreak is always a wild card now – consumers' hopes of hitting the road, seas and skies could put some real wind into the sails of various travel stocks, including these five hotel picks and these five restaurant plays.

For a wider smattering of potential travel winners, however, consider this list spanning cruise lines, auto rental businesses, air carriers and more:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.