Stock Market Today: Stocks Scratch Out Meager Gains

Lowest jobless claims number since 1968 gives the major indexes just enough oomph to avoid a third straight session in the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street seemed to be en route to another day of losses, but a strong jobless-claims report helped stocks gain some momentum ahead of the week's final session.

The Labor Department on Thursday said that for the week ended April 2, just 166,000 Americans filed for unemployment benefits – the lowest number since November 1968 (though also what they were for the week ended March 19). It also easily flew in lower than the 200,000 claims expected.

"Initial jobless claims looked too good to be true," says Edward Moya, senior market strategist at currency data provider OANDA. "Today's impressive claims data reminds Wall Street that the labor market is 'firing on all cylinders', which should allow the Fed to continue to solely focus on inflation."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, while the markets did manage to turn higher, it was primarily led by defensive names. Pfizer (PFE, +4.3%) and Thermo Fisher Scientific (TMO, +4.2%) were among the best performers in the healthcare sector (+1.9%), while Costco (COST, +4.0%) and Target (TGT, +5.7%) helped lift consumer staples stocks (+1.2%).

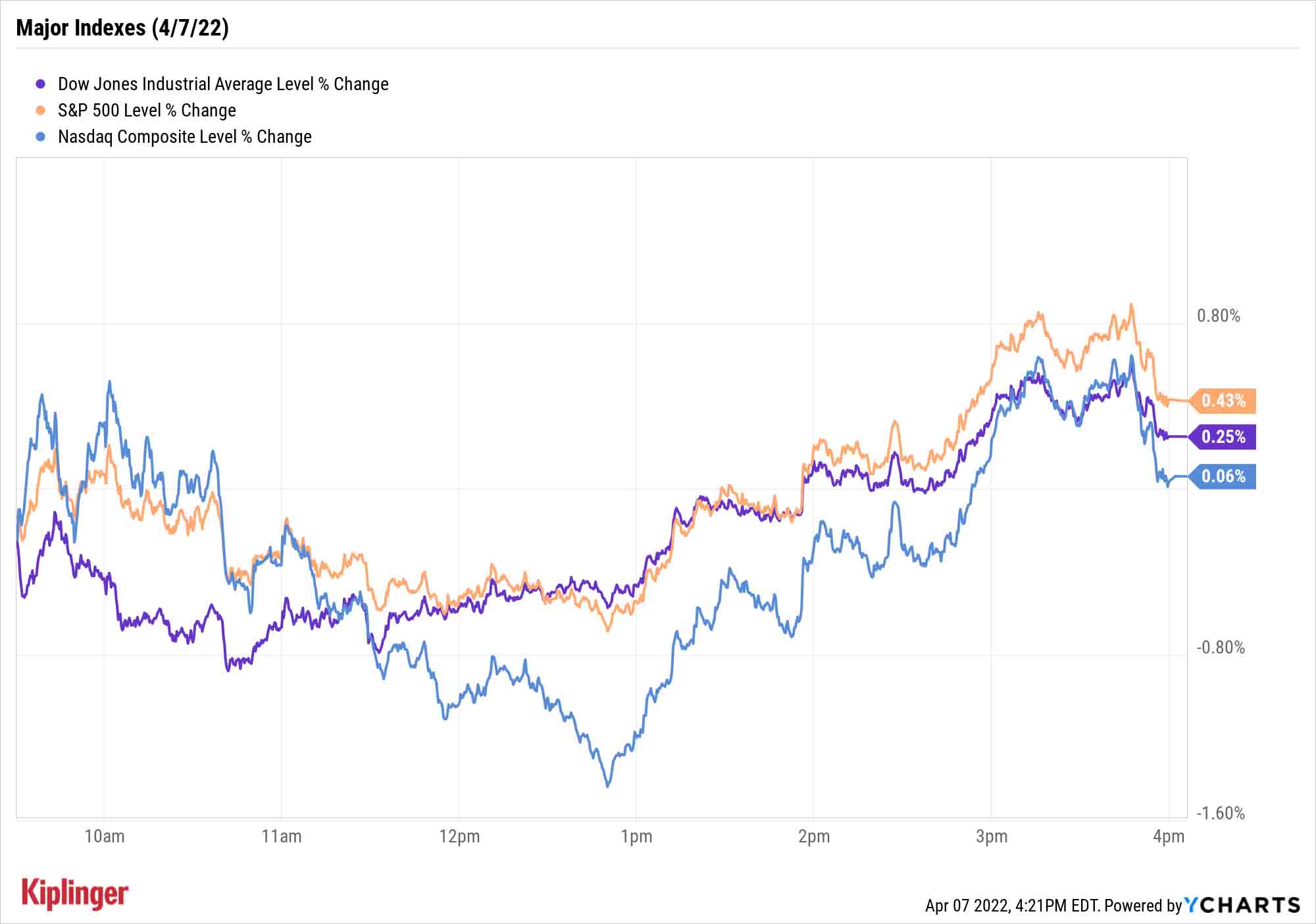

The end result was modest gains among the major indexes. The Dow Jones Industrial Average closed up 0.3% to 34,583, the S&P 500 improved 0.4% to 4,500 and the Nasdaq Composite eked out a marginally higher finish at 13,897.

"We continue to see defensive trading patterns in the options market, especially at the onset of earnings season, and remain surprised that the Cboe Volatility Index, or VIX, remains relatively subdued," says Steven Sears, president and chief operating officer of asset-management firm Options Solutions. "If earnings reports are as stressed as many investors believe they could be amidst these extraordinary economic and risk conditions, we could see a sharp investor re-rating of risk assets."

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.4% to 2,009.

- U.S. crude futures slipped 0.2% to $96.03 per barrel, marking their third straight loss.

- Gold futures gained 0.8% to settle at $1,937.80 an ounce.

- Bitcoin retreated 0.8% to $43,414.98. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Deutsche Bank analyst George Hill downgraded Rite Aid (RAD, -17.2%) to Sell from Hold and slashed his price target on the pharmacy chain to a mere dollar per share from $16. The bruising analyst note comes ahead of RAD's fourth-quarter earnings report – due out after the April 14 close – in which Hill will closely be watching the company's guidance for its next fiscal year. Why? "Because RAD needs to generate $190 million to $200 million in cash annually to cover its debt service costs, plus another $200 to $250 million to cover its store maintenance capital expenditure requirement, meaning RAD needs to generate ~$400 to $450 million in annual adjusted EBITDA [earnings before interest, taxes, depreciation and amortization ] to continue as an operating company," Hill writes in a note. Anything below that $400 million mark and "the equity arguably has no value as the company is not in a position to generate real returns to shareholders," he adds.

- Ford Motor (F) skidded to a 2.9% loss after Barclays analyst Brian Johnson cut his rating on the automaker to Equalweight from Overweight (the equivalents of Hold and Buy, respectively). The analyst said Ford remains "vulnerable" to an ongoing global semiconductor shortage, while additional macro headwinds like commodities inflation could pressure margins. "Despite the selloff, we believe investors are still underestimating risks to the sector – and in particular to suppliers - from inflation and production pressures – as well as the impact of interest rate hikes on portfolio allocations," the analyst says.

Buffett Makes Another Big Buy

One of the day's most noteworthy gainers was printer leader HP (HPQ, +14.8%), but it had nothing to do with any economic indicators. No, HP's good fortune was a vote of confidence from none other than the Oracle of Omaha.

Last night, Warren Buffett's Berkshire Hathaway disclosed a huge 11.4% stake in HPQ stock, immediately making it a dominant shareholder in the PC-and-printers name. Berkshire bought up 121 million shares worth $4.2 million, surpassing asset manager Vanguard as the top holder of HPQ.

Much of the Berkshire Hathaway portfolio represents bets by one of the greatest investors of all time, so as most of our readers know, we regularly keep tabs on what Buffett is buying and selling. But he has been busier than usual of late, also taking a massive stake in oil play Occidental Petroleum (OXY) and outright buying insurer Allegheny (Y) in the past month or so alone.

Berkshire's most recent splash might leave some investors scratching their heads. But we explain why and how the HPQ stake move looks like a classic Buffett bet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.