Stock Market Today: Stocks Struggle, But Energy Keeps Charging Ahead

Mixed bank earnings and rising Treasury yields muted most sectors Monday, but energy continued its market-leading ways.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street started the week on a shaky note as the 10-year Treasury yield hit its highest point in more than three years, but stocks' difficulties were limited to mild declines.

Monday's session saw the yield on the 10-year T-note climb to as high as 2.884% – a rate last seen in December 2018 – before easing a hair, to 2.866%. That spooked equity traders early, though BlackRock Investment Institute strategists say stock prices have already priced in rapid rate hikes by the Federal Reserve.

"We believe fears about a further downdraft in equities are overblown," they say. "The rate hikes we expected are happening faster, but we don't see central banks raising policy rates beyond neutral levels that neither stimulate or restrain the economy."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bank earnings were also front and center Monday amid what so far has been a lousy Q1 earnings season for the broader financial sector.

"Financials had the weakest start of earnings since 1Q20, with just 36% of the 11 companies that reported beating on both sales and [earnings per share] so far (40% beat last quarter after Week 1)," say BofA Securities strategists Savita Subramanian and Ohsung Kwon.

Bank of America (BAC, +3.4%) headed higher as better credit quality among its borrowers translated into a modest 1.8% revenue improvement to $23.3 billion and a 12% profit decline to 80 cents per share – both ahead of Wall Street's estimates.

However, Bank of New York Mellon (BK, -2.3%) also reported a double-digit profit decline (11%) that topped expectations but its stock was dragged lower. And Charles Schwab (SCHW, -9.4%) was the S&P 500's worst performer after higher expenses weighed on profits and caused it to miss the mark on both the top and bottom lines.

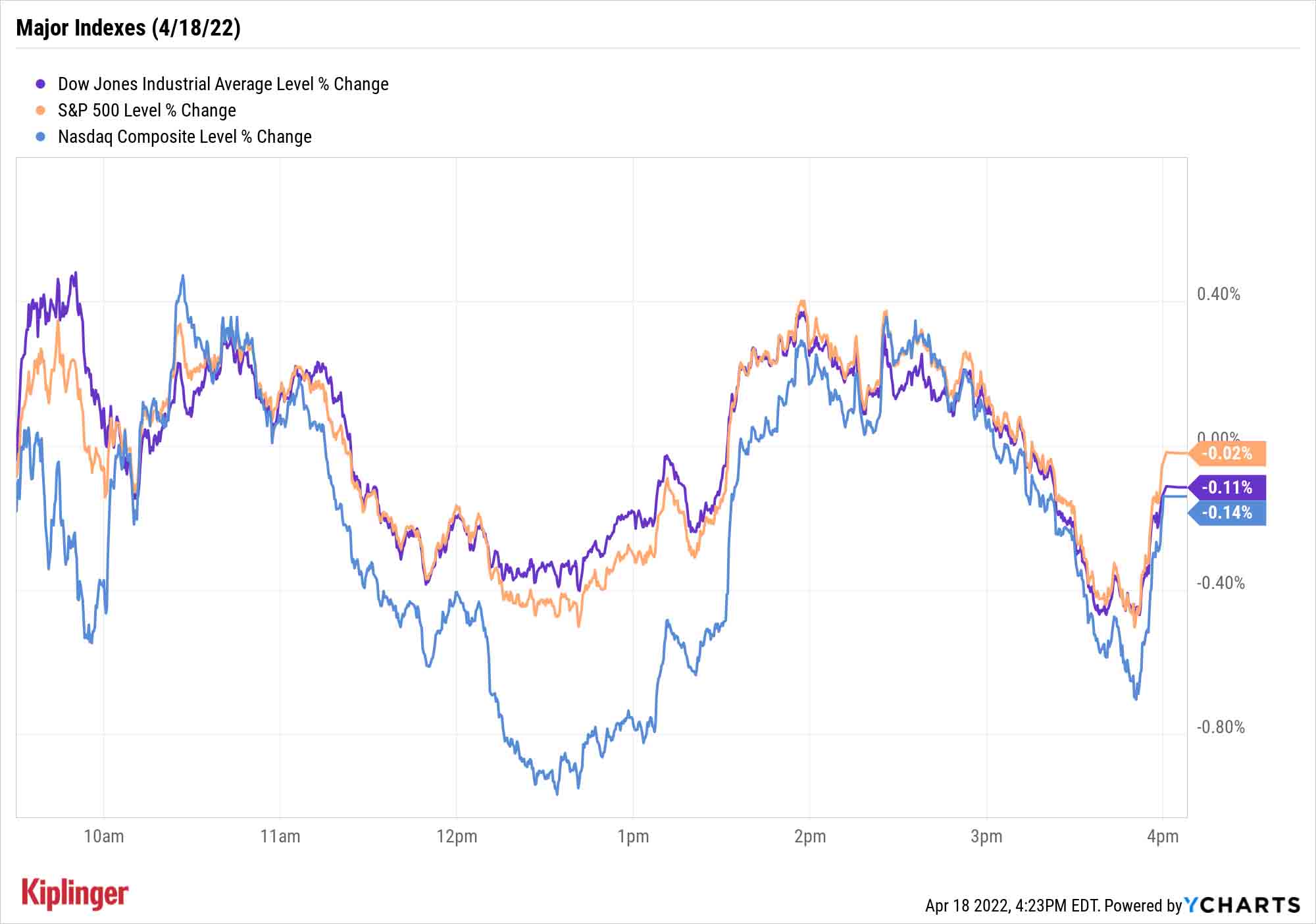

The Dow Jones Industrial Average (-0.1% to 34,411), S&P 500 (off marginally to 4,391) and Nasdaq Composite (-0.1% to 13,332) all traded similarly throughout the day, floating between positive and negative territory before finishing slightly lower.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.7% to 1,990.

- Gold futures edged up 0.6% to finish at $1,986.40 an ounce.

- Bitcoin managed to get back above the $40,000 mark, rising 2.5% to $40,756.73. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Synchrony Financial (SYF) rose 6.2% after the credit card provider reported earnings. In the first quarter, SYF recorded adjusted earnings of $1.77 per share and net interest income of $3.79 billion, higher than the $1.73 per share and $3.76 billion analysts were expecting. The firm also boosted its stock buyback program by $2.8 billion and hiked its quarterly dividend by 5%. Still, CFRA Research analyst Alexander Yokum maintained a Hold rating on SYF stock and lowered his price target by $3 to $40 – about in line with where shares closed today.

- UBS Global Research analyst Myles Walton downgraded United Airlines (UAL, -2.6%) to Neutral (Hold) from Buy. "Although we see strong pricing in the second quarter and beyond, the operational picture could be less smooth for UAL as they adapt to an aggressive growth strategy," Walton says. Several other travel-related stocks closed lower today, too, including American Airlines Group (AAL, -2.4%), Southwest Airlines (LUV, -1.1%) and Carnival (CCL, -2.7%).

Another Big Day for Energy

Monday's top-performing sector is certainly starting to become familiar with the winner's circle. The likes of Marathon Petroleum (MPC, +3.3%) and Phillips 66 (PSX, +5.2%) helped keep energy stocks (+1.5%) way out in front in 2022, buoyed by a 1.2% rise in U.S. crude oil futures to $108.21 per barrel.

Indeed, the energy sector has now raced to a 46% gain so far in 2022, more than 40 percentage points ahead of the next closest sector (utilities, +5.8%) and far better than the 7.8% loss in the S&P 500.

An anticipated "return to normal" in global travel as summer starts to near, as well as a drastic reshaping of global oil supplies thanks to Russia's invasion of Ukraine, have driven U.S. crude prices up well more than 40% in 2022 alone – in turn lifting all parts of the sector, from refiners to pipeline master limited partnerships (MLPs).

Now, while it's fair to argue that the easy money has likely been made in the energy sector, that doesn't mean all the money has been made. Despite the sector's torrid run, analysts see upside of at least 20% in a number of the sector's shares.

Read on as we look at five oil and gas stocks that still command a large number of analysts' Buy ratings, as well as lofty price targets suggesting even more gains ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.