Stock Market Today: Netflix's Epic Crash Clips Nasdaq

Rare subscriber loss hacks Netflix's value and weighs on its streaming rivals; Tesla reports Q1 beat after hours.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The earnings calendar was front and center Wednesday as a mixed session for the broader indexes was easily overshadowed by a plunge in of Wall Street's most notable mega-caps.

Netflix (NFLX) suffered its worst single-day decline in 18 years – a 35.1% nosedive eroding roughly $55 billion in market value – triggered by the company's first quarterly subscriber loss since 2011.

The streaming giant, which expected to add 2.5 million net subscribers during the first quarter, announced it had lost 200,000, triggering a flurry of analyst downgrades despite an easy earnings beat. The shortfall was in part caused by Netflix's decision to pull out of Russia, which cost it 700,000 subscribers, but inflation is also forcing customers worldwide to make tougher spending choices.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

CEO Reed Hastings also said NFLX was planning to launch an advertising-supported version.

"The initial allure of Netflix was that it didn't have any ads; it's unclear if Netflix fans will be amenable to advertisements," says David Trainer, CEO of investment research firm New Constructs. "Rivals like Disney can monetize content through a variety of other channels, like merchandise and theme park revenue. Netflix doesn't have the infrastructure for those kinds of revenue streams."

Ripples were felt throughout the streaming industry. Rivals including Disney (DIS, -5.6%), Amazon.com (AMZN, -2.6%), Warner Bros. Discovery (WBD, -6.0%), Paramount Global (PARA, -8.6%), Roku (ROKU, -6.2%) and even Chinese streamer iQiyi (IQ, -6.7%) all finished well in the red.

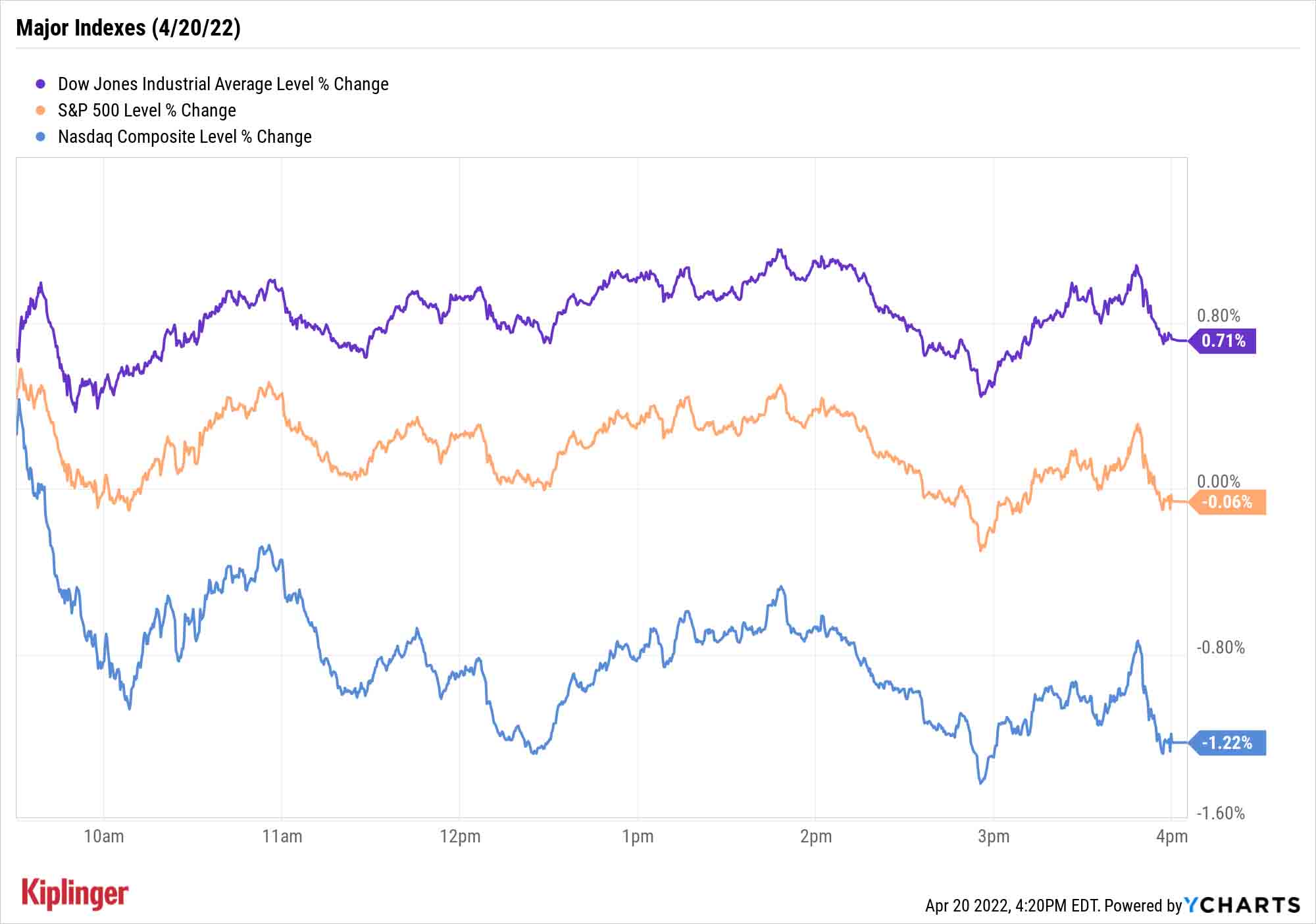

These losses weighed heaviest on the Nasdaq Composite, which declined 1.2% to 13,453. Faring relatively better were the S&P 500 (down marginally to 4,459) and Dow Jones Industrial Average (+0.7% to 35,160), which were buoyed by more positive earnings news.

International Business Machines (IBM, +7.1%) was the Dow's top component after it reported a 24% pop in profits and beat top- and bottom-line expectations.

"Stringing together consecutive quarters of outperformance illustrates that there is a clearer path to accelerating growth in 2022," says Morgan Stanley analyst Erik Woodring (Overweight, equivalent of Buy).

Meanwhile, price hikes helped Procter & Gamble (PG, +2.7%) offset inflation-pressured margins and deliver better-than-expected sales and profits.

Tesla (TSLA), off 5.0% during Wednesday's session, was up by roughly the same percentage following a Street-beating Q1 report. Earnings of $3.22 per share easily cleared estimates of $2.26, while revenues of $18.76 billion topped the consensus mark of $17.80 billion.

Other news in the stock market today:

- The small-cap Russell 2000 managed a 0.4% improvement to 2,038.

- U.S. crude futures edged up 0.1% to settle at $102.19 per barrel.

- Gold futures slipped 0.2% to finish at $1,955.40 an ounce.

- Bitcoin was relatively calm, sliding 0.3% to $41,243.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Rite Aid (RAD) stock was up more than 38% at its intraday peak before paring its gain to 10.8%. Sparking the surge was a report in the New York Post that suggested the pharmacy chain rejected a late-March buyout bid from Spear Point Capital Management. According to the article, the private-equity firm offered to buy Rite Aid for $815 million, or $14.60 per RAD share – a 56% premium to its March 30 close at $9.36.

- Omnicom Group (OMC) jumped 4.5% after the advertising firm reported earnings. Despite suspending operations in Russia during the first quarter, OMC reported earnings $1.39 per share and revenue of $3.41 billion – more than the $1.30 per share and $3.29 billion analysts were expecting. CFRA Research analyst Janice Quek maintained a Buy rating on OMC stock, citing the company's "good cost control" and an upward revision to its organic growth forecast.

The Time to Buy Emerging Markets?

Inflation is hardly just an American problem.

Yesterday, the International Monetary Fund said inflation was a "clear and present danger" as it lowered its 2022 global GDP forecast by 0.8 percentage points, to 3.6%. And emerging markets are expected to struggle even more than developed economies as higher prices weigh heavy on commodity importers.

That in turn has meant even worse year-to-date returns for many emerging market (EM) stocks compared to their still struggling U.S. counterparts.

But this dip might prove an ideal buying opportunity for those wishing to brave the high potential (and high volatility) of EMs, especially given expectations for emerging market growth to recover in 2023.

If you want to take the plunge, you can spread out your risk across dozens or even hundreds of stocks from numerous countries through exchange-traded funds (ETFs). Or you can narrow your bet to a single region – for instance, these five stocks and funds allow you to harness the growth of Africa.

If you're looking for some of the most potent individual picks across the globe, however, look no farther than this cluster of 11 emerging-market stocks. We explore the opportunity each presents, and what about them stands out to stock-research experts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.