Stock Market Today: Twitter Buyout Outshines Relief Rally

An afternoon rally helped the major indexes snap their short skid. But Twitter accepting Elon Musk's bid stole the spotlight.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. equities followed up last week's losses with a comeback in this week's opening session, but the day's biggest news was a deal cementing an M&A Monday for the ages.

Numerous global bourses finished lower earlier Monday amid worries about a COVID-19 breakout in China and fear that restrictions would weigh on global growth.

"Beijing is on 'high COVID alert," with three days of testing to begin in a central district of Beijing after 15 new cases came to light, which will impact 3 million people," says Jennifer Lee, senior economist for BMO Capital Markets. "Lockdowns are not planned, apparently, but let's see how these tests go and if there are any new cases."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. crude oil futures, which end trading earlier than the stock markets, dropped 3.5% to a two-week low of $98.54 per barrel. That hampered shares of energy firms including Exxon Mobil (XOM, -3.4%) and Chevron (CVX, -2.2%).

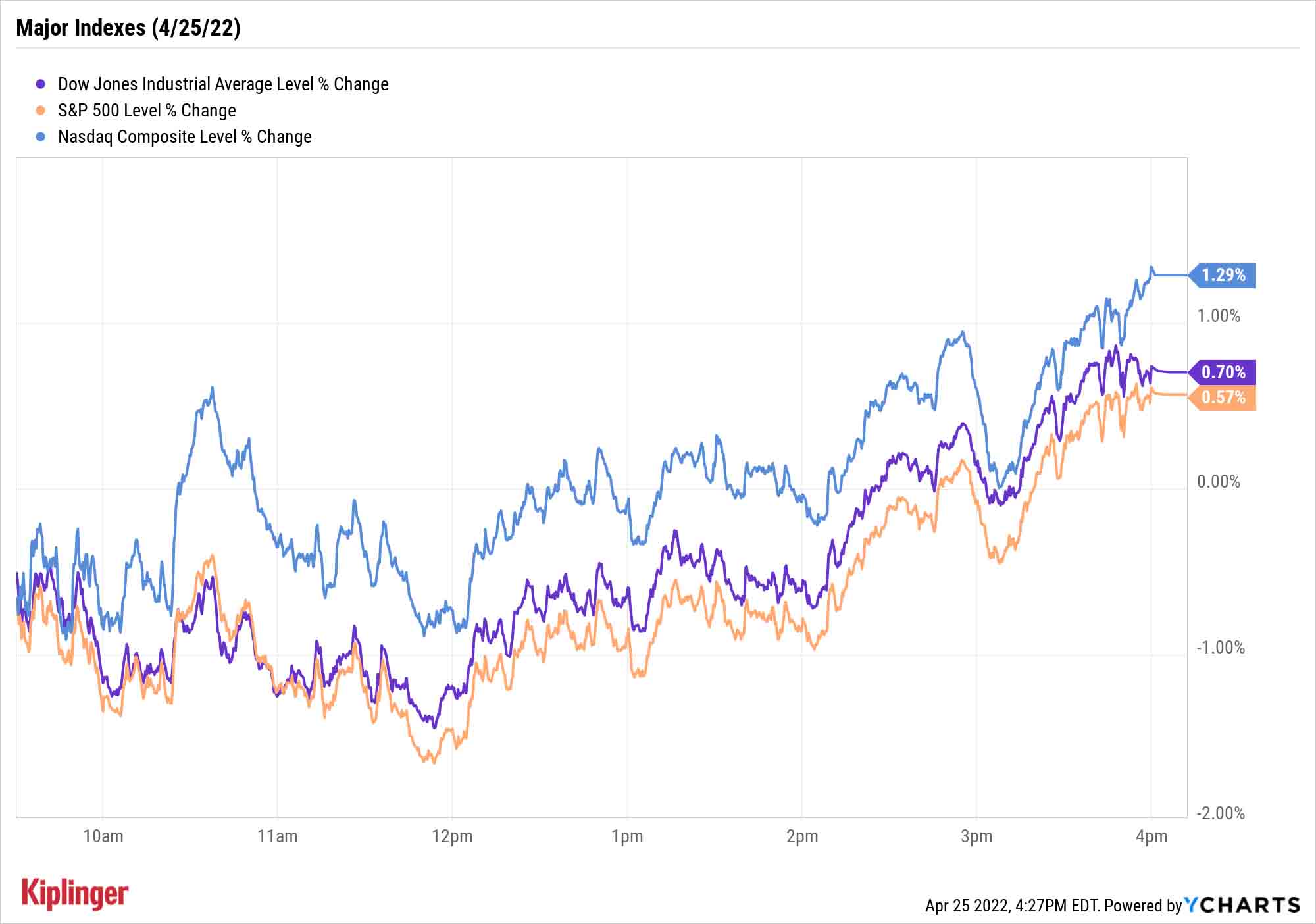

However, after opening considerably in the red, stocks rebounded in the afternoon, led by the technology (+1.5%) and communication services (+1.4%) sectors. The Nasdaq Composite gained 1.3% to 13,004, the Dow Jones Industrial Average was up 0.7% to 34,049, and the S&P 500 finished 0.6% to 4,296.

Monday's most significant headline, however, was the juice behind the communication sector's move: a jump in Twitter (TWTR, +5.7%), which has agreed to Tesla (TSLA, -0.7%) CEO Elon Musk's buyout offer of $54.20 per share – a deal worth $44 billion.

Prior to Monday, TWTR shares hadn't traded close to the offer price amid questions about how serious the offer was and how Musk would pay for the transaction. But recent reports that he had financing, as well as Monday reports that Twitter's board had warmed to – and, later in the day, accepted – Musk's overtures to take the social platform private sent shares up to a close of $51.70. (You can check out our report for more about Musk's deal for Twitter.)

While most social media companies didn't move much on what would be the world's biggest leveraged buyout ever, Digital World Acquisition Corp. (DWAC) – the company behind Donald Trump-backed Truth Social – plunged 12.9%.

Other news in the stock market today:

- The small-cap Russell 2000 improved by 0.7% to 1,954.

- Gold futures shed 2% to settle at $1,896 an ounce.

- Bitcoin also joined in the afternoon rally, advancing 2.0% to $40,278.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Coca-Cola (KO) gained 1.1% after the soft drink maker reported first-quarter earnings of 64 cents per share on $10.5 billion in revenue, both figures higher than analysts were expecting. The company also reiterated its full-year forecast for revenue growth of 7% to 8% and earnings-per-share growth of 5% to 6%, even as Coca-Cola suspended operations in Russia. "We think KO's strong results reflect its brand power and ability to thrive in an inflationary environment, as top line improvement was entirely driven by price and mix," says CFRA Research analyst Garrett Nelson, who reiterated a Buy rating on the Dow Jones stock.

- Snowflake (SNOW) – another member of the Berkshire Hathaway equity portfolio – spiked 7.6% after Wolfe Research analyst Alex Zukin intiated coverage on the cloud-based data platform with an Outperform (Buy) rating and $250 price target, a roughly 34% premium to today's close. Zukin believes SNOW could be a major player in the cloud computing space alongside Microsoft (MSFT), Alphabet (GOOGL) and Amazon.com (AMZN), and he sees significant opportunity in replacing legacy data warehouse systems as more customers migrate to the cloud.

Is a Recession Coming? (And If So, Should You Do Anything?)

While the rest of us gawk at a major social platform falling under the control of the world's richest man, market strategists remain fixated on the economy. Linda Kitchens, director in wealth management at Aspiriant, is among those who sees a greater chance of the U.S. economy falling into recession.

"We think recession probabilities for the next 18-24 months are in the 25%-30% range, which is meaningfully higher than where we were at the end of 2021 (probably less than 10% chance of recession then)," she says. "Economically, things like slowing growth, increasingly higher inflation and elevated commodity prices are important things to watch."

But she warns about making any major moves in anticipation.

"While the likelihood of recession has certainly increased, it's important to remind investors to stay focused on having a long-term time horizon, remaining fully invested and avoiding any market timing. As has often been said, 'far more money has been lost by investors trying to anticipate a recession than lost in recessions themselves.'"

To that end, the best thing you can do is position yourself in investments built for the long haul. For some, that means large, blue-chip companies that have been deemed worthy enough for inclusion in the Dow Jones Industrial Average (and we rank all 30 of these mega-cap names here). For others, that means companies that have proven they can not only profit – but share those profits – for decades on end (like the Dividend Aristocrats).

And for still others, one of the best ways to keep calm and steady, regardless of what the economy throws our way, is to hand over the keys. Investors can do quite well by allowing seasoned fund managers who charge reasonable fees to manage the stocks and bonds they want to hold. That's the idea behind the Kip 25: our 25 favorite low-cost mutual funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.