Stock Market Today: Dow Surrenders 809 Points as Q1 Earnings Roll In

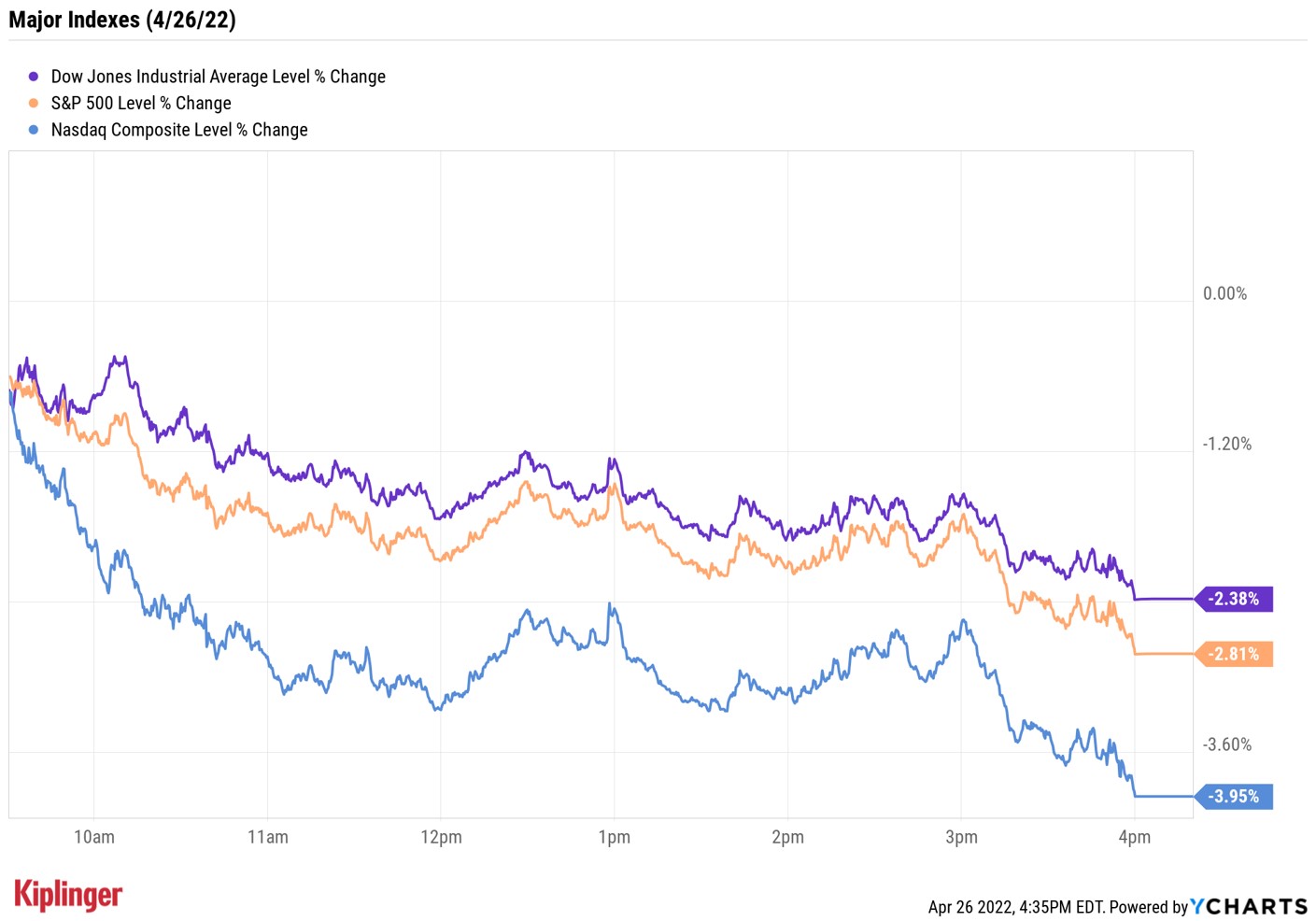

The Nasdaq, meanwhile, suffered its biggest one-day percentage loss since September 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. stocks opened the day in negative territory and losses accelerated as the session wore on.

Earnings remained in focus, and several of today's reactions were negative. General Electric (GE), for instance, spiraled downward 10.3% after its results. While the industrial conglomerate beat on the top and bottom lines in its first quarter, CEO Lawrence Culp warned the company is "trending toward the low end" of its full-year guidance as it continues "to work through inflation and other evolving pressures."

JetBlue Airways (JBLU), meanwhile, shed 11.4% after the air carrier's plans to reduce capacity growth in the short term offset a narrower-than-expected first-quarter loss. JBLU's post-earnings decline pressured fellow airline stocks, with Alaska Air Group (ALK, -4.6%), Southwest Airlines (LUV, -3.0%) and Delta Air Lines (DAL, -3.2%) all finishing notably lower.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The selling was broad-based, with consumer discretionary (-5.1%) and technology (-3.7%) the two hardest hit sectors. Only energy gained ground, adding 0.1% as U.S. crude futures climbed 3.2% to $101.70 per barrel.

At the close, the Nasdaq Composite was down 4.0% at 12,490 – its worst day since September 2020 – the S&P 500 Index was off 2.8% at 4,175 and the Dow Jones Industrial Average was 2.4% lower at 33,240.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 3.3% to 1,890.

- Gold futures gained 0.4% to settle at $1,904.10 an ounce.

- Bitcoin retreated 5.9% to $37,918.63. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) "Bitcoin was tentatively back above the $40,000 level as Wall Street became more optimistic with the long-term outlook for cryptocurrencies after reports that Fidelity Investments will allow Bitcoin into 401(k)s," says Edward Moya, senior market strategist at currency data provider OANDA. "Bitcoin reversed lower as risk aversion returned to Wall Street; Russia's suspension of gas supplies to Poland sent risky assets, including Bitcoin, sharply lower."

- Sherwin-Williams (SHW) jumped 9.4% after the paints and coatings retailer reported first-quarter adjusted earnings of $1.61 per share and revenue of $5 billion, both figures higher than analysts were expecting. SHW also reaffirmed its full-year guidance for adjusted earnings of $9.25 to $9.65 per share. "Our team delivered results in line with our expectations in an environment characterized by strong demand, ongoing cost inflation and choppy raw material availability that improved meaningfully in the final weeks of the quarter," said John Morikis, CEO of Sherwin-Williams, in the company's earnings release.

- United Parcel Service (UPS) slipped 3.5% after the delivery giant reported earnings. In its first quarter, UPS recorded adjusted earnings of $3.05 per share and revenue of $24.4 billion, higher than consensus estimates. The company also reiterated its full-year guidance, though CEO Carol Tome cautioned that we're not likely to see the same kind of e-commerce growth witnessed during the pandemic going forward. Argus Research analyst John Eade (Buy) said weakness in the stock represents a "buying opportunity," and that the company "remains well positioned to benefit from a number of positive trends."

What Wall Street's Saying About Social Media Stocks

One notable decliner in today's trading: Twitter (TWTR). Shares retreated 3.9% to $49.68– one day after the company's board of directors approved Elon Musk's $44-billion, or $54.20 per-share, buyout of the platform.

News that the Tesla (TSLA) CEO is taking TWTR private has narrowed the field of social media stocks, but analysts are still upbeat about the few remaining primary players.

Case in point: S&P Global Market Intelligence pegs the average analyst price target for Facebook parent Meta Platforms (FB) – which joins Twitter on this week's tech-focused earnings calendar – at $315.51, implying 44% potential upside from current levels.

Today, we take a closer look at the social media stocks to watch post-Twitter and break down why Wall Street's pros are so bullish on the group. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.