Stock Market Today: Microsoft Delivers, Alphabet Disappoints in Flat Day for Stocks

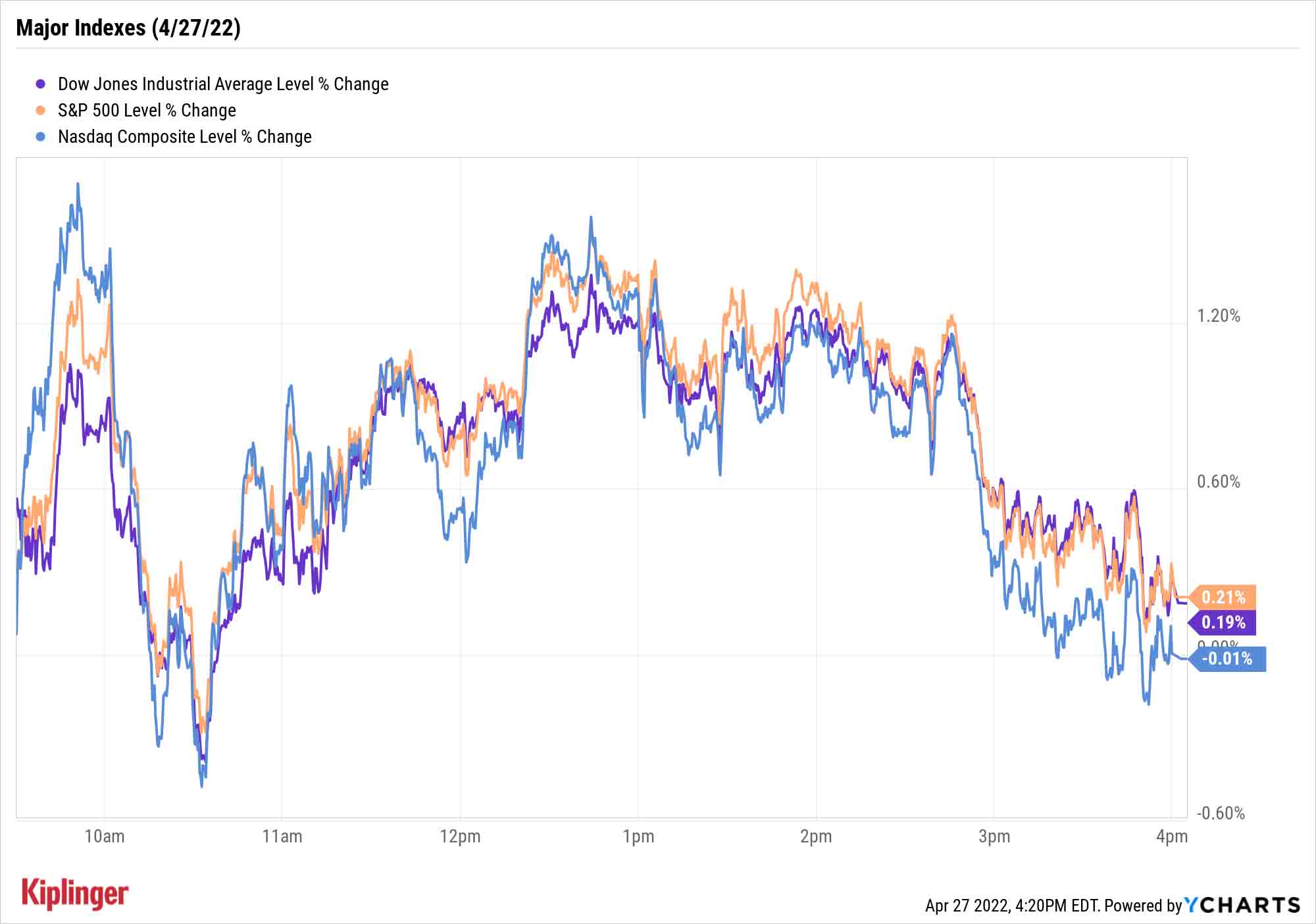

The Nasdaq touched a new intraday low but finished near breakeven Wednesday as two of its biggest components reported earnings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The major indexes managed to mostly stop the bleeding after yesterday’s rout, but they didn’t gain much ground, either, amid mixed earnings reports from a range of blue-chip stocks.

Microsoft (MSFT, +4.8%) shares were jolted higher Wednesday following the software maker's stellar quarterly report last night. Microsoft grew sales by 18% in its fiscal Q3, beat top- and bottom-line expectations alike, and provided current-quarter outlooks for all three of its operating divisions that were better than Wall Street forecasts.

"With software investors keyed in on every word, MSFT (yet again) demonstrated the resilience of its platform and ongoing benefits stemming from the strategic shift towards cloud," says Wells Fargo analyst Michael Turrin, who rates the stock at Overweight (equivalent of Buy).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Wedbush's Daniel Ives (Outperform, equivalent of Buy) was even more effusive:

"There are some moments in the financial markets that are pivotal and historical when put in context (e.g., Dimon's JPM conference calls and hand holding in the financial crisis 2008-09 timeframe)," he says. "Last night was one of them, when, in a white-knuckle market with the whole Street watching Microsoft's earnings with a close eye, Nadella & Co. gave a robust cloud guidance 'for the ages' that will calm Street nerves this morning and was a bullish data point for MSFT and importantly the whole tech sector moving forward."

Also jumping Wednesday was Visa (V, +6.4%), which credited a rebound in business and personal travel for its first-quarter revenues-and-earnings beat. It also predicted "high-teens" percentage growth in sales for all of 2022.

Google parent Alphabet (GOOGL, -3.7%) was a drag, however. While Google Cloud revenues were slightly better than expected, a wide miss on YouTube advertising revenue caused overall profits and sales to fall short of Wall Street estimates.

Boeing (BA, -7.5%) also had a litany of bad news to report: The aircraft maker lost $2.75 per share in Q1 – wider than its year-ago $1.53 in red ink – said it would temporarily suspend production of its 777X passenger jet, and logged $660 million in first-quarter charges related to its deal with the Trump administration to provide new planes for the Air Force One fleet.

The Nasdaq Composite briefly dipped to a new intraday low for 2022 before recovering, though it still finished with a marginal loss to 12,488. The S&P 500 was up a modest 0.2% to 4,183, and the Dow Jones Industrial Average gained 0.2% to 33,301.

Other news in the stock market today:

- The small-cap Russell 2000 was off 0.3% to 1,884.

- U.S. crude oil futures were up marginally to $102.02 per barrel after a greater-than-expected drop in gasoline and distillate inventories helped oil recover from an intraday decline below the $100 mark.

- Gold futures fell 0.8% to end at a two-month low of $1,888.70 an ounce.

- Bitcoin jumped 2.5% to $38,859.58. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Robinhood Markets (HOOD) ended the day down 4.9% after the trading platform said it would let go of roughly 9% of its workforce, or more than 300 employees. This comes as a period of "rapid headcount growth has led to some duplicate roles and job functions," said Vlad Tenev, co-founder and CEO of Robinhood, in a blog post late Tuesday. "Layoffs can't be a good sign, but bringing cost down to Earth is a positive," says Mizuho Americas analyst Dan Dolev (Buy).

- F5 (FFIV) plunged 12.8% after the network applications specialist reported earnings. In its fiscal second quarter, FFIV reported earnings of $2.13 per share on revenue of $634.2 million, more than analysts were expecting. However, the company lowered its full-year revenue growth outlook to a range of 1.5% to 4% versus previous guidance for growth of 4.5% to 8%. Still, Needham analyst Alex Henderson maintained a Buy rating on FFIV. "F5 is undervalued," Henderson writes in a note to clients. Plus, "FFIV offers a strong blend of accelerating revenue growth, expanding gross margin and operating margin, a strong balance sheet with nearly $10/share in cash, a $500 million annual buyback and free cash flow generation."

Could Stocks Swoon More in Summer?

The natural question on many investors' minds: Have we finally hit the bottom for 2022? The answer … well, we won't know the answer until it's in our rear-view mirror, but history suggests this summer could be worse.

"Could stocks' bottom for the year [be] in March or April? Sure, but history would say midterm year lows tend to be later in the year," says LPL Financial Chief Market Strategist Ryan Detrick. "Midterm years see the S&P 500 bottom on Aug. 14 on average, and the median bottom is in early September."

But that's no reason for panic – or necessarily even a guarantee that stocks will finish the year in the red.

"Many investors forget that double-digit declines during a year are actually normal," Detrick adds. "After only one 5% pullback all of last year, markets have provided an unfriendly reminder in 2022. In fact, since 1980, the average correction each year is 14.0%, putting this year's 13.0% correction in perspective.

"Taking this a step further, 21 times since 1980 the S&P 500 has been down double digits at one point from its peak, with an impressive 12 of those years managing to come back and finish the year positive."

For now, investors might best be served by making lemonade out of the market's lemons. A number of tech stocks with appealing long-term business theses suddenly find themselves in the discount bin. Of course, even when tech goes on sale, it's sometimes still not a true bargain – it's cheaper, but not necessarily cheap.

If you demand a bona fide value, consider these 15 value-priced stock picks. Each of these names appears undervalued based on several metrics, despite convincing bull cases that could pull them back up by the end of 2022:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.