Stock Market Today: Markets Climb Again Ahead of Likely Fed Hike

A few Street-beating blue-chip earnings helped lift stocks to modest gains as Wall Street prepared for another rise in benchmark interest rates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks wobbled their way to a second consecutive session of gains Tuesday as investors looked ahead to tomorrow's pivotal Federal Reserve announcement.

Not that Tuesday was entirely without its own developments.

U.S. job openings unexpectedly increased in March, by 205,000 to a record 11.55 million, though 4.5 million U.S. workers quit the labor force to widen the labor gap to 5.6 million workers – also a new high.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"This increased tightness suggests that strong wage growth will persist until improvements in labor supply and normalization of job openings bring the labor market back into balance," says a Goldman Sachs economic research team. Also, March factory orders improved by a better-than-expected 2.2%.

The first-quarter earnings calendar kept on churning, too.

Pfizer (PFE, +2.0%) lowered its full-year earnings forecasts, but Wall Street nonetheless reacted positively to a solid Q1 report. Strong sales of both its COVID-19 vaccine and oral antiviral helped the Big Pharma outfit to solid top- and bottom-line beats.

Clorox (CLX, +3.0%) also beat Street estimates, though the company also announced it would continue raising prices after profit margins took a sharp hit in its most recent three-month period. It also lowered its full-year earnings forecast for the second consecutive quarter.

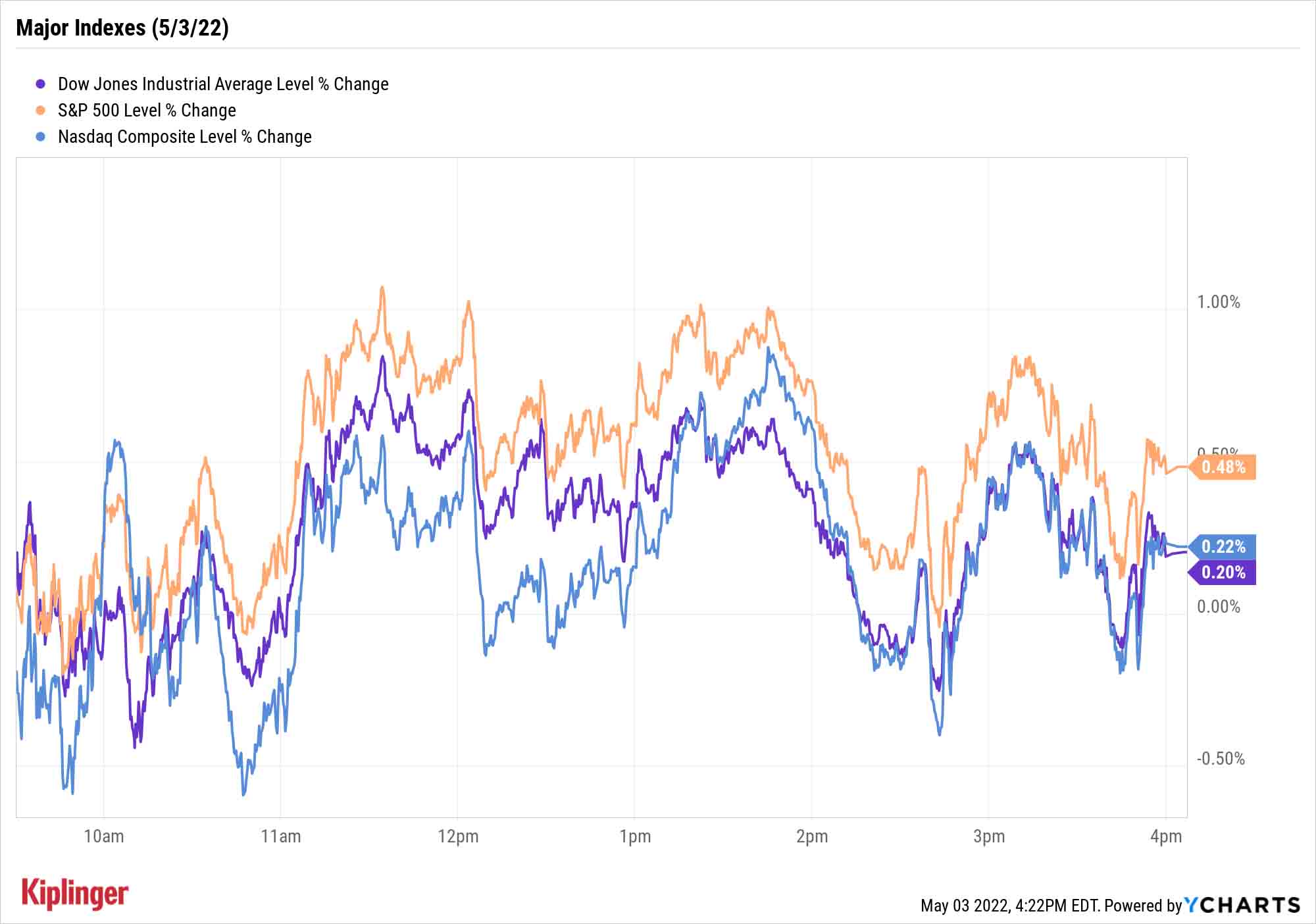

All that was enough to help the broader markets to another small up day. The S&P 500 (+0.5% to 4,175) led the way, with the Dow (+0.2% to 33,128) and Nasdaq (+0.2% to 12,563) also producing modest gains.

It's also a peculiar lead-up into tomorrow's Federal Open Market Committee policy announcement, where Kiplinger (and just about everyone else) expects the Fed to declare a 50-basis-point increase to its benchmark interest rate. Much of the market's recent issues have been tied to rate jitters, though it could be that the market has finally priced in the central bank's expected moves.

"We may very well have seen 'peak hawkishness,' meaning that the market's expectations for Fed policy could stabilize or moderate somewhat," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments. Though she adds "it's too early to be sure that 'peak hawkishness' has passed."

Other news in the stock market today:

- The small-cap Russell 2000 jumped 0.9% to 1,898.

- U.S. crude oil futures fell 2.6% to settle at $102.41 per barrel.

- Gold futures gained 0.4% to end at $1,870.60 an ounce.

- Bitcoin didn't partake in Tuesday's recovery, dropping 2.2% to $37,701.91. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Carvana (CVNA) slid 5.2% after Wells Fargo analyst Zachary Fadem downgraded the used car retailer to Equalweight from Overweight, the equivalents of Hold and Buy, respectively. "Recent evidence suggests that macro headwinds are building, access to capital is dwindling, and appetite for high-growth, free cash flow-negative companies is becoming increasingly scarce," Fadem says. The analyst also downgraded Vroom (VRM, -4.3%) and Shift Technologies (SFT, -5.0%).

- Nutrien (NTR) climbed 6.5% after the fertilizer firm reported higher-than-expected adjusted first-quarter earnings of $2.70 per share. The company also said it raised its full-year forecast as prices for key crops like corn, soybean and wheat are up 50% to 90% above their 10-year average. "We think NTR's retail segment will continue to experience strong top-line growth across most of its products, given solid demand and price increases," says CFRA Research analyst Richard Wolfe (Hold). "NTR's Q1 results and guidance capture the benefits of being a crop input provider amid strong agriculture fundamentals and investors may view this as a safe haven in the inflationary environment." Other materials stocks like Mosaic (MOS, +8.7%) and CF Industries (CF, +4.4%) posted solid gains today, too.

Let's Go, IPOs! Let's Go!

A return to market stability, even if for a short while, would be welcome news to two Wall Street groups: investment bankers, and retail investors needing to scratch an itch for "something new."

A downturn in equities and high volatility have put the pinch on initial public offerings (IPOs), in which privately held companies list on the public markets. According to IPO-focused registered investment adviser Renaissance Capital, just 26 U.S. initial public offerings have priced so far in 2022 – down a little more than 80% from the same date last year.

But it's possible this week could help kick-start some IPO activity. In just a couple of days, consumer eye care name Bausch + Lomb will hit the public markets in a spinoff from Bausch Health Companies (BHC). A warm reception to this offering – and no nasty surprises from the Fed – could help coax a few more anticipated offerings on the market, such as Steinway, which recently announced its plans to list on the New York Stock Exchange.

Investors curious about which new stocks could be hitting the markets this year need look no farther than our list of highly anticipated potential offerings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.