Stock Market Today: Stocks Suffer Worst Losses of 2022

Investors snapped out of their brief post-Fed euphoria and rushed to the exits Thursday, with high-priced tech among the most punished stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The major indexes wiped out yesterday's relief-rally gains and then some Thursday in a market-wide rout as Wall Street took a more sober look at the investing landscape.

For one, most of the worries hanging over stocks haven't disappeared, including on the interest-rate front. While Federal Reserve Chair Jerome Powell did dismiss the idea of a 75-basis-point hike yesterday, the expectation is for at least two more 50-basis-point hikes at the next two Federal Open Market Committee meetings – a still-considerable level of monetary tightening.

"We are still not out of the woods yet, as there is still too much uncertainty over how the Federal Reserve's actions will tame inflation without causing a recession," says Zach Stein, chief investment officer of climate change-focused investment manager Carbon Collective.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Indeed, the yield on the 10-year Treasury, which retreated yesterday, roared back to life Thursday to eclipse 3% once more. That weighed particularly hard on rate-sensitive growth places in tech and tech-esque stocks such as mega-caps Tesla (TSLA, -8.3%), Nvidia (NVDA, -7.3%) and Apple (AAPL, -5.6%).

Speculative assets such as cryptocurrency went heavily risk-off, too; Bitcoin, for instance, plunged 8.9% to $36,287. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Gene Goldman, chief investment officer of Cetera Investment Management, pointed to additional drivers for Thursday's woes.

"There is less optimism around the less hawkish Fed and the softish landing scenario," he says. "We saw data this morning portraying more inflation and a weaker economy – labor costs surged in Q1, unemployment claims rose, and productivity was weaker than expected."

Goldman also pointed to disappointing earnings reports from the e-commerce industry, which, because of high valuations to boot, were selling off particularly hard.

Shopify (SHOP), for one, plunged 14.9% after the e-commerce company reported lower-than-expected adjusted earnings and revenue in its first quarter (20 cents vs. 63 cents est.; $1.2 billion vs. $1.24 billion est.) and projected soft revenue guidance in the first half amid tough comparisons. SHOP also said it will buy San Francisco-based fulfillment startup Deliverr for $2.1 billion.

"Although e-commerce growth was below our view, SHOP is lapping pandemic figures, with comparisons to get more favorable exiting the calendar year," says CFRA Research analyst Angelo Zino (Hold). "That said, we do think consensus expectations will need to be tempered, partly reflecting lower than expected merchant additions to start the year."

eBay (EBAY, -11.7%) spiraled lower despite topping first-quarter estimates after it forecast second-quarter revenues of $2.35 billion to $2.40 billion and adjusted earnings of 87 to 91 cents per share, both under expectations for $2.54 billion and $1.01 per share, respectively. Etsy (ETSY, -16.8%), meanwhile, slightly beat revenue expectations but was merely in-line on profits and forecast Q2 sales of $540 million to $590 million, falling far short of the $627 million analyst mark. Amazon.com (AMZN) bled 7.6% in sympathy.

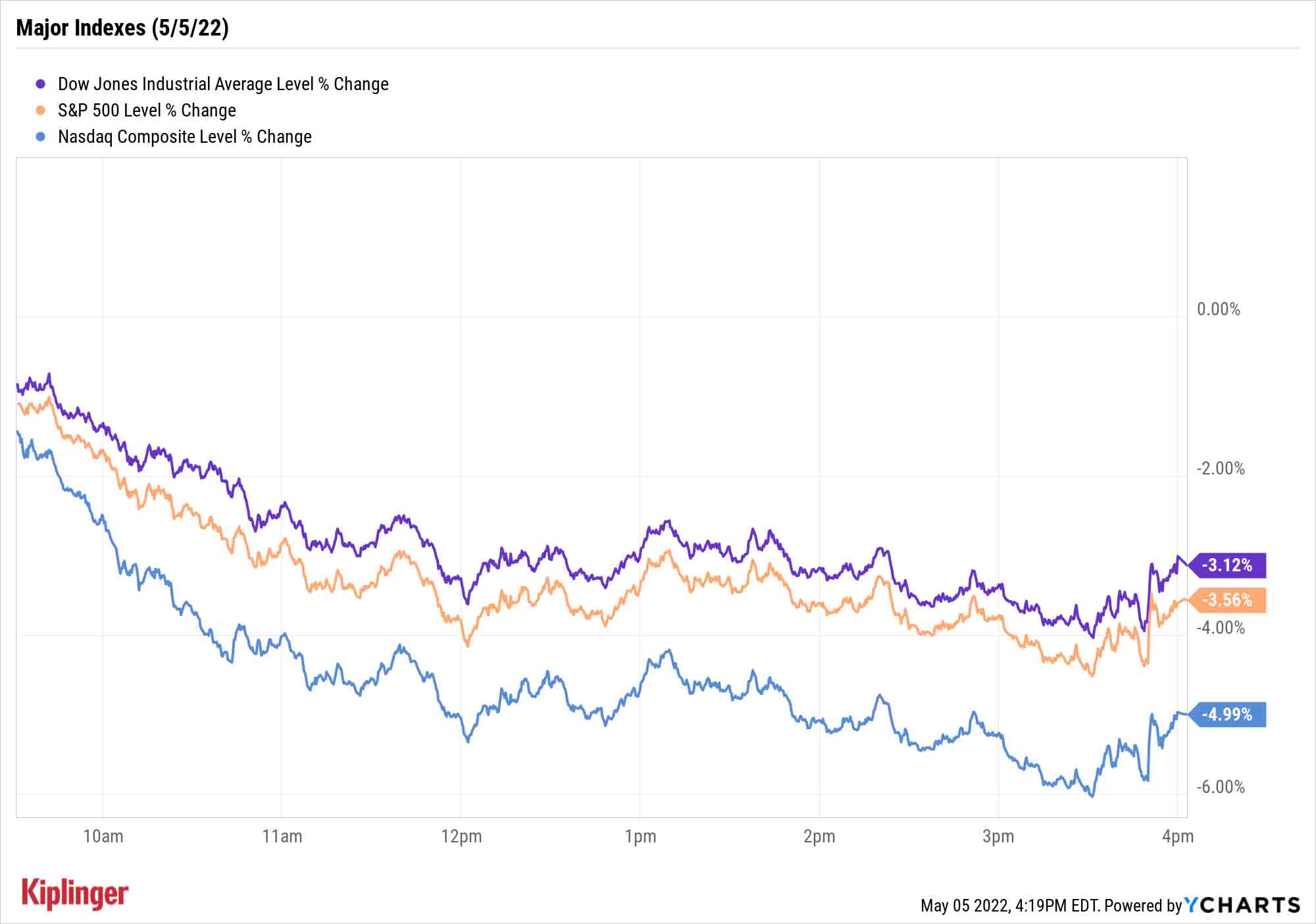

The result was the worst single-session performance of 2022 for both the Nasdaq Composite (-5.0% to 12,317) and Dow Jones Industrial Average (-3.1% to 32,997), while the S&P 500 (-3.6% to 4,146) was just a hair shy of outdoing its marginally larger decline April 29.

How low could we go from here?

Well, a bear market (a 20% drop from highs) would mean about 3,850 for the S&P 500, and John Lynch, chief investment officer for Comerica Wealth Management, thinks the index could scrape that figure.

"Bear markets without recession tend to be short and shallow," Lynch says. "It's conceivable the S&P 500 needs to establish a bottom in this 3,850 to 4,000 range. Without recession in 2022, which is our base case, stocks can resume higher as equity investors discount cyclical recovery in an environment where monetary policy is no longer shepherding expensive growth and technology names at a multiple of sales."

Other news in the stock market today:

- The small-cap Russell 2000 dropped 4.0% to 1,871.

- U.S. crude oil futures eduged up 0.4% to settle at $1081.26 per barrel.

- Gold futures gained 0.3% to finish at $1,875.70 an ounce.

- Booking Holdings (BKNG) was a rare splash of green today, adding 3.3% after the online travel company reported earnings. In its first quarter, BKNG reported earnings of $3.90 per share on $2.7 billion in revenue, more than the 85 cents per share and $2.5 billion analysts were expecting. The company also posted gross bookings of $27.3 billion, a record quarterly amount. "We have a favorable view of online travel companies, and particularly of BKNG given its focus on Europe, where it generates most of its gross profit," says Argus Research analyst John Staszak (Buy). "BKNG is trading at a projected 2022 price-to-earnings ratio of 20.2, below the average for other online booking companies; however, we believe that it merits a higher multiple given the company's strong earnings outlook."

Warren Buffett Splashes More Cash

Warren Buffett is spending like there's no tomorrow. A Wednesday evening regulatory filing from Berkshire Hathaway (BRK.B, -2.5%) revealed that the Oracle of Omaha's holding company bought $350 million shares in energy firm Occidental Petroleum (OXY, +1.2%).

The Berkshire Hathaway equity portfolio has plumped up on Occidental exposure in recent months – Buffett revealed a nearly 10% OXY stake in early March that now sits at 15.2%, and he also owns $10 billion worth of 8% preferred stock, as well as 84 million warrants to purchase OXY stock. The move is part of Buffett's renewed buying interest in energy that has seen Chevron (CVX) become Berkshire's fourth-largest holding.

All of this falls under an even larger underlying theme, which is that Buffett has gone from being a voracious seller in 2021 to buying everything that isn't tied down this year. Part of that seems to be the Oracle taking advantage of a considerable dip in the market. But a closer look at what Buffett's buying signals that he, like the rest of us, has rapidly rising prices on the brain.

We recently talked to noted Buffett expert David Kass about the Berkshire CEO's recent binge, and how much of Warren Buffett's activity has been connected to inflation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.