Stock Market Today: Stocks Sink After April Jobs Report

The U.S. stock market added to Thursday's big losses following the release of the latest jobs update.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

On the heels of their worst session of 2022, stocks initially struggled to find direction Friday following the release of the April jobs report – though in the end, they settled for selling, again.

The Labor Department this morning said the U.S. added 428,000 jobs last month, while the unemployment rate held steady at 3.6%. This marked the 12th straight month U.S. employers have added at least 400,000 new jobs. At this pace, the economy could recover all of its pandemic-related job losses by mid-July, says Kiplinger economist David Payne.

Also notable in the report was wage growth, which rose 0.3% month-over-month and 5.5% year-over-year, and the participation rate – or the percentage of the population that have jobs or are seeking them – which declined slightly to 62.2%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"While there's no shortage of concerns to take the wind out of investors' sails right now, this jobs read likely won't be one of them," says Mike Loewengart, managing director of Investment Strategy at E*Trade. "With a relatively rosy jobs picture, despite slight misses on participation and wages, the Federal Reserve likely won't be swayed from its rate hike campaign. And since numbers came in mostly in line with expectations, the market may have already priced in a robust jobs read."

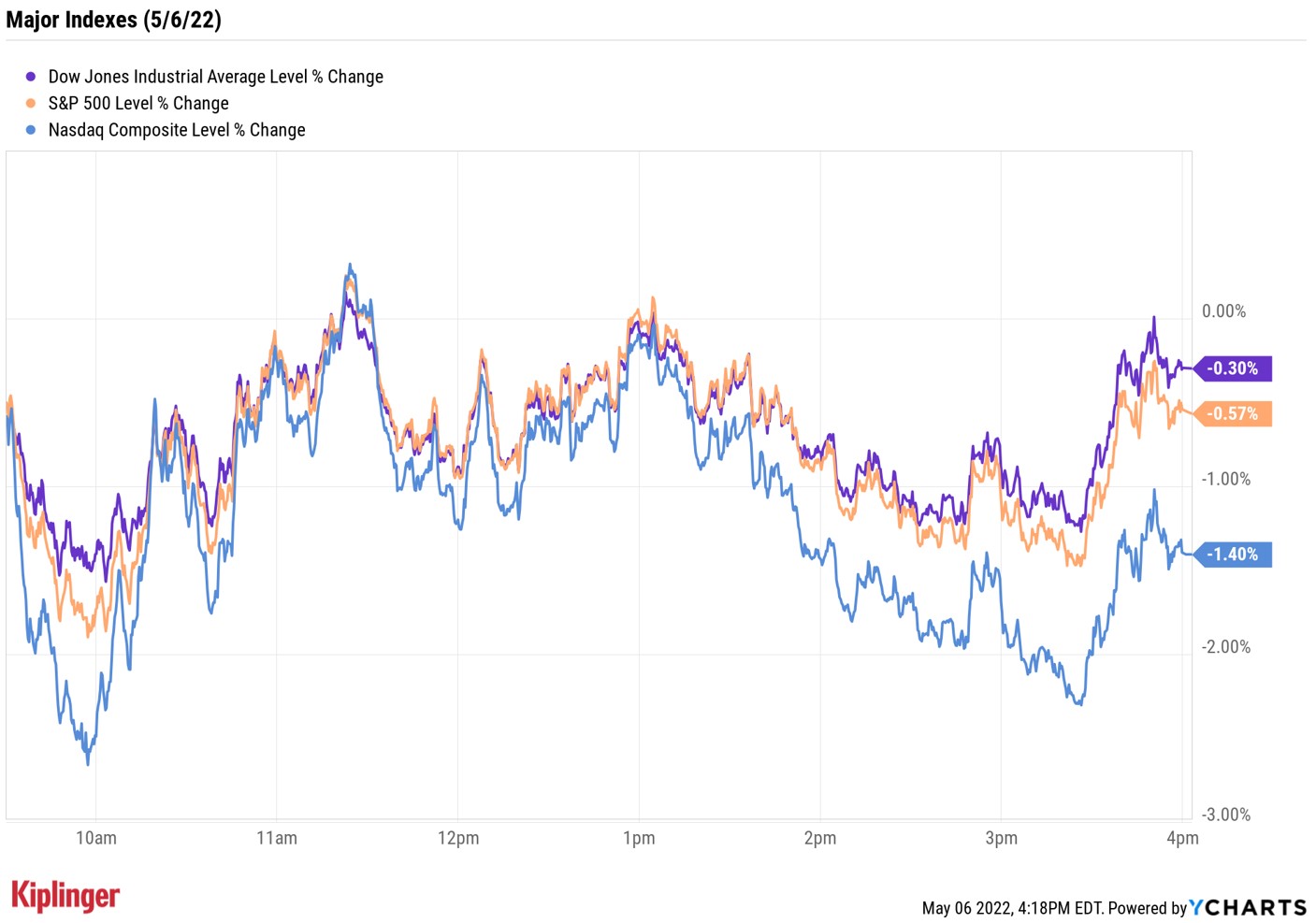

Stocks initially opened lower before finding their way higher by lunchtime. These intraday gains were short-lived, however, with all three markets sinking back into negative territory in the afternoon.

At the close, the Nasdaq Composite was down 1.4% at 12,144, the S&P 500 Index was 0.6% lower at 4,123 and the Dow Jones Industrial Average was off 0.3% at 32,899.

Other news in the stock market today:

- The small-cap Russell 2000 plunged 1.7% to 1,839.

- U.S. crude oil futures gained 1.4% to end at $109.88 per barrel.

- Gold futures rose 0.4% to settle at $1,882.80 an ounce.

- Bitcoin retreated 0.9% to $35,953.66. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- DraftKings (DKNG) plunged 8.9% after the online sports gambling company reported a first-quarter net loss of $467.7 million, wider than the $346.3 million net loss it incurred in the year-ago period. On an adjusted basis, though, DKNG's adjusted per-share loss of 74 cents was slimmer than the $1.09 per-share loss analysts were expecting. Revenue of $417 million came in above the $412 million consensus estimate. "DraftKings quarter was buoyed by strong numbers from March Madness and the Super Bowl, which set records for first-time bettors," says Jonathan Dube, executive in residence at investment bank Progress Partners. "DraftKings and its competitors are all looking at ways to grow their businesses and increase their margins, and one of the ways they are doing so is aggressively moving into the iGaming online casino space. DraftKings announced it completed its purchase of Golden Nugget Online Gaming, which will help it compete with established brands like Caesars and BetMGM in the iGaming space, a strategically complementary business which has higher margins than sports betting."

- In its first quarter, global cloud services provider Cloudflare (NET) posted revenue of $212.2 million, up 54% year-over-year, and adjusted earnings of 1 cent per share compared to a per-share loss of 3 cents in the year-ago period. Still, NET stock plunged 12.4% post-earnings, possibly due to the company reporting cash flow from operations of -$35.5 million for the three month period vs. +$23.5 million in Q1 2021. "The company is beating best of breed point solutions with its easier-to-use and cheaper bundled solutions, all on one developer platform—workers," says Oppenheimer analyst Timothy Horan (Perform). "It had a major role in protecting Ukraine's and other countries' digital infrastructure from Russian attacks." Horan also believes Cloudflare "should be able to deliver double-digit revenue growth rates over the next several years based on the strong demand for its offering and the rising economic importance of the internet across the globe."

Wall Street's Newest Dividend Payers

The Fed is unlikely to change course with its monetary-tightening plan any time soon. That seems to be the general consensus around Wall Street, especially on the heels of today's solid jobs report.

"We have been cautious all year given the unprecedented size of the Fed's balance sheet, which they need to unwind due to the inflationary pressures we have been experiencing and a concern that valuations were too high as interest rates were poised to move higher," says Chris Zaccarelli, chief investment officer for registered investment advisor Independent Advisor Alliance. Zacarelli believes the Fed will continue to "aggressively fight inflation," no matter how much damage might be inflicted upon the stock market in the near term.

With this in mind, he reminds investors that it's prudent to be invested in quality stocks of companies that have the ability to power through a recessionary environment. This includes companies "with a competitive advantage, pricing power and a strong balance sheet (e.g. relatively low debt compared to operating earnings)," Zaccarelli adds.

There are many ways investors can track down companies with high-quality fundamentals, including looking for those that are consistently increasing dividends or issuing special dividends – both signs of financial strength.

There's also money to be made with Wall Street's newest dividend stocks. Despite a U.S. economy plagued by labor shortages, supply-chain woes and higher prices, these companies are flexing their financial muscle by initiating dividends.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.