Stock Market Today: Stocks Stumble as Inflation Remains Red-Hot

U.S. inflation eased slightly on an annual basis in April, but it wasn't enough to keep stocks in positive territory.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a choppy day for stocks as investors unpacked the latest consumer price index (CPI). Data released by the Labor Department this morning showed that prices consumers paid for goods and services in April rose at an annual rate of 8.3% – down from March's 8.5% pace to mark the first drop in inflation in eight months. While encouraging at first glimpse, there were concerning signs deeper inside the report.

For instance, the decline in CPI last month reflected a drop in gas prices, which have since rebounded. Food prices remained elevated, while airfare and restaurant bills increased ahead of the key summer travel season. And core CPI, which excludes the volatile energy and food categories, rose 0.6% on a sequential basis – double what it was in March.

"While this report appears to mark the first that shows some moderation from the ever-rising pace of inflation since September of last year, one data point does not necessarily make a trend; and the rise in core CPI should lead to some consideration that the moderation in inflation will not be quick," says Jason Pride, chief investment officer of private wealth at wealth management firm Glenmede.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

With prices already high, Pride said, it should be harder for the CPI to continue to rise at the same pace, especially with the Federal Reserve also hiking interest rates to combat higher prices. "However, it will likely take multiple reports for such a trend [of moderating inflation] to clearly establish itself," he says.

This sentiment is echoed by Mike Loewengart, managing director of Investment Strategy at E*Trade. "Today's read is a stark reminder that the journey to pre-pandemic levels of inflation will be a long one," Loewengart says. "Although inflation slowed from March, the market's reaction suggests that record high prices continue to weigh heavy on investors psyches. And with inflation persistently hot, the Fed has more fodder for increased rate hikes, which the market doesn't often welcome with open arms."

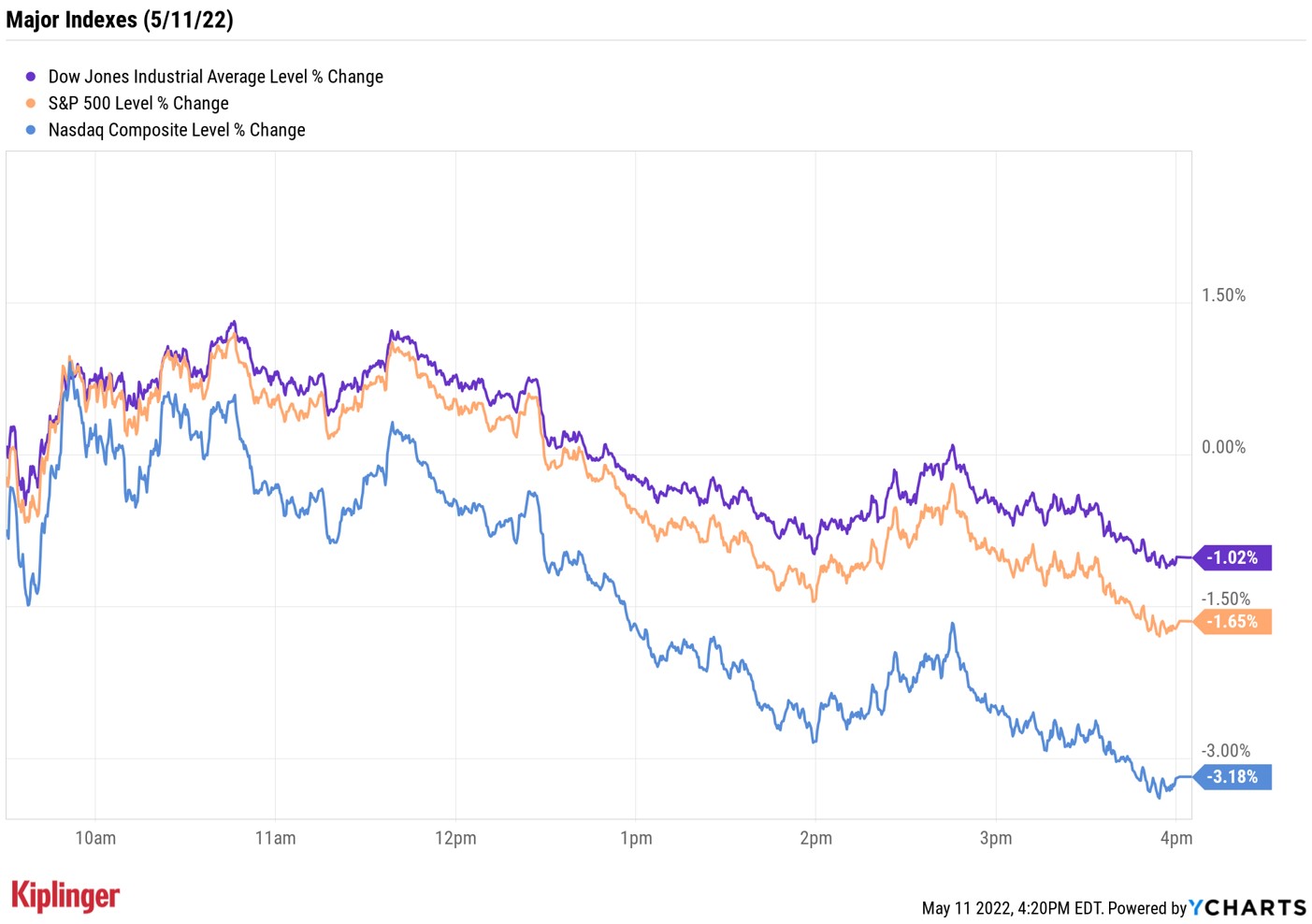

After bouncing between gains and losses in early trading, markets took a decisive turn lower this afternoon. At the close, the Nasdaq Composite was down 3.2% at 11,364, the S&P 500 Index was off 1.7% at 3,935 and the Dow Jones Industrial Average was 1.0% lower at 31,834.

Other news in the stock market today:

- The small-cap Russell 2000 retreated 2.5% to 1,718.

- U.S. crude futures surged 6% to end at $105.71 per barrel.

- Gold futures gained 0.7% to settle at $1,853.70 an ounce.

- Bitcoin slid below the $30,000 for the first time since July 2021, down 5.9% at $29,477.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Roblox (RBLX) was down as much as 10% in after-hours trading Tuesday after the video game developer reported a first-quarter loss of 27 cents per share, wider than the 21 cents per share Wall Street was expecting. The company's revenue of $631.2 million also fell short of the consensus estimate, as did bookings of 54.1 million. Still, the metaverse stock managed to finish today up 3.4% after Chief Financial Officer Michael Guthrie said on the company's earnings call that year-over-year growth may have bottomed in March, sooner than anticipated.

- Coinbase Global (COIN) shares plunged 26.4% on Wednesday after delivering a pretty disappointing quarterly report. Q1 revenues were off 27% year-over-year to $1.17 billion, widely missing analysts' expectations for $1.50 billion. Meanwhile, the company swung to a $430 million loss after earning $388 million in the year-ago period. Monthly users were down 19% YoY, too. Also raising eyebrows in the cryptocurrency community was an update to the Risk Factors section in its Form 10-Q, warning that users could potentially lose access to their assets in the event Coinbase ever had to go through bankruptcy proceedings.

Inflation Remains a Top Concern for Investors

Inflation remains top of mind for investors. This is according to the latest Charles Schwab Trader Sentiment Survey, which reviews the outlooks, expectations and trading patterns of 845 Charles Schwab and TDAmeritrade clients. Inflation was the main concern for those surveyed in the report (20% of respondents), followed by geopolitics (15%) and recession/domestic politics (12% apiece). And nearly half of participants (45%) do not believe inflation will begin to ease until 2023.

"Overall, in the second quarter, market sentiment among traders is unquestionably skewing bearish," says Barry Metzger, head of trading and education at Schwab. But market participants do see investing opportunities, the report notes.

Among the sectors survey respondents are most bullish on at the moment are energy (70%) and utilities (54%). The industries they are most upbeat toward include cybersecurity (71%) and agriculture (70%).

And 70% of those surveyed are interested in seeking out opportunities in defense stocks. While Russia's invasion of Ukraine has unsettled many parts of the stock market, it has also sparked an increase in global military spending, which could create a potential boon for the industry. Here, we've compiled a quick list of defense stocks that are poised to benefit from this spending build. The names featured include familiar names as well as some under-the-radar picks – and they all sport top ratings from Wall Street's pros.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.