Stock Market Today: Stocks Finish Lower as Traders Mull Recession Odds

Wall Street is mixed about whether the U.S. is headed toward recession in 2022. Worth watching this week: Retail earnings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The potential for the U.S. to slip into recession was the topic du jour Monday as stocks kicked off the week with a wobbly, uneven session.

Over the weekend, former Goldman Sachs chief Lloyd Blankfein told CBS' Face the Nation that recession was "a very, very high risk factor." That opinion was met by a number of other calls Monday morning.

Wells Fargo Investment Institute, for instance, says "our conviction is that the chances of an outright recession in 2022 remain low" but believes odds are growing that 2023 could see an economic contraction. UBS strategists say the chances are different depending on where you look – their global economists say "hard data" points to a sub-1% chance of recession over the next 12 months, but the yield curve implies 32% odds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"There's no crystal ball to predict what's next, but historical trends can come into play here. With the [S&P 500] closing 15% below its weekly record, there's only been two times in the past 60-plus years that the market didn't fall into bear territory after a similar drop," adds Chris Larkin, Managing Director of Trading at E*Trade. "This doesn't mean it's bound to happen, but there is room for potential downside."

Larkin says to keep an eye on major retail earnings this week – which will kick off in earnest with Walmart's Tuesday report – to get a pulse check on the American consumer.

Monday itself was a fairly quiet affair. Exxon Mobil (XOM, +2.4%) and Chevron (CVX, +3.1%) were among a number of plays from the energy sector (+2.7%) that popped after U.S. crude oil futures jumped another 3.4% to $114.20 per barrel.

Twitter (TWTR, -8.2%) shares dropped after Tesla (TSLA, -5.9%) CEO Elon Musk spent the weekend questioning how much of Twitter's traffic comes from bots. Wedbush analyst Daniel Ives said the move feels more like a "'dog ate the homework' excuse to bail on the Twitter deal or talk down a lower price." TWTR stock has now given up all its gains since Musk announced his stake in the social platform.

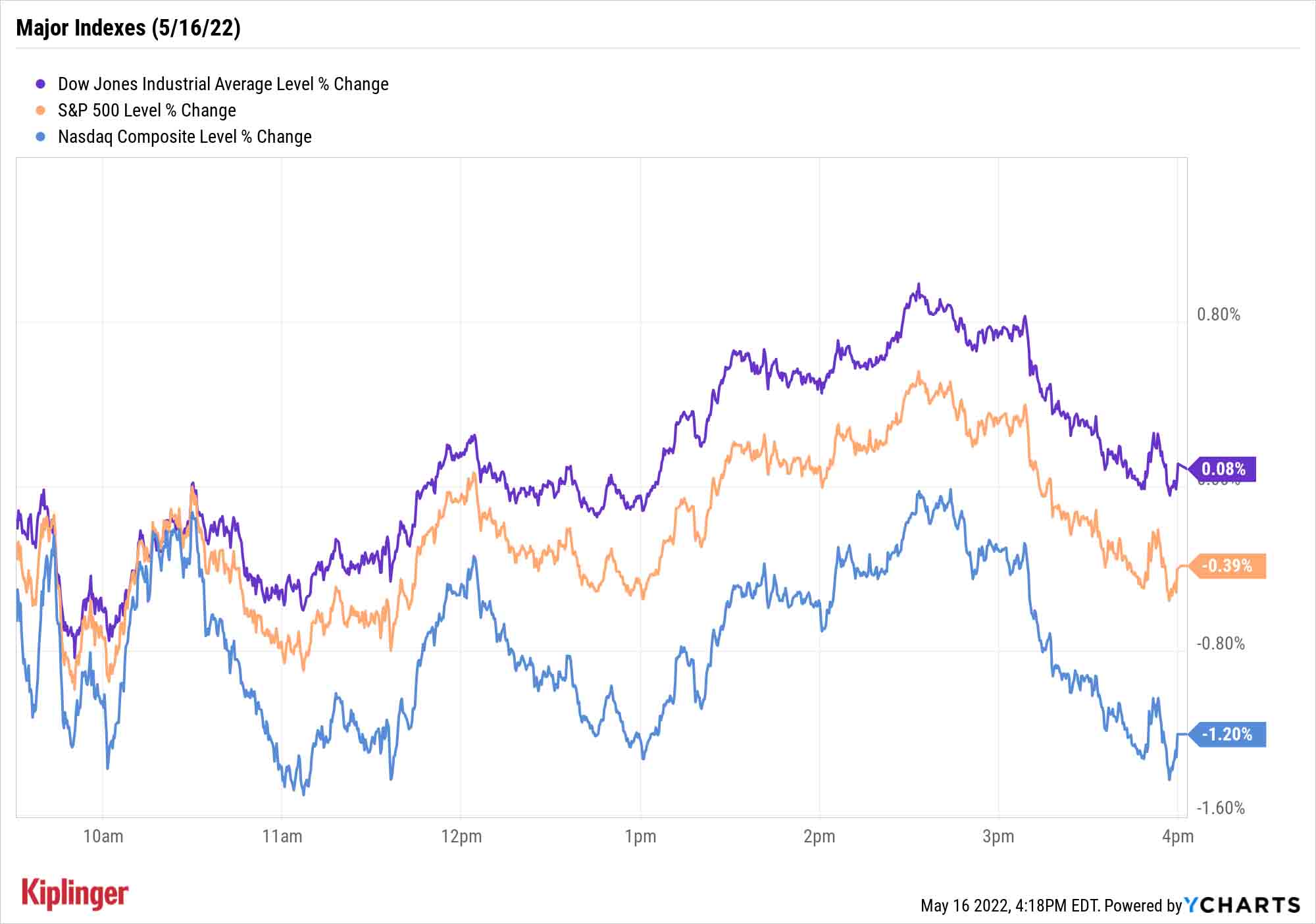

The major indexes finished an up-and-down session with mostly weak results. The Dow Jones Industrial Average managed to eke out a marginal gain to 32,223, but the S&P 500 declined 0.4% to 4,008, while the Nasdaq Composite retreated 1.2% to 11,662.

Also worth noting: Warren Buffett's Berkshire Hathaway will file its quarterly Form 13F soon. Check back here tonight as we examine what Buffett has been buying and selling.

Other news in the stock market today:

- The small-cap Russell 2000 closed out the session with a 0.5% dip to 1,783.

- Gold futures gained 0.3% to settle at $1,814 an ounce.

- Bitcoin was off 1.6% to $29,551.92 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- JetBlue Airways (JBLU, -6.1%) ramped up its hostile takeover attempt of Spirit Airlines (SAVE, +13.5%) on Monday, urging SAVE shareholders to vote against a buyout offer from fellow low-cost air carrier Frontier Group Holdings (ULCC, +5.9%). JBLU last month offered to buy Spirit Airlines for $33 per share – a premium to the $21.50 per share ULCC offered in February – but SAVE's board of directors rejected the bid citing concerns over regulatory approval. JBLU followed up in early May with an "enhanced superior proposal," including paying a $200 million, or $1.80 per SAVE share, reverse break-up fee should regulators block the deal.

- Warby Parker (WRBY) fell 5.3% after the eyeglass maker reported a loss of 30 cents per share in its first quarter. This was much wider than the per-share loss of 3 cents the company reported in the year-ago period and missed the consensus estimate for breakeven on a per-share basis. Revenue of $153.2 million also fell short of analysts' expectations. WRBY did maintain its full-year revenue guidance of $650 million to $660 million. "We remain cautiously optimistic on shares as WRBY continues to show ability to grow the top line, open new stores, and is recession resistant as a lower cost option for non-discretionary spend," says CFRA Research analyst Zachary Warring (Buy). "We see the company leveraging SG&A to become profitable in the second half of 2022."

Check Out Europe's Dividend Royalty

If you're seeking out more stable opportunities amid an uncertain U.S. market … well, the rest of the world is admittedly looking pretty shaky, too. But that doesn't mean there aren't a few morsels worth a nibble.

BCA Research notes that while there's negative news around the globe, "European benchmarks already discount a significant portion of the negative news." And looking ahead, inflation there is expected to peak over the summer "as the commodity impulse is decelerating" – that should help stagflation fears recede and help European shares.

Graham Secker, Morgan Stanley's chief European and U.K. equity strategist, chimes in that his firm remains "overweight [European] stocks offering a high and secure dividend yield."

We've previously highlighted our favorite European dividend stocks, which on the whole tend to produce higher yields than their U.S. counterparts.

But we'd also like to shine the spotlight on Europe's twist on an American income club: the Dividend Aristocrats. The S&P Europe 350 Dividend Aristocrats have somewhat different qualifications than their U.S. brethren, but in general, they've proven their ability to provide stable and growing dividends over time.

Read on as we look at the European Dividend Aristocrats.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.