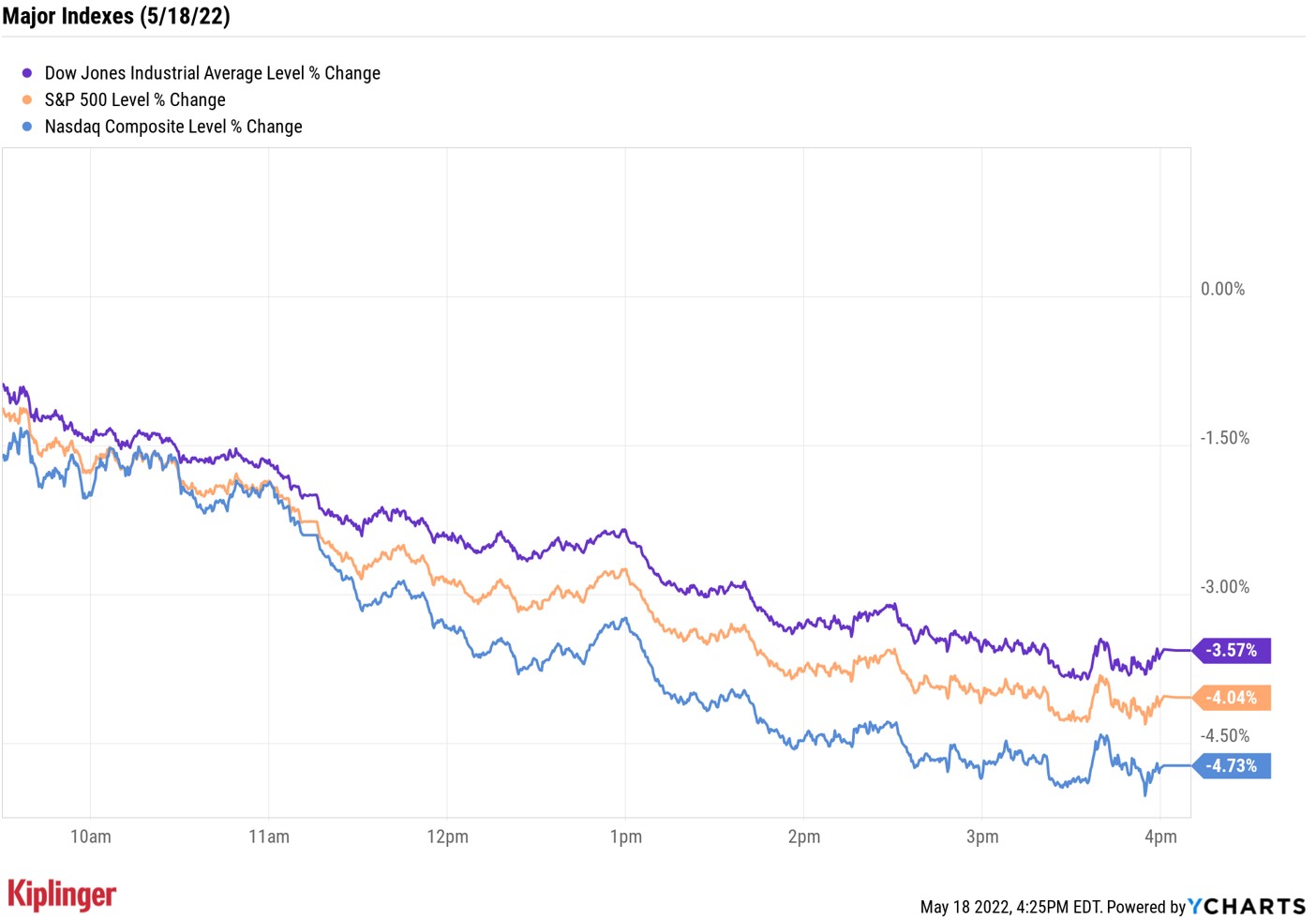

Stock Market Today: Dow Sinks 1,164 Points in Worst Day Since June 2020

The S&P 500 and Nasdaq each lost over 4% in a broad-market selloff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Retail earnings week took a big turn for the worse Wednesday.

A day after Walmart (WMT, -6.8%) sounded the alarm with a mixed quarterly report that suggested inflation was taking a toll on American consumers, Target (TGT, -24.9%) confirmed those concerns with an equally problematic set of results. That in turn sparked a deep blood-letting across most consumer stocks and sent the Dow to its worst single-day decline since June 2020.

As we detailed in today's free A Step Ahead newsletter, Target topped Wall Street's expectations for quarterly revenues, but it missed profit estimates by a country mile and issued a disappointing full-year operating profit. While consumer spending remained strong, it shifted from more discretionary purchases to staples such as groceries, plus spending on items such as luggage hinted that consumers are preparing to shift their dollars toward experiences rather than goods. Meanwhile, TGT projected it could need to absorb roughly $1 billion in other inflation-related costs, such as higher fuel and diesel prices.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The Charlie Brown shirt market continues, with big moves up and down seemingly every day," says Ryan Detrick, chief market strategist for LPL Financial. "Worries over inflation and a hawkish Fed are nothing new, but now add in worries over profit margins and the impact of inflation on the consumer, and you have the recipe for a big down day."

A big down day indeed.

Consumer-oriented sectors took Target's news the worst. Consumer discretionaries (-6.6%) led the market lower, but typically defensive consumer staples (-6.4%) weren't much better, with other stores such as Dollar General (DG, -11.1%) and Costco (COST, -12.5%) swooning in sympathy with TGT.

As far as the broader indexes were concerned? The Dow Jones Industrial Average plunged 3.6% to 31,490 – its worst single-session loss since a 6.9% decline on June 11, 2020. The S&P 500 Index was even worse, off 4% to 3,923 as all 11 of its sectors closed in the red. And the Nasdaq Composite suffered a 4.7% drop to 11,418.

Other news in the stock market today:

- The small-cap Russell 2000 shed 3.6% to 1,774.

- U.S. crude oil futures sank 2.5% to settle at $109.59 per barrel.

- Gold futures edged nearly 0.2% lower to finish at $1,815.90 an ounce.

- Bitcoin fell 2.7% to $29,237.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- TJX Companies (TJX) was a rare splash of green today, adding 7.1% after the TJ Maxx parent reported earnings. In its first quarter, TJX reported adjusted earnings of 68 cents per share, more than analysts were expecting. However, revenue of $11.4 billion fell short of Wall Street's estimate."TJX believes profitability will improve throughout 2023 which we also see as a reasonable assumption as inventory levels normalize across retailers and TJX returns to pre-pandemic margin levels," says CFRA Research analyst Zachary Warring (Strong Buy). "Marmaxxx, the company's largest division, boasted +3% gain in comp store sales while HomeGoods fell 7% in Q1. TJX continues to return capital to shareholders, repurchasing $600 million in shares in Q1 and $307 million in dividends."

The Best Stocks for a Bear Market

Today's selloff brought the dreaded "B" word back into focus. Although bear markets are very unpleasant for investors to watch unfold, they are a fact of life when it comes to market cycles.

"There have been 17 bear (or near-bear markets) since World War II," says Detrick. The average drop for the S&P 500 was nearly 30% and lasted nearly a full year, he adds. But history suggests those losses could accelerate should the U.S. economy enter a recession. Specifically, bear markets that coincided with recessions typically lasted 15 months and saw losses of 34% for the S&P 500.

The Nasdaq entered bear-market territory awhile back, but the S&P 500 has so far managed to avoid that fate. Bear markets are classified as a decline of 20% from the most recent high. Based on where the broad-market index finished Wednesday, it's off just 18.2% from its Jan. 3 peak.

Although it can be scary for investors to put their money into the market at a time like this, there are stocks that tend to fare better than others in this type of environment. The best stocks for bear markets tend to be those that have a defensive business, a long history of dividend growth and relatively low volatility. Here, we've gathered 10 stocks that fit those criteria and get consensus Buy recommendations from industry analysts to boot. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.