Stock Market Today: Stocks Snap Weekly Losing Streak

The latest inflation data helped lift investor sentiment on Friday, as did a round of well-received tech earnings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

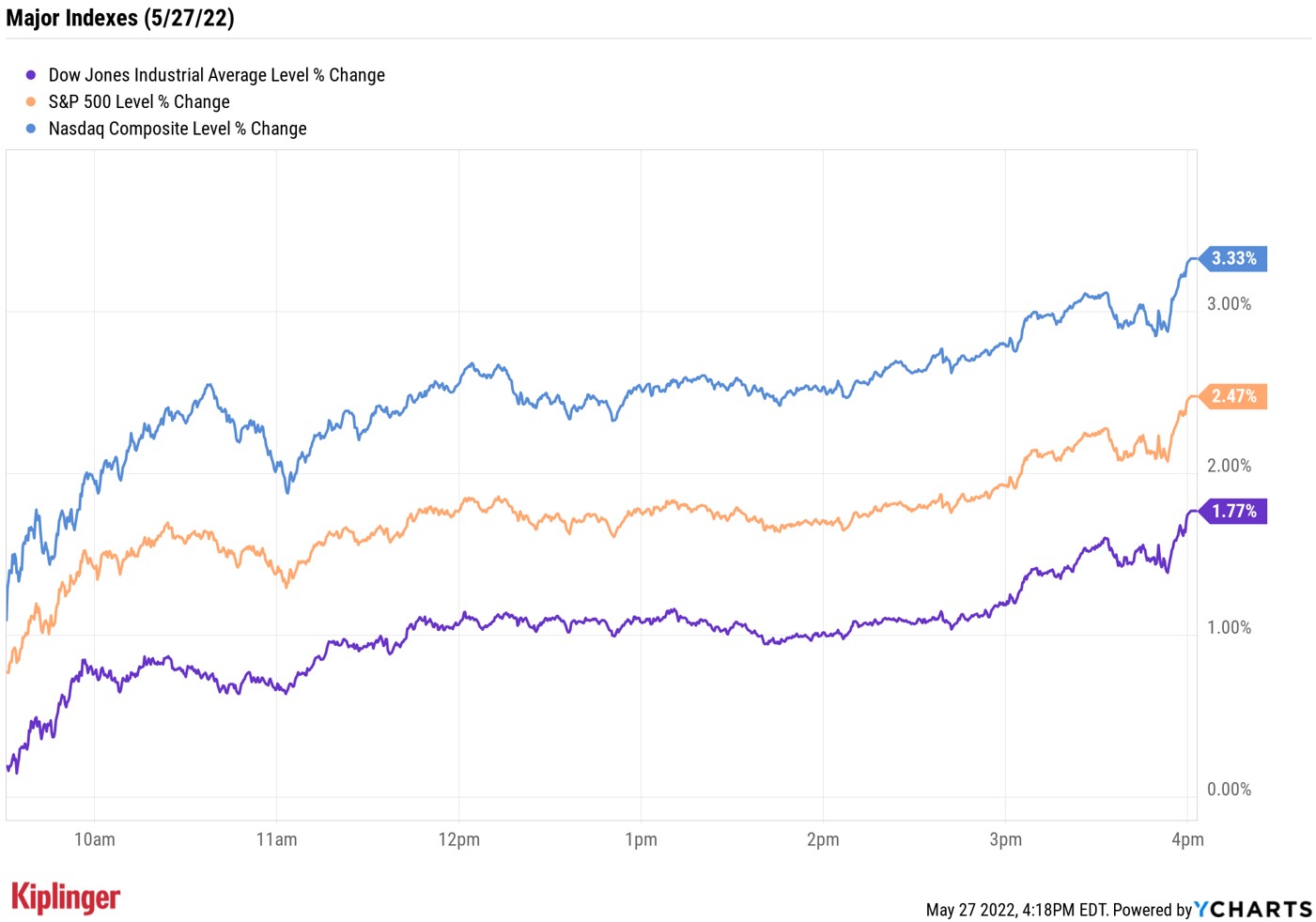

Stocks headed into the long weekend on a high note with all three major indexes posting gains for the week for the first time in a long time. As a a reminder, markets will be closed this Monday, May 30, for Memorial Day.

Boosting investor sentiment today was the latest inflation update, with this morning's report from the Commerce Department showing that the core personal consumption expenditures (PCE) price index – which excludes energy and food prices – rose 4.9% annually in April. While this pace is still elevated, it's down from the 5.2% year-over-year rise seen in March.

Separate data showed consumer spending was up 0.9% sequentially last month. However, the personal savings – or, savings as a percentage of disposable income – rate fell to 4.4% from March's 5.0%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The drop in the savings rate indicates "U.S. consumers are now starting to chip away at those much-ballyhooed excess savings [accumulated during the pandemic], to help pay for the spurt in food and energy costs," says Douglas Porter, chief economist at BMO Capital Markets.

But even with that money already spent, there's still an estimated $2.3 trillion, or more than 9% of gross domestic product, in savings, he adds. "True, they are not well distributed across income cohorts – hence the wildly differing experiences by varying retailers. But, even if just a third of these pandemic savings are spent, this will readily support overall outlays through 2023," Porter says.

A round of well-received earnings reports from several tech firms like software maker Autodesk (ADSK, +10.3%), IT solutions firm Dell Technologies (DELL, +12.9%) and integrated circuit specialist Marvell Technology (MRVL, +6.7%) also buoyed the broader markets.

At the close, the Dow Jones Industrial Average was up 1.8% at 33,213, the S&P 500 Index was 2.5% higher at 4,158 and the Nasdaq Composite had gained 3.3% to 12,131.

For the week, the Dow rose 6.2% to snap its eight-week losing streak, while the S&P 500 (+6.6%) and Nasdaq (+6.8%) held their consecutive weekly declines to seven.

Other news in the stock market today:

- The small-cap Russell 2000 rose 2.7% to 1,887.

- Gold futures edged up 0.2% to settle at $1,851.30 an ounce.

- Bitcoin did not participate in today's broad-market rally, sinking 2.0% to $28,779.96. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Ulta Beauty (ULTA) jumped 12.5% after the cosmetics retailer said revenue jumped 21% year-over-year in its first quarter to $2.3 billion, while earnings soared 53.4% to $6.10 per share, both figures more than analysts were expecting. "We believe [ULTA's earnings] clearly demonstrates that beauty spending is recovering strongly as households feel more comfortable in re-engaging in pre-pandemic routines," says UBS Global Research analyst Michael Lasser (Buy). "Plus, ULTA is executing nicely and gaining share in the process."

- Red Robin Gourmet Burgers (RRGB) surged 25.1% after the burger chain reported a slimmer-than-expected loss and higher-than-anticipated revenue for its first quarter. RRGB also said same-store sales were up an impressive 19.7% over the three-month period. "We see multiple tailwinds at off-premium and structural efficiencies from [Red Robin's] menu/labor model that give us confidence in continued momentum through 2022 and 2023," says Jefferies analyst Alexander Slagle (Buy). "We believe risk/ reward for RRGB at current valuation is among the most attractive at trough multiples relative to category peers, and see tangible drivers of same-store sales upside beyond the near term that have yet to be fully reflected at current levels."

Is it Too Late to Buy Energy Stocks?

Worried you've missed the runup in energy stocks? Several macro catalysts such as sizzling inflation, short-term supply and demand dynamics and the Ukraine war have boosted oil prices in 2022. U.S. crude futures tacked on 0.9% on Friday to settle at $115.07 per barrel, bringing their weekly gain to 4.3%. This helped fuel a more than 8% weekly gain for the energy sector, bringing its year-to-date return to 59.4%.

"With commodity prices up and inflation creating waves, is it too late for investors to capitalize on high commodity prices?" asks Lucas White, portfolio manager at asset management firm GMO.

No, the strategist says – for a number of reasons, including the fact that energy sector components are still considered value stocks. "Though commodities are up, resource companies trade at more than a 60% discount relative to the S&P 500, a level that has almost never been seen," White explains, adding that the recent spike in commodity prices has yet to flow through to companies' fundamentals – meaning investors can still expect strong returns going forward.

For those looking to capitalize on the red-hot sector, there are plenty of energy stocks to choose from, including high-yielding master limited partnerships (MLPs). But for those looking for more diversified exposure to high oil prices, may we suggest this list of energy exchange-traded funds (ETFs). The funds featured here sport a variety of strategies that should help investors leverage any additional gains in oil and natural gas.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.