Stock Market Today: May Delivers One Final Roller-Coaster Ride

The major indexes finished lower Tuesday amid a resurgence in bond yields and a higher-than-expected inflation reading.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

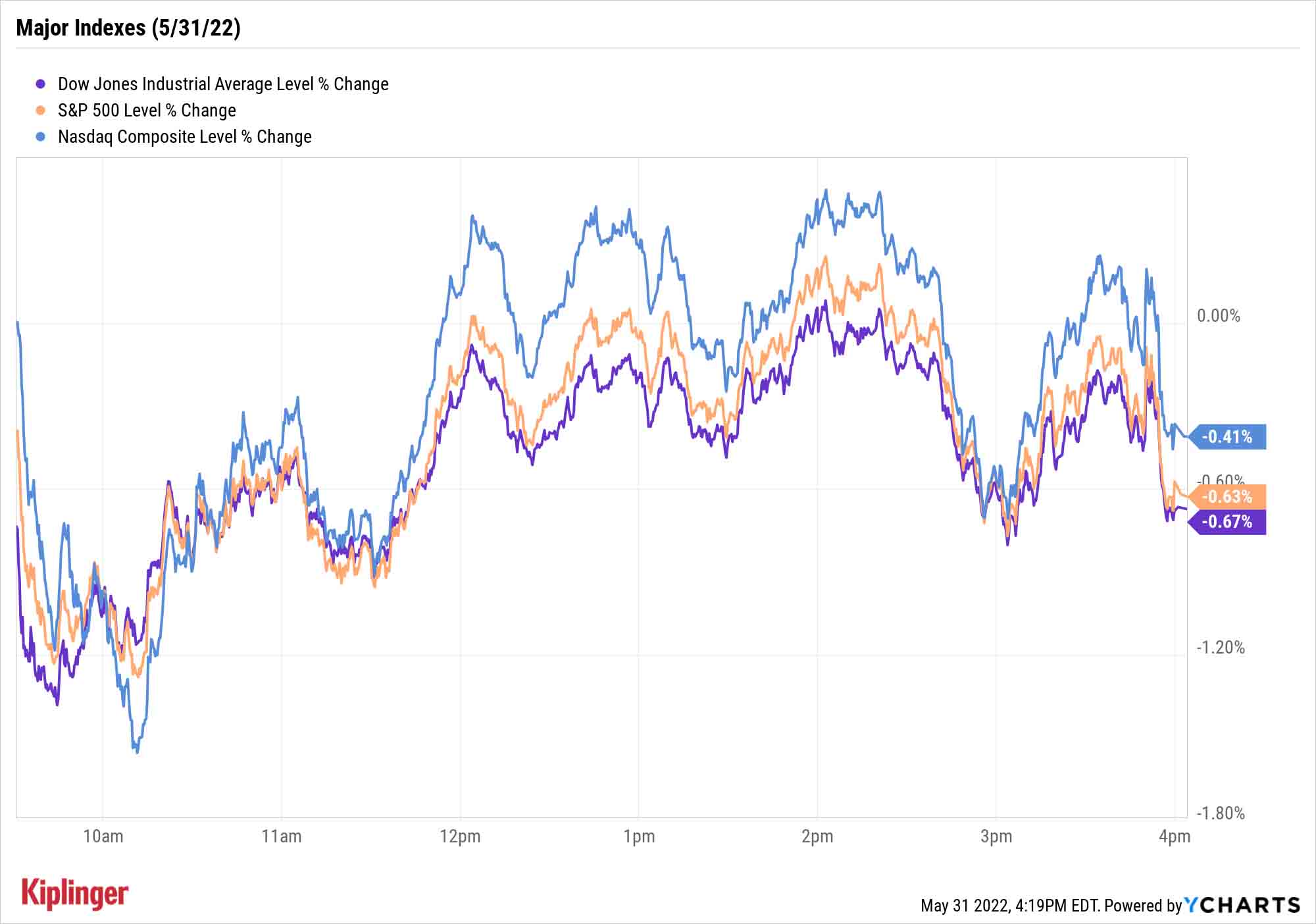

May's final session was a fitting one for a wild month, with the major indexes swinging up and down Tuesday before closing in the red.

Over the Memorial Day weekend, Federal Reserve Governor Christopher Waller said during a speech in Germany that he expects 50-basis-point interest-rate increases to continue into the later part of the year – a departure from previous dovish statements from Fed members suggesting hikes of that magnitude would be limited to the next two summer meetings.

That sent bond yields spiking Tuesday, with the 10-year Treasury yield reaching as high as 2.88%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"It is really too bad that the Fed can't learn to speak with one voice on this," says Dean Smith, portfolio manager and chief strategist of investment technology platform FolioBeyond. "The constant seesaw from hawkish to dovish is increasing uncertainty in the market and in the economy. The 'buy-the-dip' mentality that has been nurtured in a generation of investors is being supported and encouraged by these carelessly dovish Fed speakers. In the end, all it does is make their job harder."

Also Tuesday, the Federal Reserve's preferred gauge of inflation – the core personal consumption expenditures (PCE) price index – rose by 4.9% year-over-year and 0.34% month-over-month, which was more than expected.

"The April increase represents the third month of more muted, but still solid, increases," UBS analysts note.

The consumer discretionary (+0.5%) and communication services (-0.1%) sectors were the best performers in a largely down day. That was largely thanks to Amazon.com (AMZN, +4.4%), whose shareholders on Friday approved a 20-for-1 AMZN stock split set to take effect June 6; that lifted spirits at Alphabet (GOOGL, +1.3%), which intends on executing its own 20-for-1 GOOGL/GOOG stock split in July. (Indeed, 2022 is shaping up to be quite a busy year for stock splits.)

That helped the Nasdaq Composite deliver the smallest loss among the major indexes Tuesday: a 0.4% decline to 12,081. However, the tech-heavy index posted a 2.1% decline for the entire month. The S&P 500 (-0.6% to 4,132) finished May marginally higher, however, as did the Dow Jones Industrial Average (-0.7% to 32,990).

Other news in the stock market today:

- The small-cap Russell 2000 slid 1.3% to 1,864.

- Gold futures declined 0.5% to $1,848.40 ounce, clinching the yellow metal's second consecutive monthly decline.

- U.S. crude oil futures were down 0.4% to $114.67 per barrel, good for a nearly 10% gain in the commodity across May. Oil had a back-and-forth session; gains from the European Union's agreement to ban most Russian crude oil imports were negated after a report that OPEC+ was considering suspending Russia from its oil-output deal.

- Bitcoin rebounded hard during the long weekend, improving by roughly 10% to $31,649 from its Friday afternoon prices. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

As Red Flags Mount, Stock Up on Quality

A few cracks are starting to show in the American economic engine. Wealth management firm Glenmede's Jason Pride and Michael Reynolds say that several U.S. leading indicators are signaling slowing growth.

"Last week, the Flash Composite PMI, which tracks the manufacturing and services sectors, fell," they say. "The latest round of retail earnings reflects slowing demand as consumers grapple with higher costs and pivot their spending from goods to services. The housing market is starting to show signs of softening as sales of newly built homes fell 16.6% in April from March (rising mortgage rates are reducing buyer demand)."

This has Glenmede's recession model projecting a 10% probability of recession within the next 12 months, up from 0% projections to start the year.

That's the kind of environment that, unlike the year-plus of rip-roaring gains out of the COVID bottom, necessitates selectivity – every stock pick isn't just going to stick to the wall, so to speak. Defensively minded investors, for instance, will want to focus on stocks that seem best positioned to perform in bear markets. Dip-buyers will need to make a distinction between "cheap" and "undervalued" – the latter you're likely to find in these high-growth-potential stocks boasting low prices.

And on the whole, it pays to invest in the best of the best. These 10 S&P 500 stocks, for instance, represent the best the index has to offer right now, in the eyes of Wall Street's analyst community. Each of them is teeming with bullish pros who believe they have anywhere between 20% to 110% upside over the next year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.