Stock Market Today: May's Surprising Jobs Data Slams Brakes on Stocks

Investors didn't celebrate last month's strong gain in nonfarm payrolls; instead, they took it as a sign to fear the Fed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a "good news is bad news" trading session Friday. Rather than cheer a better-than-expected May jobs report, investors pondered how the encouraging numbers would affect the Federal Reserve's path forward.

The Labor Department reported that May nonfarm payrolls grew by 390,000, which was much better than the 318,000 expected. It wasn't a perfect report – unemployment of 3.6% was above estimates of 3.5%, while average hourly earnings growth of 0.3% was below expectations for 0.4% – but it still fanned fears that America's central bank would need to keep up its hawkish bent for longer, meaning that stiff 50-basis-point interest-rate hikes could continue past the Fed's summer meetings.

"The May employment report perfectly describes the current state of the economy. It is likely still expanding and jobs are still plentiful, but companies are facing elevated compensation costs as consumers grapple with inflation amid a tight labor market," says Shawn Snyder, Head of Investment Strategy at Citi U.S. Wealth Management. "However, the strength of the report is a double-edged sword for investors because a resilient economy will likely make the Fed confident that it can tighten monetary policy further."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, Rick Rieder, BlackRock's chief investment officer of global fixed income, sees a potential shift in May's report.

"The persistent headlines of major companies freezing hiring, or reducing staff are clearly indicative of a major change in forward business growth expectations," he says. "This is a watershed moment for the trajectory of payrolls and now directly places the spotlight on how deep this turn will be."

Speaking of reducing staff, Tesla (TSLA, -9.2%) shares bombed after CEO Elon Musk said in an email Friday that he planned to cut 10% of the electric vehicle (EV) maker's roughly 100,000 jobs, citing a "super bad feeling" about the American economy. President Joe Biden, asked about Musk's take, countered by listing other automakers who were ramping up investments. "Well, let me tell you, while Elon Musk is talking about that, Ford (F, -2.8%) is increasing their investment overwhelmingly," he said, adding that Stellantis (STLA, -3.6%, formerly Chrysler) was also pouring more money into EVs.

Also dragging the market lower was Amazon.com (AMZN, -2.5%), which snapped a six-day, 20%-plus win streak – its best such run since early 2015.

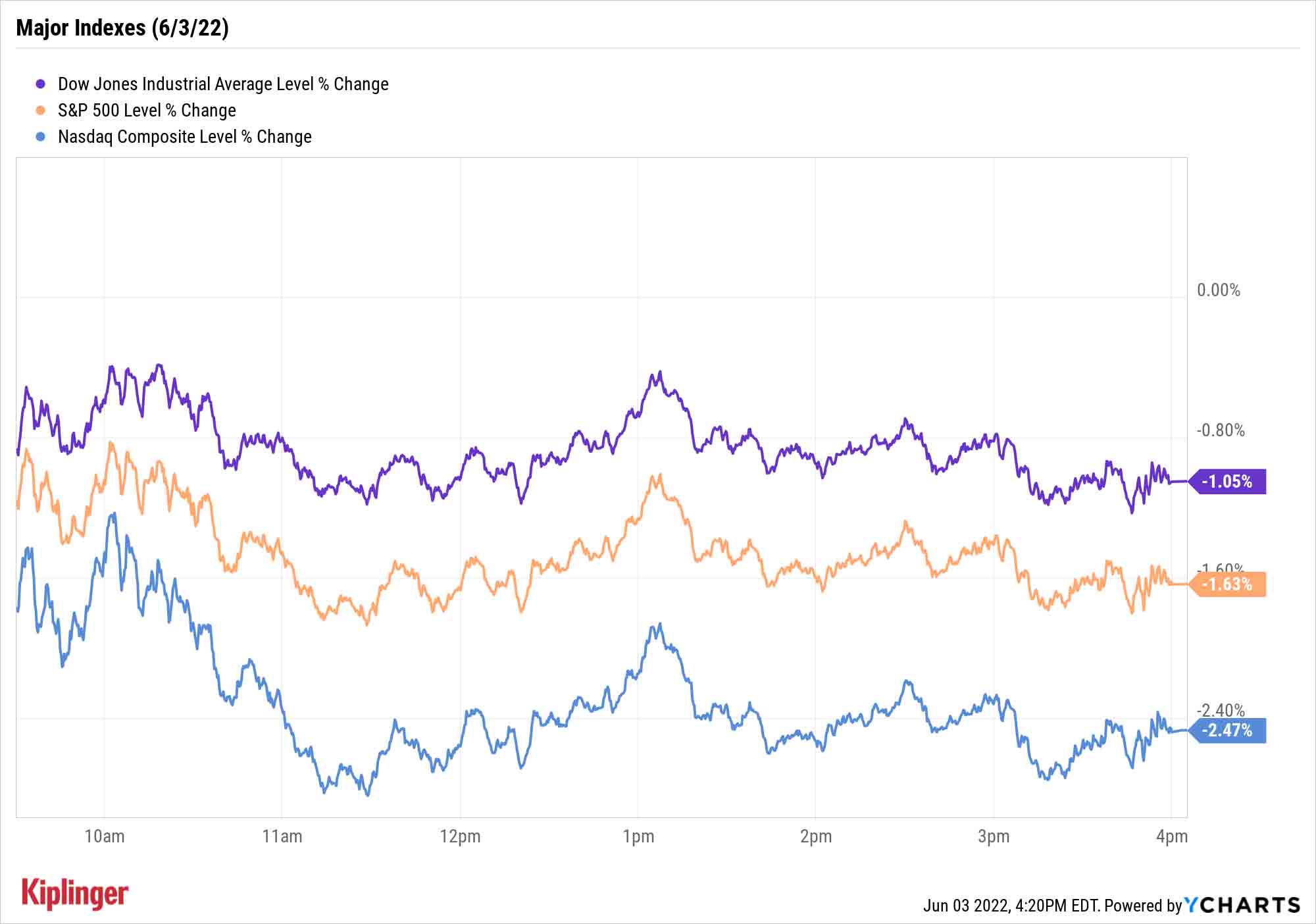

The broader indexes spent Friday retching up much of yesterday's gains. The Nasdaq Composite retreated 2.5% to 12,012, the S&P 500 finished down 1.6% to 4,108 and the Dow Jones Industrial Average dropped by 1.1% to 32,899.

Other news in the stock market today:

- The small-cap Russell 2000 was off by 0.8% to 1,883.

- U.S. crude futures jumped 1.7% to settle at $118.87 per barrel.

- Gold futures fell 1.1% to finish at $1,850.20 an ounce.

- Bitcoin joined in Friday's downturn, declining 2.4% to $29,539.64. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- American Airlines (AAL) slumped 7.1% after the company updated guidance for several second-quarter metrics. While AAL said it expects revenue to be 11% to 13% higher than where it was in Q2 2019 – up from previous guidance of a 6% to 8% increase – it believes available seat miles in the second quarter, a measure of passenger carrying capacity, will be down 7% to 8% on a two-year basis, wider than its prior outlook for a decline of 6% to 8%. The air carrier also raised its average fuel cost estimate to a per-gallon range of $3.92 to $3.97 from $3.59 to $3.64. AAL dragged several other airline stocks lower today too, with Delta Air Lines (DAL, -3.6%), Spirit Airlines (SAVE, -1.8%) and United Airlines (UAL, -2.9%) among those losing ground.

- CrowdStrike Holdings (CRWD) reported first-quarter adjusted earnings of 31 cents per share on revenue of $487.8 million, beating analysts' estimates for earnings of 23 cents per share and sales of $465.1 million. The cybersecurity firm also posted annual recurring revenue of $1.9 billion and free cash flow of $158 million – up 61% and 34% year-over-year, respectively. "Like its larger cybersecurity peers, CRWD argues that industry fundamentals are as strong as they've ever been," says UBS Global Research analyst Roger Boyd (Buy). "In addition, we see a market leading position, high degree of revenue visibility, strong balance sheet and cash flow generation as attributes that can help CRWD succeed in the current macro environment." Nonetheless, shares slid 6.9% today.

Weather Worries by Setting It and Forgetting It

The worry about 2022's slump is that you can't chalk it up to any one or two things – these losses truly are a team effort.

"Rising inflation, supply chain woes, labor market troubles, dwindling consumer spending, and the general downcast sentiment in the economy are having a combined negative impact," says Kunal Sawhney, CEO of Australian research firm Kalkine Group. Though he adds that unease over runaway inflation is "almost contagious" and that investors "are also increasingly concerned that Fed's monetary tightening could trigger a recession."

As we've mentioned over the past couple of months, one of your best lines of defense is to position your portfolio to combat inflation. Stocks with exceptional pricing power, as well as investments that are either insulated or benefit from inflation, might be able to help investors ward off at least some continued stock-market losses.

But another tack to take is to evaluate the market's best long-term, dividend-paying investments, buy them on the dip, slap on an eye mask and noise-canceling headphones, and let compounding do its thing until you retire – or, if you're already in retirement, let the dividend checks help finance your post-career life.

OK, we jest: You shouldn't check out completely, but the point still stands that steady high-yield stocks like these 20 names can provide significant peace of mind when the market hits scary patches of turbulence.

Kyle Woodley was long AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.