Stock Market Today: Stocks Nudge Higher as Treasury Yields Spike

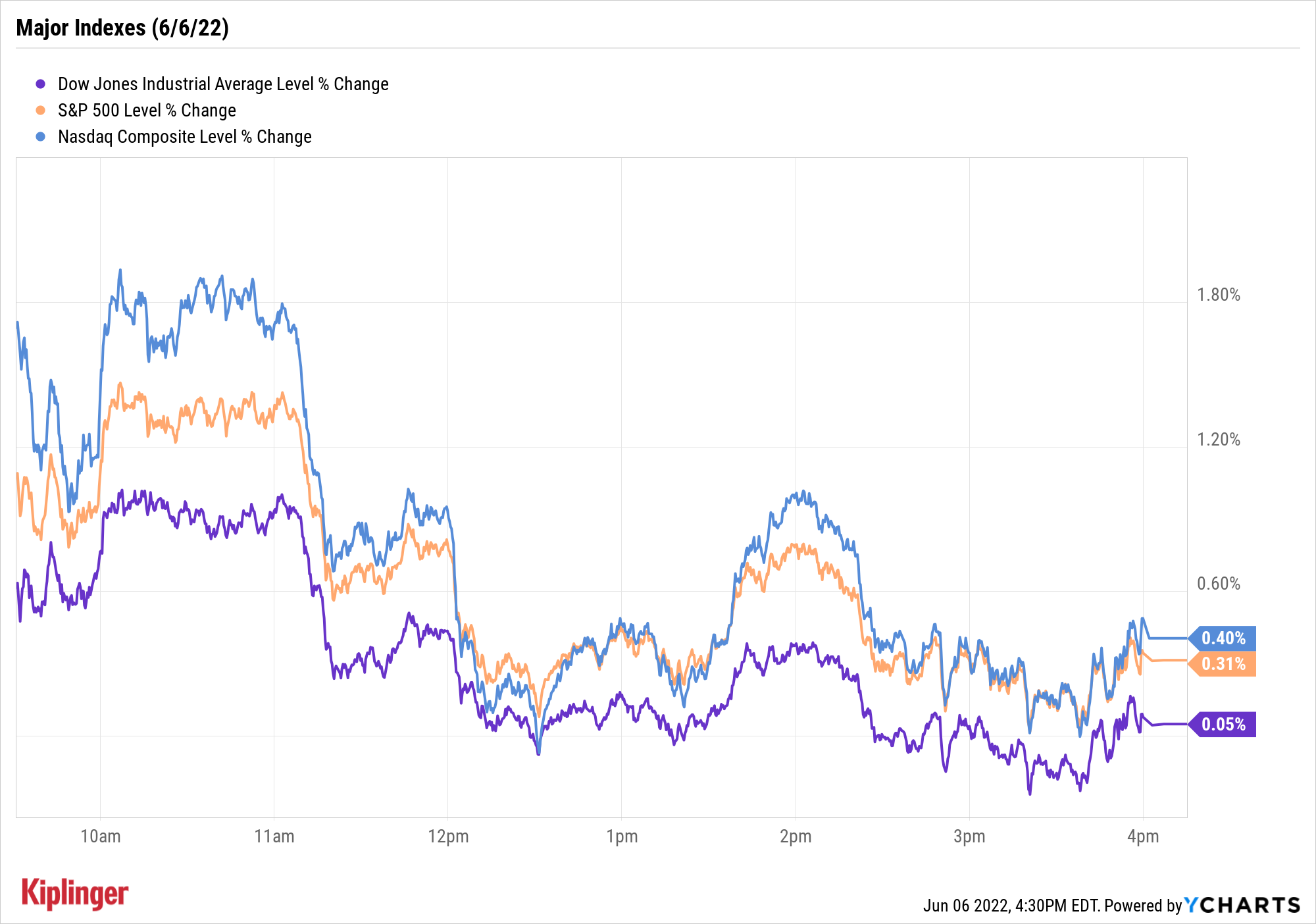

Stocks pared this morning's lofty gains as interest rates rose, but still managed to hold on for a win.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks opened the week's trading solidly higher amid reports that China is easing some of its COVID-related restrictions following a roughly two-month lockdown across several heavily populated areas of the country.

Additionally, a report in The Wall Street Journal indicated Chinese officials are nearing an end to their probes into several U.S.-listed firms – including ride-hailing company Didi Global (DIDI, +24.3%) – adding to signs Beijing may be taking steps to boost economic growth.

"While there may be little excitement in the U.S. market, China's recent attempts to reassure support to domestic firms may have a positive impact on global bourses this week," says Kunal Sawhney, CEO of Australian research firm Kalkine Group. "Major technology stocks worldwide were trading higher on Monday after Beijing said it is concluding its DiDi Global probe. After the statement, ADRs of Alibaba Group (BABA, +6.2%), DiDi Global, Baidu (BIDU, +2.5%) and JD.com (JD, +6.5%) saw significant gains."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the major benchmarks began easing back from their earlier gains by midday amid a spiking 10-year Treasury yield – which jumped 8.9 basis points (a basis point is one-one hundredth of a percentage point) to 3.044%, its highest level since December 2018.

Strength in the communication services (+0.04%) and consumer discretionary (+1.0%) sectors helped markets regain their footing in early afternoon trading, thanks in large part to a solid day for Amazon.com (AMZN). The e-commerce giant added 2.0% on the first day of trading following its 20-for-1 stock split.

At the close, the Nasdaq Composite (+0.4% at 12,061) and S&P 500 Index (+0.3% at 4,121) were modestly higher. Meanwhile, the Dow Jones Industrial Average – which was up 1% at its session peak – eked out a 0.05% gain to end at 32,915.

Monday's lurches could be a sign of what's to come for this week, says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. All eyes will be on this Friday's important consumer price index (CPI), slated for release at 8:30 a.m. ET. Until then, Wantrobski says, "expect volatile, choppy trading in both directions."

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.4% to 1,889.

- U.S. crude futures slipped 0.3% to end at $118.50 per barrel.

- Gold futures gave back 0.3% to finish at $1,843.70 an ounce.

- Bitcoin jumped 6.4% to $31,432.36. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- A lawyer for Tesla (TSLA, +1.6%) CEO Elon Musk sent a letter to Twitter (TWTR, -1.5%) accusing the social media platform of refusing Musk's data requests. The letter said Musk, who is a prospective buyer of Twitter, believes the company "is actively resisting and thwarting his information rights (and the company's corresponding obligations) under the merger agreement" to provide him with data regarding its active user base. "This stems back to last month when Musk said he was placing the deal on hold to seek greater clarification on the status of bots and fake accounts," says CFRA Research analyst Angelo Zino (Hold). "We continue to believe that Elon is playing hard ball, which makes complete sense (pending offer at $54.20 per share), to gain leverage/options to either reduce his offer price or indeed completely walk away if he gets cold feet (Musk did rush in and failed to do due diligence). Ultimately, we are finding it increasingly difficult to envision a scenario where this doesn't get settled in the courts."

- Several solar stocks rallied today after the Biden administration said it would suspend tariffs on solar panel products from four countries – Cambodia, Malaysia, Thailand and Vietnam – for 24 months. Enphase Energy (ENPH, +5.4%), SolarEdge Technologies (SEDG, +2.9%) and Sunrun (RUN, +5.9%) were among those that gained ground.

What Stocks are the Billionaires Buying?

Recession risks are on the rise, but there is still time for investors to prepare. So say a team of strategists at Wells Fargo Investment Institute (WFII) in their latest investment strategy report.

"Recessions are a normal part of an economic cycle," writes Michelle Wan, investment strategy analyst at WFII. "Even though it is difficult to predict the timing and magnitude of one, there are signals cautioning investors so they can prepare portfolios ahead of a recession."

Wan points to the Conference Board's leading economic indicators index, which measures the health of the U.S. economy via the labor market, credit market, stock market and new orders in manufacturing. The index is currently declining at a rapid pace, the strategist notes, signaling an "increased probability of a recession."

Investors looking to prepare their portfolios for such a scenario may want to consider gaining exposure to commodities or other defensive sectors, such as healthcare, consumer staples and utilities, Wan adds.

Another tactical approach for investors is to see what the smart money is doing. Institutional investors, hedge funds and billionaires have access to research and insights that most retail investors do not, which makes their top stock picks all the more enlightening to follow – particularly at a time of economic uncertainty. Read on as we take a closer look at 15 companies the billionaire class bought in the first quarter of 2022. While some of the names featured here are familiar blue chips, others maintain a much lower profile.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.