Stock Market Today: Growth Concerns Get Bears Back on Board

Energy was the only sector in the black Wednesday as the broader stock market continued its up-and-down ways.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Wall Street roller coaster remains oiled up and operational as summer hits its stride, with stocks dipping down Wednesday amid a few worrisome signals.

U.S. crude oil futures gushed 2.3% higher, to $122.11 per barrel, after the Energy Information Administration said U.S. crude inventories dropped by 2 million barrels, and gasoline stocks dropped by 800,000 barrels, during the week ended June 3. That helped the energy sector finish ahead of its 10 other counterparts Wednesday, albeit with a mere 0.2% advance.

The market's overall weakness Wednesday could be chalked up to any number of things. Goldman Sachs says it believes Q4's year-over-year growth will slow to 1.3% this year, "driven in large part by a substantial fiscal drag and a negative impulse from tighter financial conditions."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Signs of slowing also are cropping up in what has hitherto been a screaming housing market, with the Mortgage Bankers Association reporting that mortgage application volume dropped 6.5% week-over-week to multidecade lows.

"Weakness in both purchase and refinance applications pushed the market index down to its lowest level in 22 years," says Joel Kan, MBA's associate vice president of economic and industry forecasting.

And it's possible investors' attention is on the upcoming consumer price index (CPI) report, due out Friday morning, which could provide guidance on the Federal Reserve's direction.

"What's perplexing for investors may be the lack of clarity over the upper end of rate expectations so that they could factor in a price," says Kunal Sawhney, CEO of Australian research firm Kalkine Group. "It is presently unclear when the Fed would pause the rate hikes; unless, of course, we see definite evidence on the ground that inflation is easing. In this context, the CPI data for May … would be critical."

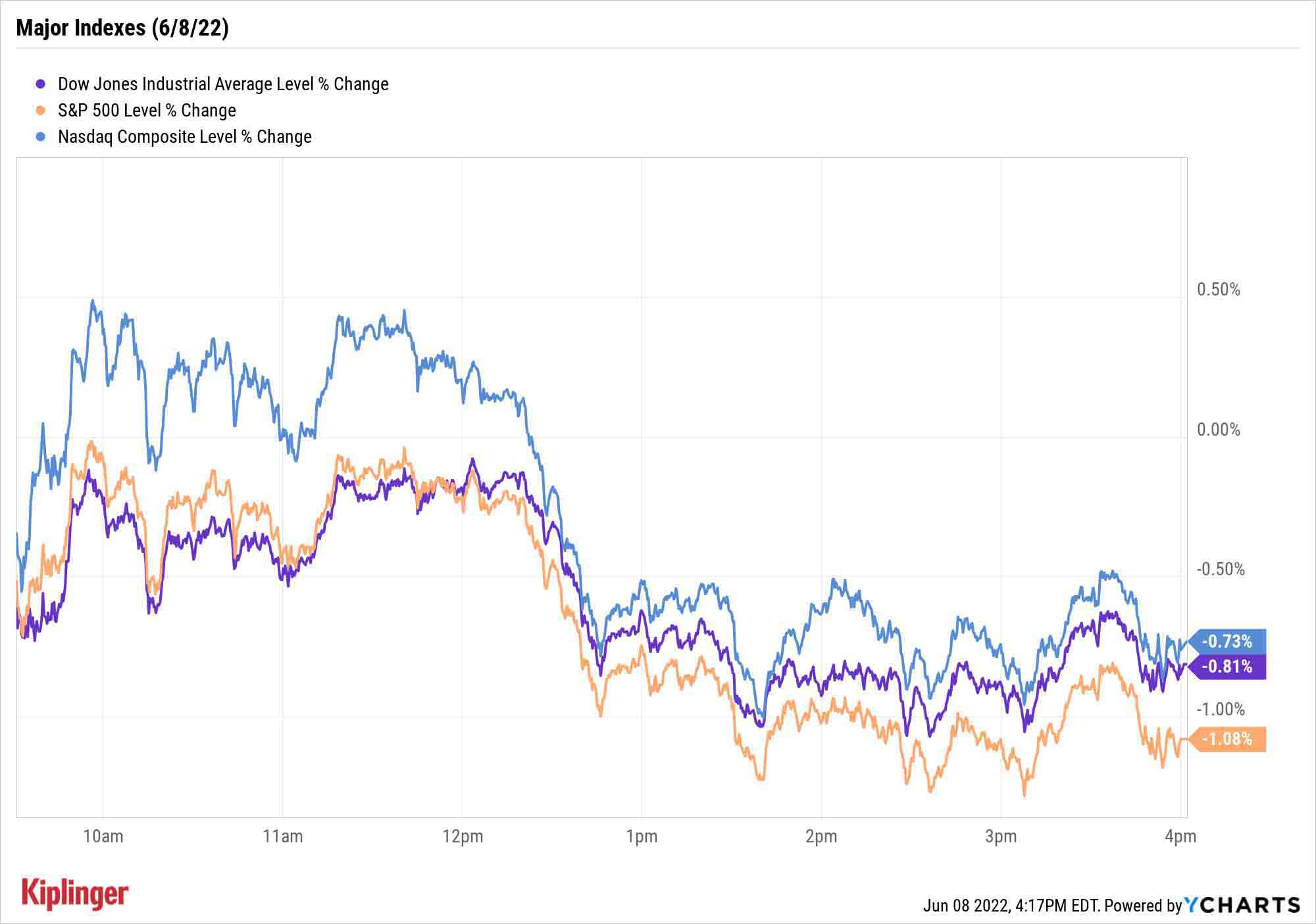

The real estate (-2.4%) and materials (-2.1%) sectors led the market lower Wednesday. The S&P 500 was the worst of the major indexes, down 1.1% to 4,115, followed by the Dow Jones Industrial Average (-0.8% to 32,910) and the Nasdaq Composite (-0.7% to 12,086).

Other news in the stock market today:

- The small-cap Russell 2000 retreated 1.5% to 1,891.

- Gold futures edged up 0.2% to settle at $1,856.50 an ounce.

- Bitcoin also took a step back, slipping 2.9% to $30,078.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Altria (MO) fell 8.4% after Morgan Stanley analyst Pamela Kaufman downgraded the consumer staples stock to Underweight from Equal Weight, the equivalents of Sell and Hold, respectively. The analyst says there are increasing headwinds facing the tobacco industry, namely the sharp rise in gas prices, slowing wage growth and consumer confidence hovering near a three-year low. MO also faces rising competition from Philip Morris's (PM, -2.6%) acquisition of Swiss tobacco maker Swedish Match.

- Wedbush analyst David Chiaverini initiated coverage on Affirm Holdings (AFRM, -4.2%) with an Underperform (Sell) rating and $15 price target, nearly 36% below the buy now, pay later (BNPL) stock's Wednesday's close at $23.33. There are several things to like about AFRM, the analyst says, including its value proposition to both consumers and investors, as well as its solid execution to drive growth and build merchant relationships. However, "we're concerned about Affirm's path to GAAP profitability, increasing competition in the BNPL space, industry forecasts calling for slowing e-commerce sales (which drive Affirm's gross merchandise volume, or GMV), and its ability to cover its cost of capital as funding costs increase," Chiaverini adds.

Thinking Income? Maybe Think Tech.

Do you invest with an eye toward income? If so, think about the makeup of your equity portfolio for a minute. What's carrying the load: real estate investment trusts (REITs), consumer staples, maybe utilities?

It's likely that few investors are thinking "technology stocks" right now, and that's understandable. Todd Rosenbluth, head of research for VettaFi, notes that the average yield on tech stocks in the S&P 500 Index was less than 0.8% in 2021, lagging far behind much richer yields available from the aforementioned sectors.

The flip side? They punch above their weight in dividend growth. Most of the tech dividend payers in the index are relatively new to delivering cash to shareholders – and newer payers often make bigger or more frequent hikes early on. Indeed, virtually all of the S&P 500's tech dividend stocks either raised their payouts or initiated dividend programs in 2021.

There are, however, a few standout dividend payers in the technology space that offer excellent yields at current prices. We examine seven of these tech stocks, which also boast growing earnings and ample free cash flows that will help them afford bigger dividends over time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.