Stock Market Today: Dow Sinks 880 Points After Inflation Shocker

The University of Michigan's latest consumer sentiment index didn't help the bull case today, either.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Speculation that inflation might have peaked earlier this year died abruptly with this morning's release of the Labor Department's latest consumer price index (CPI). And what the data showed was that prices were still rising last month.

Specifically, the CPI surged 8.6% year-over-year in May, the fastest pace since December 1981. The sharp rise in consumer inflation was broad-based, but annual increases were particularly stunning in both gas prices (+50.3%) and groceries (+11.9%). On a month-over-month basis, the consumer price index was up 1%, compared to April's 0.3% rise in prices. Both figures were higher than what economists were expecting.

Also released this morning was the University of Michigan's preliminary consumer sentiment index for June, which arrived at 50.2 – down 14.2% from May, the lowest value this decades-old indicator has reported. According to the report, 46% of survey respondents pointed to inflation for their negative outlook toward the economy, up 38% from last month.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The crash in sentiment means that consumers are more and more worried about future economic conditions," says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial. "We need to listen to what consumers say but more importantly, we need to watch what consumers do. We do expect a slowdown in consumer spending as inflation and uncertainties weigh heavily on sentiment."

The reports were met with sharp selling on Wall Street. All 11 sectors finished in the red, with consumer discretionary (-4.0%) and technology (-3.8%) suffering the biggest drops.

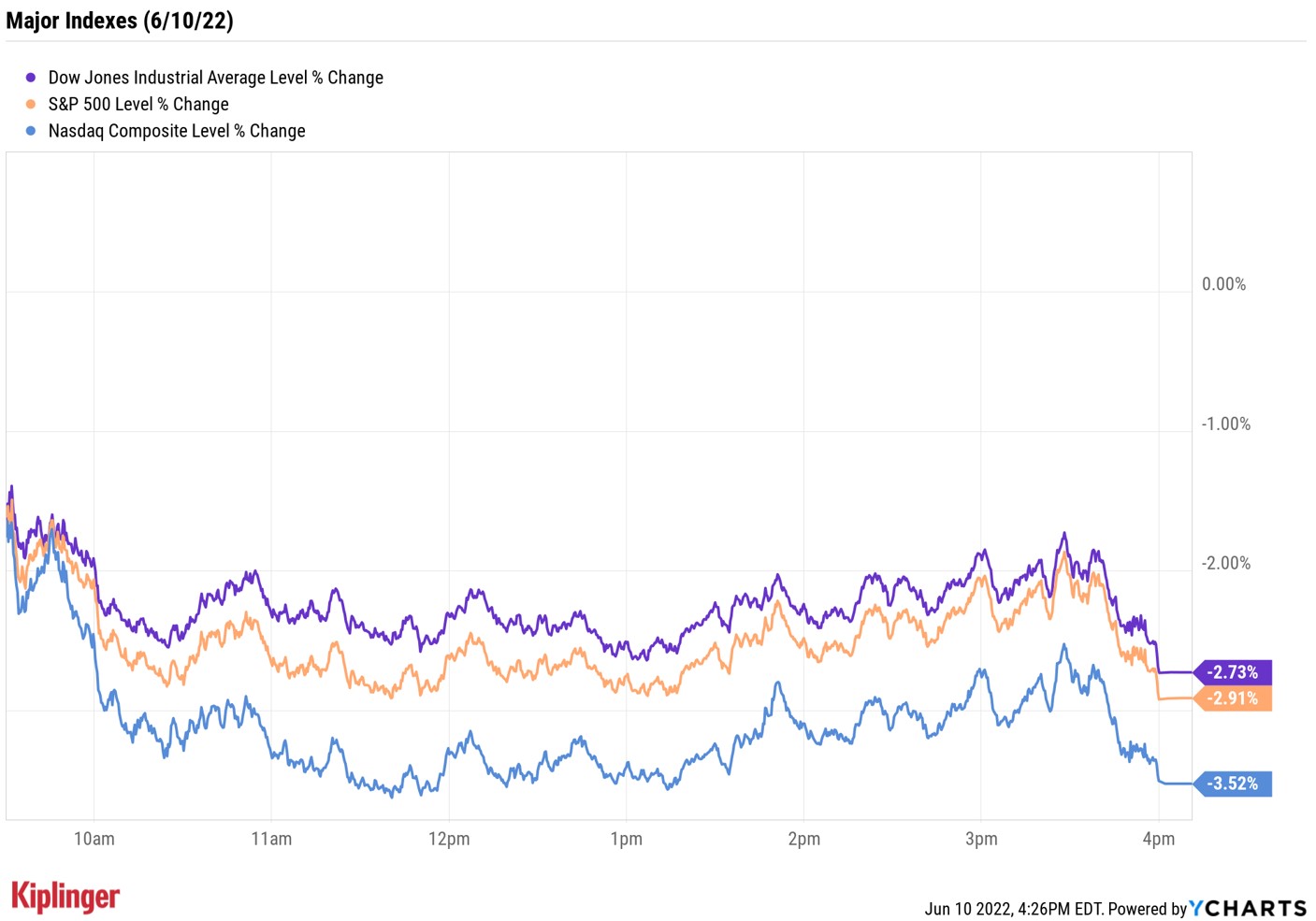

As for the major indexes, the Nasdaq Composite slid 3.5% to 11,340, the S&P 500 Index shed 2.9% to 3,900 and the Dow Jones Industrial Average skidded 2.7% to end at 31,392.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 2.7% to 1,800.

- U.S. crude futures shed 0.7% to settle at $120.67 per barrel.

- Gold futures jumped 1.2% to end at $1,875.50 an ounce.

- Bitcoin sank 3.4% to $28,966.18. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Netflix (NFLX, -5.1%) and Roblox (RBLX, -9.0%) posted sharp losses today after Goldman Sachs downgraded the stocks to Sell. "We downgrade NFLX to Sell as we have concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends (both in the form of gross adds and churn), margin expansion and levels of content spend and view NFLX as a show-me story with a light catalyst path in the next 6-12 months," the analysts write in a note. And while they still view RBLX as the best-positioned name for long-term growth opportunities in the gaming/interactive universe, "we have increasing concerns around the post-pandemic environment and expect a continuation of slowing growth, tough comps, & normalization of margins in the near term."

- DocuSign (DOCU) plummeted 24.5% after the e-signature firm reported earnings. In its first quarter, DOCU reported adjusted earnings per share of 38 cents on revenue of $588.7 million. Analysts, on average, were expecting earnings of 38 cents per share on $581.8 million in revenue. The company also lowered its full-year billings growth estimate to 7% to 8% from prior guidance for 15% growth at the midpoint. "DocuSign pegged the guide-down on a) macro headwinds (customers being cautious about volume expansions across all regions), b) sales execution (high sales rep turnover) c) customers that are still digesting excess capacity (pandemic distortions are still playing out in stocks) and d) a fall-off in rate-sensitive loan / mortgage e-signature volumes, impacting the financial/real estate verticals," says UBS Global Research analyst Karl Keirstead. "We remain on the sidelines with a Neutral rating."

The Best Stocks for Sky-High Inflation

We'll get a glimpse on how the Federal Reserve will respond to today's red-hot inflation update next week, with the central bank slated to unveil its latest policy decision Wednesday afternoon.

"From a Fed perspective, the chase continues, and more aggressive Fed measures will likely be needed to catch up to runaway inflation," says Charlie Ripley, senior investment strategist for Allianz Investment Management.

"Whether this translates to more aggressive hikes this summer, or a continuation of 50 basis point [a basis point is one-one hundredth of a percentage point] hikes this fall is the option for the Fed, but the overall reality for the Fed is that inflation is not under control, and they have their work cut out for them in the coming months," Ripley adds.

We've mentioned several times in this space how investors can protect portfolios against inflation. For example, gaining exposure to firms with pricing power or scooping up Wall Street's best dividend stocks are two ways to help mitigate the effects of red-hot inflation on their portfolio.

Investors can also drill down on sectors that are typically considered more "inflation-proof" than others – namely, healthcare, consumer staples, utilities and real estate. Here, we've selected some of the top stocks from each of these sectors to create a mini-portfolio that can stand up against higher prices. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.