Stock Market Today: S&P Finally Dragged Into a Bear Market

The sizzling May CPI report finished off the job it started on Friday, putting an end to the 2020-22 bull run.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After months of surging inflation, the S&P 500 finally broke down into bear-market territory, ending a two-year-plus COVID recovery bull run.

The catalyst, of course, was Friday's surprising revelation that consumer prices soared by 8.6% in March – a report so toxic that Wall Street was still digesting it today.

"The hot inflation report provided a double dose of bad news for the economy and for stocks," says Paul Christopher, Head of Global Market Strategy for the Wells Fargo Investment Institute. "First, it added to the pressure on households' real (inflation-adjusted) income, and second, it stoked the debate over more aggressive rate increases by the Fed beyond the two half-percentage-point hikes expected next week and at the late July policy meeting. … Interest rate futures contracts are now pricing in a third half-percentage-point rate increase at the policy meeting on Sept. 20-21."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And in fact, some experts warned that the Fed might yank even harder on the reins at this week's Federal Open Market Committee (FOMC) meeting.

"With cost pressures showing no signs of easing, a 75-bp move cannot be ruled out at this week's FOMC meeting," says Priscilla Thiagamoorthy, economist at BMO Capital Markets.

Bond traders seemed to think that was a distinct possibility, as the 10-year Treasury sold off hard Monday. That sent its yield as high as 3.35% (remember: bond prices and yields move in opposite directions), surpassing a 2018 peak to reach its highest rate since 2011.

Moreover, the yield on the two-year Treasury briefly surpassed the 10-year – a "yield curve inversion" that frequently signals an impending recession.

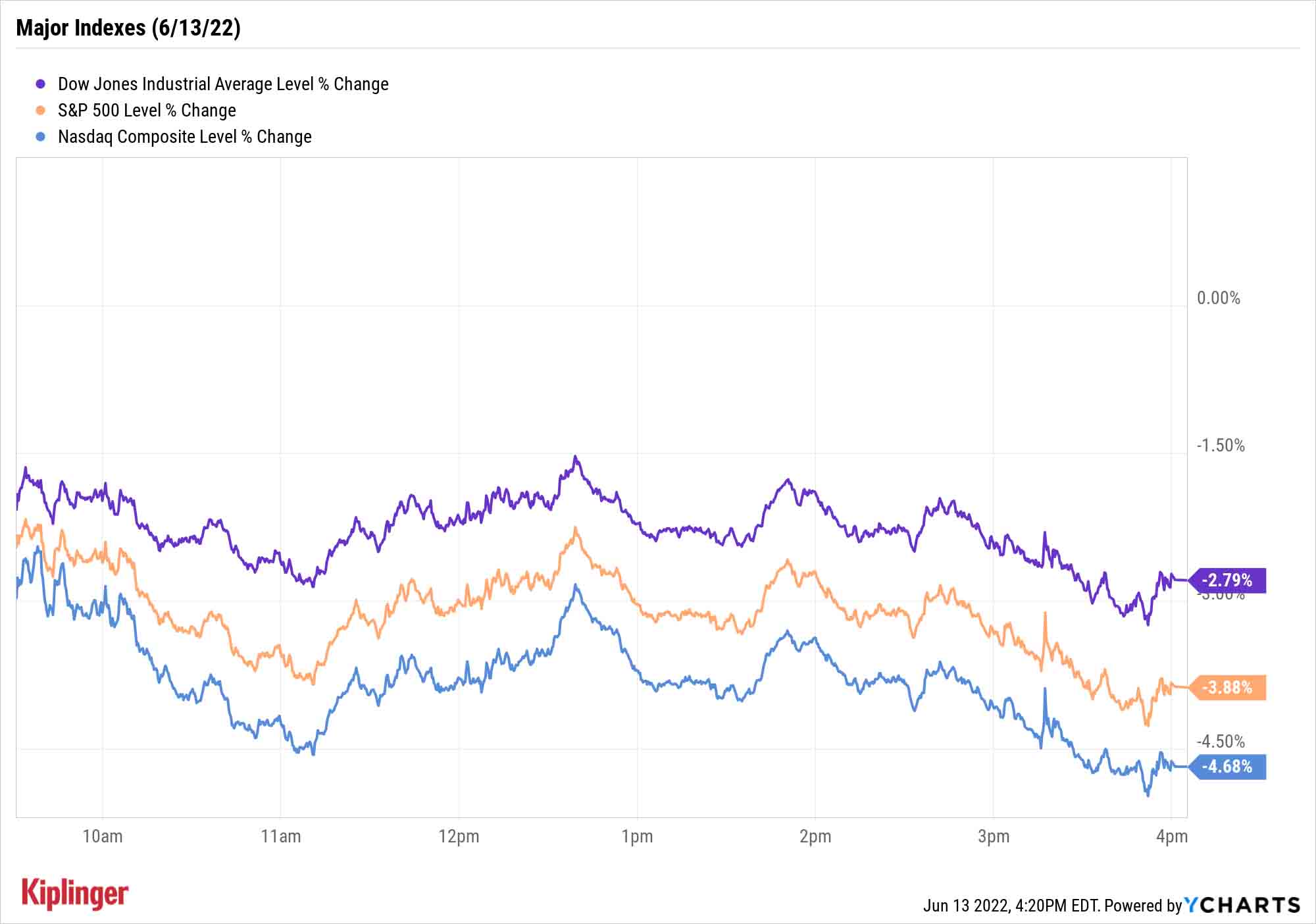

The S&P 500 plunged 3.9% to 3,749 – a 21.8% decline from its Jan. 3 closing high of 4,796, ending the bull market that started March 23, 2020. The Nasdaq Composite (-4.7% to 10,809) retreated even further into bear-market territory, and the Dow Jones Industrial Average (-2.8% to 30,516) would need to drop another 4.0% to join its fellow indexes.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 4.8% to 1,714.

- U.S. crude futures managed to eke out a small 0.2% improvement, to $120.93 per barrel.

- Gold futures slumped by 2.3%, to $1,831.80 per ounce, as the U.s. dollar continued to gain strength.

- Bitcoin melted down over the weekend, bleeding 20% since last Friday afternoon to $23,155.20. "Crypto fans have become used to volatile rides, but these rollercoaster descents are increasingly hard to stomach," says Susannah Streeter, senior investment and markets analyst for U.K. financial firm Hargreaves Lansdown. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Revlon (REV) plunged 43.2% after The Wall Street Journal late Friday suggested the makeup company is preparing to file for Chapter 11 bankruptcy. The article, citing people familiar with the matter, indicated a filing could come as soon as this week.

Zendesk (ZEN) fell 7.9% after Morgan Stanley analyst Elizabeth Porter downgraded the software developer stock to Equal Weight from Overweight, the equivalents of Hold and Buy, respectively. This comes after the company ended its strategic review without finding any suitable parties to acquire it. Porter said this took a "key catalyst off the table" for the tech stock.

Fight This Bear With ETFs

Some investors are assuredly stuck in strategic purgatory. Do you feast on this dip, expecting stocks to violently snap back like they did in spring 2020 and the first quarter of 2019? Or do you wait for the market to further price in an expected litany of interest-rate hikes and the possibility of continued high inflation?

Wall Street is hardly sure. For instance, Chris Larkin, managing director of trading for E*Trade, says that "investors shouldn't be too discouraged … over the past six decades, by the time the SPX officially entered bear territory, the selling was usually closer to its end than its beginning." However, the BlackRock Investment Institute says "we pass" on buying this dip, as "a higher path of policy rates justifies lower equity prices."

But if your instincts lean toward protecting your backside, you can find all the tools you need in your brokerage account. We recently highlighted 10 highly rated defensive stocks that should hold up well in a bear market, and today, for those that want to add some diversification to their hedges, we're exploring a dozen of the best bear-market exchange-traded funds (ETFs).

These funds run the gamut, from simple protective stock portfolios to exotic bond-market options, all with the hope of losing less than the market – or, ideally, recording some black ink. Check them out:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.