Stock Market Today: Stocks Wobble Ahead of Fed's Next Rate Decision

Tuesday's scorching producer price index (PPI) reading might have cemented an aggressive Fed policy response at tomorrow's FOMC meeting close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Another hot reading of inflation kept the bulls pinned to the ground Tuesday. All eyes now are on tomorrow's conclusion of the Federal Reserve's latest policy meeting, where America's central bank is expected to raise its benchmark interest rate once more.

The Bureau of Labor Statistics reported this morning that U.S. producer prices rocketed 10.8% year-over-year (and 0.8% month-over-month) in May, driven in large part by high energy prices. That was a higher MoM rate than April's revised 0.4%, and roughly around economist expectations.

"This report adds to evidence of price pressures remaining elevated across the board, suggesting more near-term inflation," says Barclays economist Pooja Sriram.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In other words, there's nothing to suggest that the Federal Reserve will back off from its projection that it will raise the Fed funds rate by another 50 basis points on Wednesday. In fact, Wall Street is increasingly betting they'll go farther.

"The Fed is suggesting that they are willing to induce a recession to prevent the inflation surge," says Gene Goldman, chief investment officer of Cetera Investment Management. "The CPI and PPI reports will make the Fed raise rates more than markets had anticipated just last week [75 basis points instead of 50]. This is analogous to the Fed ripping off the band-aid and raising rates fast upfront (instead of slowly pulling it off)."

Goldman adds, however, that the key thing to watch is the terminal rate – while the Fed might get more aggressive now, it also might end up raising rates by less later in the rate-hiking cycle.

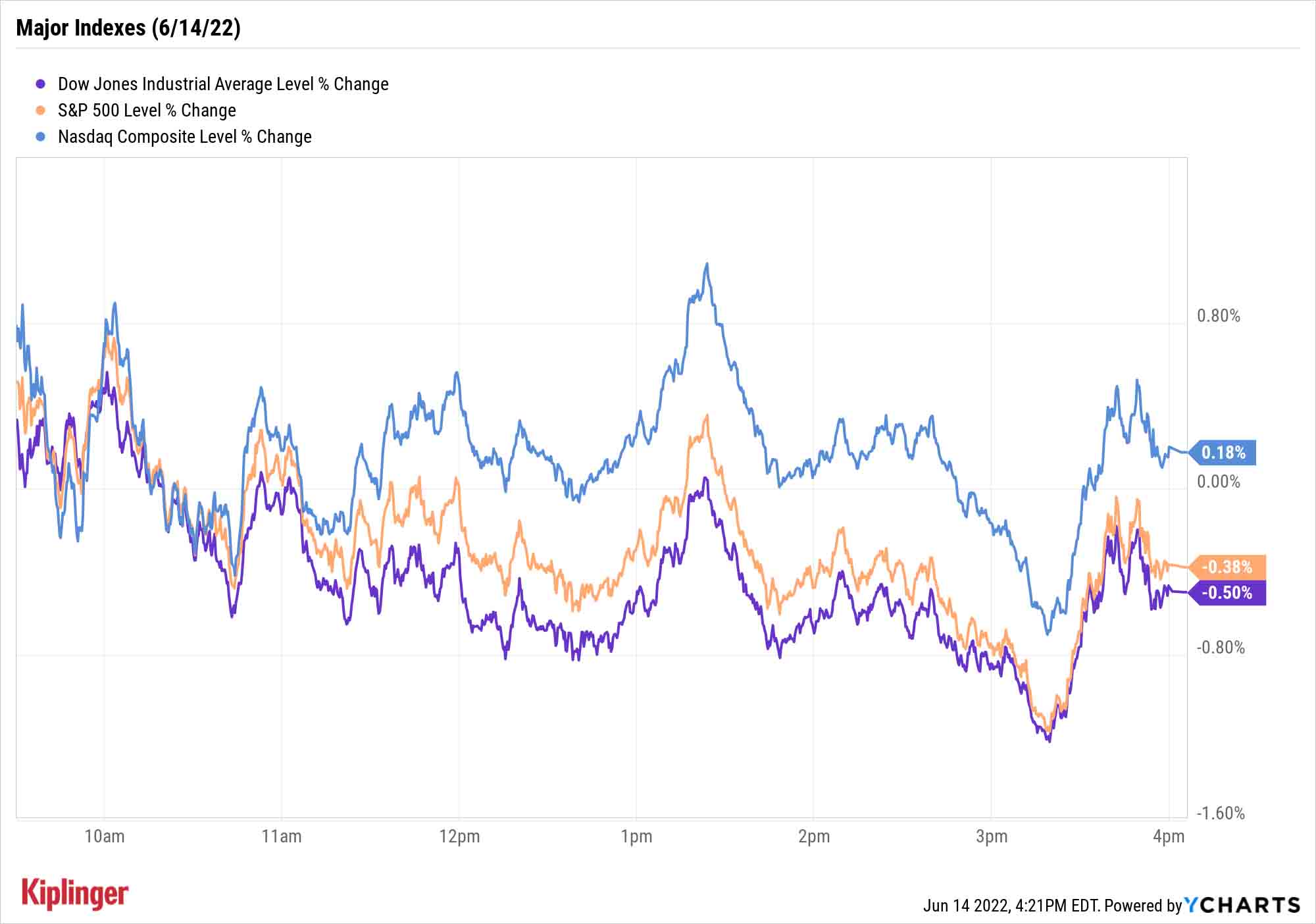

The S&P 500 dug a little deeper into bear-market territory, declining 0.4% to 3,735, while the Dow Jones Industrial Average was off 0.5% to 30,364. The Nasdaq Composite actually managed to finish in positive territory, with a modest 0.2% gain to 10,828.

Oracle (ORCL, +10.4%) was one of the trading session's brightest spots, as the enterprise software firm easily topped quarterly profit estimates and delivered better-than-expected guidance for its upcoming fiscal year.

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.4% to 1,707.

- U.S. crude oil futures shed nearly 1.7% to settle at $118.93 an ounce.

- Gold futures fell 1% to end at $1,813.50 an ounce.

- Bitcoin's slide continued, with the cryptocurrency off 4.3% to $22,156.03. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- The recent selloff in cryptocurrencies forced Coinbase Global's (COIN, -0.8%) hand, with the firm announcing today it is slashing its global workforce by 18%. "We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period," Brian Armstrong, CEO and co-founder of Coinbase, wrote in a blog post. "As we operate in this highly uncertain period in the world, we want to ensure we can successfully navigate a prolonged downturn. Our team has grown very quickly (>4x in the past 18 months) and our employee costs are too high to effectively manage this uncertain market. The actions we are taking today will allow us to more confidently manage through this period even if it is severely prolonged."

- FedEx (FDX) stock spiked 14.4% after the delivery giant said it will hike its quarterly dividend by 53% to $1.15 per share. FDX also said it is adding three new board members – two immediately and one down the road – as part of an agreement with activist investor D.E. Shaw. "The FDX bear cases are largely tied to 1) resistance to structural change, and 2) macro risks in businesses with high operating leverage," says Susquehanna Financial Group analyst Bascome Majors, who has a Neutral (Hold) rating on the stock. "Today's announcement of a board refresh and other governance updates tied to a cooperation agreement with activist investor D.E. Shaw is a significant shift to the 'won't change' narrative, though admittedly can't help their cyclical businesses outrun the macro."

The Best Performers of the 2020-22 Bull Market

"It's better to miss the bottom of a market and buy on the way up than to guess where the exact bottom is."

So says George Ball, chairman of investment firm Sanders Morris Harris, who adds that "new money should be patient money" now that investment psychology has decidedly shifted to the negative side of things.

We've recently sounded off on our picks – both stocks and exchange-traded funds (ETFs) alike – for investors buying in a bear market.

Sanders weighs in too, saying "there are opportunities right now in low volatility and high-dividend-yielding stocks that shouldn't fall much further, regardless of the trajectory of the overall indexes," and adding that "master limited partnerships (MLPs) are the types of securities that offer stability during times of market duress."

But today, we also want to look back on yesterday's official end of the two-year-plus bull market. While the COVID recovery run was best-known for highflying work-from-home names, surprisingly, those weren't the stocks that ended up on top at the bull market's end. Read on as we take a brief look at the top performers between the depths of the COVID pandemic and the bull's final breath in 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.