Stock Market Today: Bears Viciously Repel Post-Fed Rally

A heaping helping of lousy economic data Thursday washed away any optimism traders showed after the Fed's latest policy decision.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

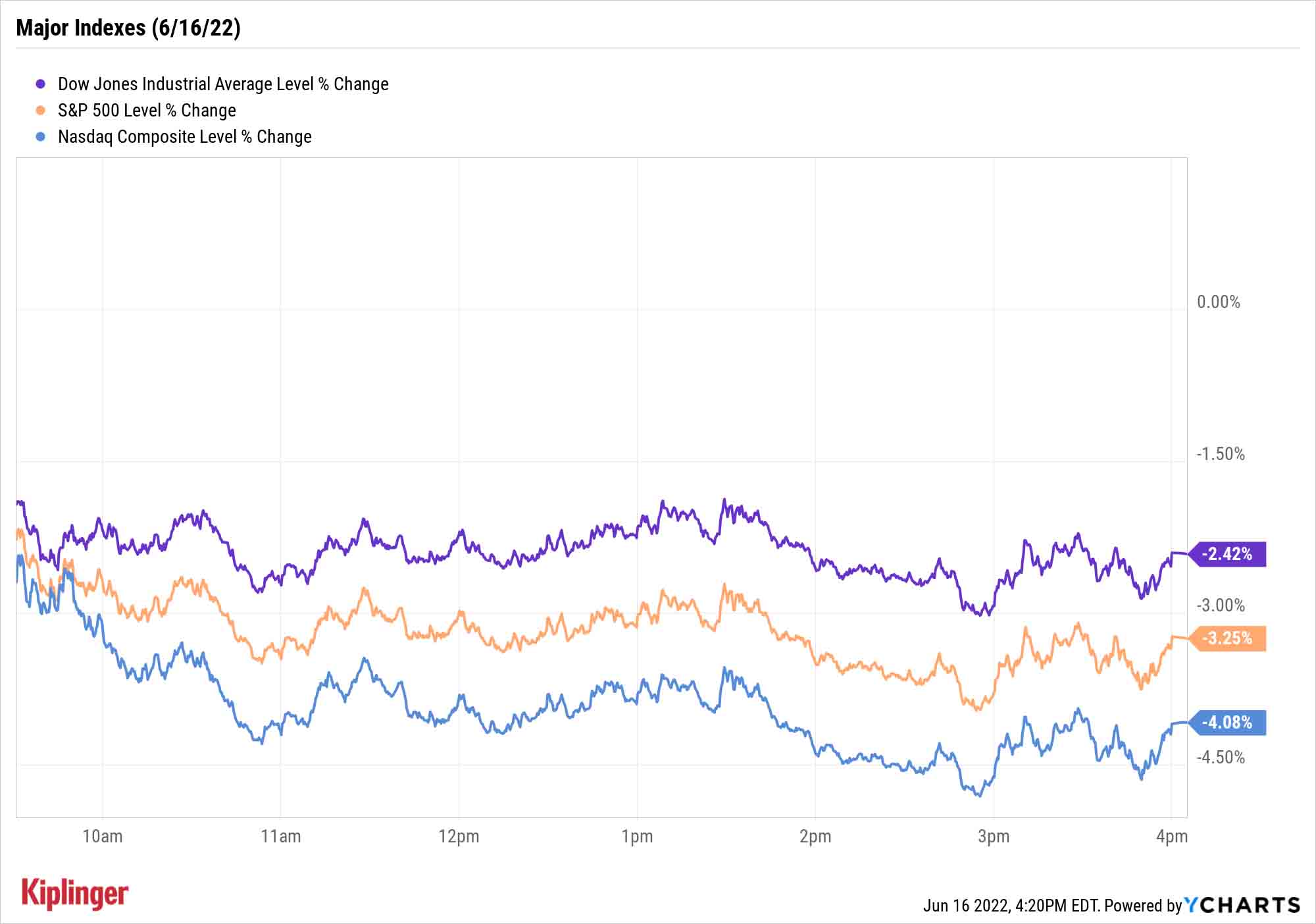

Whatever cheer investors took from yesterday's Federal Reserve policy announcement and Chair Jerome Powell's presser evaporated Thursday, as the major indexes sank and the Dow Jones Industrial Average dropped to within close reach of its own bear market.

Several pieces of data out today hinted at a slowing economy:

- The Philadelphia Fed Manufacturing Index dropped to -3.3, versus +5.5 expected, indicating that the region's manufacturing activity was contracting for the first time since May 2020.

- Housing starts plunged 14.4% in May to 1.549 million annualized units, the lowest in 13 months.

- And while initial unemployment filings for the week ended June 11 were unchanged at 229,000, the prior week's number was revised upward by 3,000 filings, and the four-week moving average of 218,500 was the highest in five months.

"The labor and housing markets are normalizing after running red-hot in 2021," says Bill Adams, Chief Economist for Comerica Bank. "Higher interest rates have broken the fever in housing, with the benchmark survey of homebuilders showing reduced foot traffic at showings. Layoffs are still historically low in the U.S., but rising. A couple of states noted layoffs in the broad industry groups that include retail, e-commerce, and temp services in the latest week's data."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, investors continue to mull the ramifications of the Federal Reserve's 75-basis-point interest-rate cut – and how effective it might be against a major market headwind.

"Perhaps [the rate cut] increases the Fed's credibility, but it remains to be seen whether monetary policy is a sufficient tool to materially impact inflation that is being primarily driven by supply side constraints," says Shawn Snyder, Head of Investment Strategy at Citi Personal Wealth Management.

Every single market sector was lower Thursday, though some had it worse than others. Energy stocks (-5.5%) were the market's worst performer despite a 2.0% improvement in U.S. crude oil futures, to $117.58 per barrel. Tech and tech-esque stocks continued to absorb the brunt of higher-rate fears; Tesla (TSLA, -8.5%), Advanced Micro Devices (AMD, -8.1%) and Charter Communications (CHTR, -7.5%) were among some of the most notable decliners.

Consumer staples (-0.8%) offered the best defense, relatively speaking, thanks to modest gains in the likes of Walmart (WMT, +1.0%) and Procter & Gamble (PG, +0.6%).

The major indexes sustained significant damage. The Nasdaq Composite (-4.1% to 10,646) led the way lower, followed by the S&P 500 (-3.3% to 3,666) and the Dow (-2.4% to 29,927). The industrial average is now just a 2.2% decline away from being 20% below its Jan. 3 closing high and entering its own bear market.

Other news in the stock market today:

- The small-cap Russell 2000 retreated by 4.7% to 1,649.

- Gold futures gained 1.7% to finish at $1,849.90 an ounce.

- Bitcoin's decline continued, with the cryptocurrency off 3.9% to $20,841.49. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Fears of a potential recession dragged on a number of travel stocks today. Cruise operators Carnival (CCL, -11.1%) and Royal Caribbean (RCL, -11.4%) were among the biggest decliners, while airlines American Airlines (AAL, -8.6%) and Delta Air Lines (DAL, -7.5%) also plummeted.

- Kroger (KR) stock slipped 2.1% after the grocery chain reported earnings. In its first quarter, KR recorded adjusted earnings of $1.45 per share and revenue of $44.6 billion, more than the $1.30 per share and $44.2 billion a nalysts were expecting. Kroger expects full-year earnings to arrive between $3.85 per share and $3.95 per share, a slight (10-cent) improvement on the low end of its previous forecast. CFRA Research analyst Arun Sundaram maintained a Sell rating on KR stock. "Gross margin headwinds could strengthen with price competition increases and continued inflationary pressures," the analyst says. "Lower fuel margins, less COVID-19 vaccine benefits, and moderating food-at-home demand will also likely be headwinds this year. Overall, we think it is a good time for investors to take profits considering KR shares have outperformed peers and the broader market year-to-date."

More Energy in Energy?

Oil and gas stocks might have had a miserable day, but don't assume they're out of fuel either.

"We believe energy prices will remain elevated for the foreseeable future, as demand for fossil fuels is not declining as fast as people think and alternative energy is not as available as people think," says David Trainer, CEO of investment research firm New Constructs. "Profits in the energy sector are rising much faster than the sector's overall valuation, so there remains plenty of upside across the sector."

But given energy's still-massive run in 2022 (+41.6% YTD), investors don't have the leeway to buy the sector indiscriminately, unlike earlier in the year.

"Investors need to do their homework in this environment and focus on the most profitable companies trading at the biggest discounts no matter what the sector is," he says.

Investors who want to try to squeeze a little more juice from the oil patch can start their search with our seven best energy picks for the rest of the year. Each of these stocks earns high marks from the analyst community, and we highlight what sets them apart from the pack.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.