Stock Market Today: Stocks Stick the Landing in Successful Short Week

Small hints that inflation might have peaked and that the U.S. might evade recession stoked broad buying Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

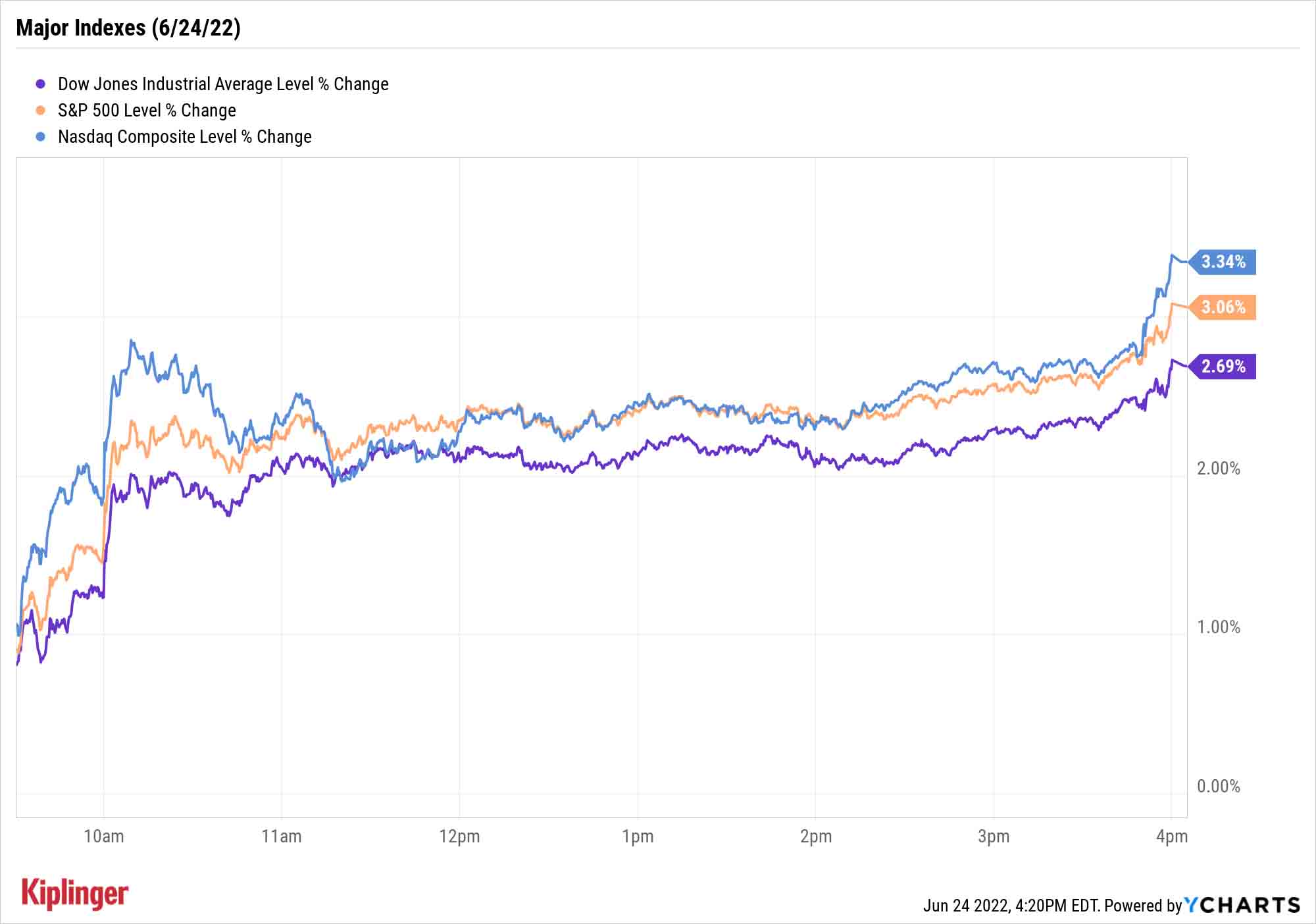

The major indexes finished the holiday-shortened week with a flourish as a recent relief rally chalked up sizable gains across the four-day period.

Federal Reserve Bank of St. Louis President James Bullard said Friday that "it is a little early to have this debate about recession probabilities in the U.S." Meanwhile, he continued to pound the table for continued aggressive interest-rate increases – remember, the Fed is just more than a week removed from its rate hike since 1994 – to repel rapidly rising consumer prices.

"Bullard's optimism is justified if inflation [does] manage to peak," says Edward Moya, senior market strategist at currency data provider OANDA. "The best-case scenario for equities is that inflation continues to show signs of peaking and the consumer remains strong."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What do consumers have to say about that? Well … the University of Michigan's Surveys of Consumers sentiment index dropped to 50.0 for June – its lowest reading since the index was established in the 1970s. But the report had a bright spot: Expectations for inflation in the year ahead dipped to 5.3% from 5.4% in the preliminary report, while the five-to-10-year outlook eased to 3.1% from 3.3%.

All 11 S&P 500 sectors finished solidly in the green Friday. The financial sector (+3.8%) pounced, with names like Wells Fargo (WFC, +7.6%) and PayPal Holdings (PYPL, +5.2%) breathing a large sigh of relief. Other cyclical sectors, such as industrials (+3.5%) and materials (+4.0%), enjoyed significant gains too.

The Nasdaq Composite (+3.3% to 11,607) walked away with a 7.5% weekly gain. The S&P 500 (+3.1% to 3,911) improved by 6.4% over the four-day period, and the Dow Jones Industrial Average (+2.7% to 31,500) was up 5.4%.

Analysts keep souring on the market, however. John Butters, senior earnings analyst for FactSet, notes that the pros have been lowering their target prices on S&P 500 companies over the past few months.

"Since peaking at 5,344.26 on January 20, 2022, the bottom-up target price for the S&P 500 [calculated by aggregating median target price estimates for all the companies in the index 12 months out] has declined by 7% to 4,987.28 on June 23, 2022," he says. "This week marked the first time the bottom-up target price for the index has dipped below 5,000 since Aug. 23, 2021."

If there's a bright side, even with the recent decline in analysts' target prices, Wall Street thinks the S&P 500 will improve by more than 30% over the next 12 months.

Other news in the stock market today:

- The small-cap Russell 2000 roared ahead 3.2% to 1,765.

- U.S. crude futures jumped 3.2% to finish at $107.62 per barrel.

- Gold futures notched a marginal gain to settle at $1,830.30 an ounce.

- Bitcoin cleared the $21,000 level, improving by 1.6% to 21,239.04. Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Carnival (CCL) soared 12.4% after the cruise operator reported earnings. In its fiscal second quarter, CCL reported an adjusted net loss of $1.9 billion – narrower than the $2.1 billion loss it incurred in the year-ago period – and revenue of $2.4 billion, a nearly 50% sequential rise. The company also said booking volumes for all future sailings were almost double what they were in Q1 – and marked the best quarter for bookings since the pandemic started. Carnival's earnings reaction created a halo effect for fellow cruise stocks Royal Caribbean (RCL, +15.8%) and Norwegian Cruise Lines (NCLH, +15.4%).

- FedEx (FDX) was another post-earnings winner, surging 7.2% after its results. In its fiscal fourth quarter, the shipping giant reported adjusted earnings of $6.87 per share on revenue of $24.4 billion, up 37% and 8% year-over-year, respectively. "The revenue growth was entirely due to FDX leveraging its pricing power with 10%-plus rate hikes at all segments," says CFRA Research analyst Colin Scarola (Strong Buy). "By design, the rate hikes helped slow volume, allowing FDX's previously overloaded network to operate more efficiently, in our view. Labor and equipment-related costs were up just 0% and 3% year-over-year, respectively, driving May quarter operating margin to 9.2% vs. an average of 6% since the pandemic began. We see further margin improvement in fiscal 2023 and 2024, and believe shares are materially undervalued even in a recession scenario."

Buffett Keeps Hoovering Up Occidental

One of this week's most interesting developments comes courtesy of Berkshire Hathaway (BRK.B). On Wednesday night, the company disclosed that Warren Buffett is continuing to buy shares of Occidental Petroleum (OXY) with both hands.

Specifically, Berkshire recently bought 9.6 million OXY shares worth about $530 million, according to a regulatory filing. Add that to some massive first-quarter buying, and that brings the equity portfolio's stake in the integrated energy firm to 152.7 million shares worth nearly $9 billion at current prices. Buffett owns $10 billion worth of 8% preferred shares and 84 million warrants, too; all in, he owns about one-third of Occidental.

And at least one analyst thinks Uncle Warren could be set up to buy the rest.

Read on as we explore why Occidental Petroleum could go from part of the Berkshire Hathway equity portfolio holding to a fully owned entity, joining the likes of Dairy Queen, GEICO and BNSF Railway.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.