Stock Market Today: Markets Steady, But Bed Bath, Cruise Lines Tumble

The calmest market day of 2022 wasn't nearly so pleasant for a few individual stocks, including retailer BBBY and cruise operator CCL.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A slow macroeconomic news day resulted in one of the lowest-volume sessions of 2022, though a few individual equities endured more than their fair share of volatility.

The S&P 500, which finished with a small gain Wednesday, posted the index's smallest intraday range for the year, according to Michael Reinking, senior market strategist for the New York Stock Exchange. "That bit of stability is welcome after the violent reversal seen during yesterday's session, which saw the early 1% gain in the S&P 500 turn into a 2% loss when all was said and done."

Not so for the energy sector (-3.5%), where recent whipsawing continued. U.S. crude oil futures declined 1.8% to $109.78 per barrel as traders waited for news from the Organization of the Petroleum Exporting Countries and their allies (together, OPEC+), which are meeting today and tomorrow. That clipped oil and gas stocks including Devon Energy (DVN, -6.1%) and APA (APA, -6.9%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A few individual stocks hit the mat even harder. Bed Bath & Beyond (BBBY) fell 23.6% after announcing that quarterly revenues had plunged by 25% to a worse-than-expected $1.46 billion, and that same-store sales (revenues earned in stores open at least 12 months) were off by 24%. And worse –the ship just lost its captain, as BBBY said CEO Mark Tritton has left the company.

Another firm in troubled waters is Carnival (CCL, -14.1%), which dragged down the entire cruise line industry Wednesday after a price-target cut from Morgan Stanley. Analyst Jamie Rollo now sees the stock going to $7 per share (-32% from yesterday's closing price), with a worst-case scenario in which a global downturn sends the stock to zero.

"If there is a demand shock that causes trip cancellations or weak bookings … liquidity could quickly shrink," he says.

Industrymates Royal Caribbean (RCL, -10.3%) and Norwegian Cruise Line Holdings (NCLH, -9.3%) swooned in sympathy.

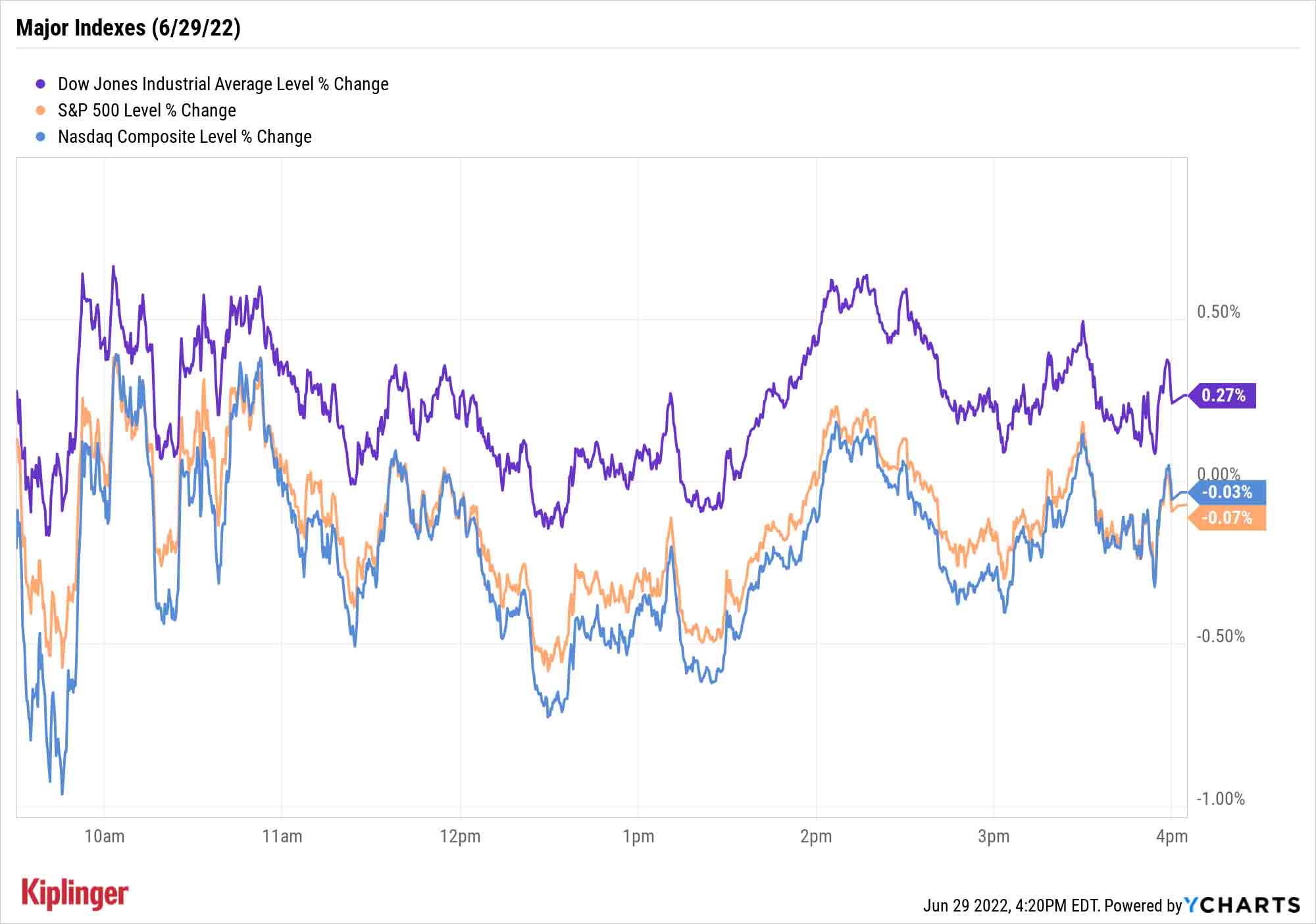

The major indexes didn't move much, however. The Dow Jones Industrial Average improved by 0.3% to 31,029, while the S&P 500 and Nasdaq Composite slipped marginally to 3,818 and 11,177, respectively.

Other news in the stock market today:

- The small-cap Russell 2000 wasn't nearly so calm, dipping 1.1% to 1,719.

- Gold futures gave back 0.2% to end at $1,817.50 an ounce.

- Bitcoin finished marginally higher to $20,255.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Teradyne (TER) slumped 5.2% after BofA Global Research analyst Vivek Arya downgraded the semiconductor equipment manufacturer to Neutral (Hold) from Buy. "We continue to think of Teradyne as a high-quality vendor and leader in the relatively duopoly market of semiconductor testing," Arya says. "However, TER's high exposure to Apple (~10% currently but has been 20-25% in the past) exposes the company to large volatility in iPhone demand and Apple design complexity." He adds that TER's high-growth industrial automation segment is exposed to any downturn in the global industrial economy and competition from Asia.

- It was a volatile session for Nio (NIO), which was down nearly 8% at one point after short seller Grizzly Research issued a report accusing the electric-vehicle maker of an "audacious scheme" to "exaggerate revenue and profitability." Nio replied in a statement, saying the report was "without merit," bringing the shares close to breakeven in late-morning trading, although they still ended the day down 2.2%. CFRA Research analyst Lim Jian Xiong maintained a Buy rating on NIO, saying more disclosures from the company should be expected. "We think NIO's EV portfolio expansion (3 SUV and 2 sedan models in 2022) will sustain its strong revenue momentum, drive an improvement in operating leverage, and support our projected turnaround in NIO's business by Q4 2023," the analyst added.

Trying to Call a Bottom Misses the Point

How low will the market go, and when will it hit its nadir? While there's no crystal ball that has the exact answer to either of these questions, Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, is happy to project a possible bottom, but he stresses that's not the point.

"We still believe the U.S. equity markets are entering the bottoming process of a correction cycle that began well over a year ago," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. "There is still likely more volatility to come, and within such a framework, we continue to believe the 3,100-3,200 range is a distinct possibility for the S&P 500 in the weeks ahead (before a final low is confirmed)."

However, he says the goal here shouldn't be to trade these markets on a short-term basis or try to pinpoint an exact bottom. "Rather, it should be to take advantage of significant multiple compression in valuations relative to the long-term growth prospects for the U.S. When viewed from this lens, we believe those investors with longer-term horizons can start to put some money to work in the current environment." As in, now.

Thus, keep an eye on values. Kiplinger columnist James A. Glassman recently disclosed his own wish list of stocks to buy while they're down. But the general thrust for investors right now is, if it's high-quality and bargain-priced, now might be the time to bite – as long as you're patient. Keep that in mind as you explore these 15 value stocks that seem ripe for a renaissance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.